[ad_1]

Solana’s price action is sending a clear message: the correction may not be finished yet. While buyers continue to show up at key levels, the broader structure still points to the possibility of one final downside test before a sustainable move higher can take shape.

Wave IV Still Unfinished As C-Wave Pressure Persists

Crypto analyst More Crypto Online, in a recent update, explained that Solana’s chart structure still points to the possibility of another downside move before the ongoing correction is fully completed. Within the orange scenario, price action continues to align with a C-wave decline in a broader wave IV correction, keeping the corrective outlook valid as long as the structure remains non-impulsive.

Even when viewed through the alternative white scenario, the current pullback can still be classified as an A-wave, which leaves room for another low before a B-wave recovery begins or before a potential fifth wave to the upside develops. In both interpretations, the analyst noted that the correction may not yet be finished.

From a short-term perspective, the chart suggests that Solana could drift lower into the $81 to $90 region. Currently, there are no clear structural signals indicating an immediate bullish continuation, as the absence of impulsive upside movement keeps downside scenarios firmly in play.

However, if prices were to turn higher from current levels without setting a new low, the broader structure since January 2025 would start to resemble a triangular consolidation rather than a completed wave IV. This alternative setup would imply extended sideways movement instead of a rapid trend resumption. Until stronger upside momentum appears, the focus remains on the risk of one more corrective low.

Controlled Reaction At The 50% Fibonacci Signals Solana Buyer Strength

AltCoin Việt Nam stated that Solana’s current price action is showing a strong and reassuring reaction around the 50% Fibonacci level. Instead of breaking down aggressively, the price has been rebounding in a controlled manner, suggesting that buyers are still maintaining influence. From a wave-structure perspective, wave IV does not appear to be rushing toward completion, leaving room for wave C to extend further if the market continues to move in line with the broader rhythm.

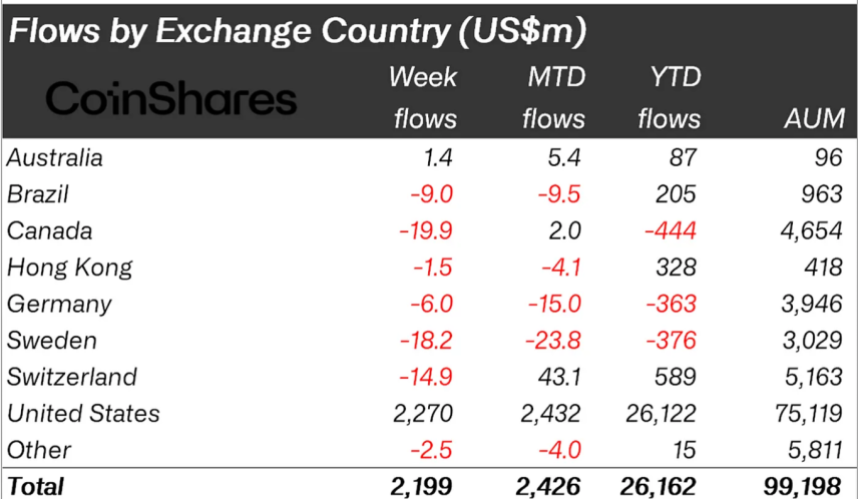

Adding to the bullish bias is the ongoing ETF narrative surrounding Solana. Spot SOL inflows are not arriving in a FOMO-driven manner, but rather through steady accumulation across several sessions. This type of capital flow often reflects longer-term positioning rather than short-term speculation, which explains why the price tends to rebound quickly whenever it revisits key support zones.

That said, the outlook is not without invalidation. A sustained move below the 50% Fibonacci level would signal that the current structure has broken down. However, the analyst views the recent pauses as temporary breathers within a broader upward structure, rather than the beginning of a meaningful downtrend.

[ad_2]

Godspower Owie

Source link