This may surprise you: Wall Street analysts expect earnings for the S&P 500 to increase 8% during 2023, despite all the buzz about a possible recession as the Federal Reserve tightens monetary policy to quell inflation.

Ken Laudan, a portfolio manager at Kornitzer Capital Management in Mission, Kan., isn’t buying it. He expects an “earnings recession” for the S&P 500

SPX,

— that is, a decline in profits of around 10%. But he also expects that decline to set up a bottom for the stock market.

Laudan’s predictions for the S&P 500 ‘earnings recession’ and bottom

Laudan, who manages the $83 million Buffalo Large Cap Fund

BUFEX,

and co-manages the $905 million Buffalo Discovery Fund

BUFTX,

said during an interview: “It is not unusual to see a 20% hit [to earnings] in a modest recession. Margins have peaked.”

The consensus among analysts polled by FactSet is for weighted aggregate earnings for the S&P 500 to total $238.23 a share in 2023, which would be an 8% increase from the current 2022 EPS estimate of $220.63.

Laudan said his base case for 2023 is for earnings of about $195 to $200 a share and for that decline in earnings (about 9% to 12% from the current consensus estimate for 2022) to be “coupled with an economic recession of some sort.”

He expects the Wall Street estimates to come down, and said that “once Street estimates get to $205 or $210, I think stocks will take off.”

He went further, saying “things get really interesting at 3200 or 3300 on the S&P.” The S&P 500 closed at 3583.07 on Oct. 14, a decline of 24.8% for 2022, excluding dividends.

Laudan said the Buffalo Large Cap Fund was about 7% in cash, as he was keeping some powder dry for stock purchases at lower prices, adding that he has been “fairly defensive” since October 2021 and was continuing to focus on “steady dividend-paying companies with strong balance sheets.”

Leaders for the stock market’s recovery

After the market hits bottom, Laudan expects a recovery for stocks to begin next year, as “valuations will discount and respond more quickly than the earnings will.”

He expects “long-duration technology growth stocks” to lead the rally, because “they got hit first.” When asked if Nvidia Corp.

NVDA,

and Advanced Micro Devices Inc.

AMD,

were good examples, in light of the broad decline for semiconductor stocks and because both are held by the Buffalo Large Cap Fund, Laudan said: “They led us down and they will bounce first.”

Laudan said his “largest tech holding” is ASML Holding N.V.

ASML,

which provides equipment and systems used to fabricate computer chips.

Among the largest tech-oriented companies, the Buffalo Large Cap fund also holds shares of Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

Amazon.com Inc.

AMZN,

and Alphabet Inc.

GOOG,

Laudan also said he had been “overweight’ in UnitedHealth Group Inc.

UNH,

Danaher Corp.

DHR,

and Linde PLC

LIN,

recently and had taken advantage of the decline in Adobe Inc.’s

ADBE,

price following the announcement of its $20 billion acquisition of Figma, by scooping up more shares.

Summarizing the declines

To illustrate what a brutal year it has been for semiconductor stocks, the iShares Semiconductor ETF

SOXX,

which tracks the PHLX Semiconductor Index

SOX,

of 30 U.S.-listed chip makers and related equipment manufacturers, has dropped 44% this year. Then again, SOXX had risen 38% over the past three years and 81% for five years, underlining the importance of long-term thinking for stock investors, even during this terrible bear market for this particular tech space.

Here’s a summary of changes in stock prices (again, excluding dividends) and forward price-to-forward-earnings valuations during 2022 through Oct. 14 for every stock mentioned in this article. The stocks are sorted alphabetically:

| Company | Ticker | 2022 price change | Forward P/E | Forward P/E as of Dec. 31, 2021 |

| Apple Inc. |

AAPL, |

-22% | 22.2 | 30.2 |

| Adobe Inc. |

ADBE, |

-49% | 19.4 | 40.5 |

| Amazon.com Inc. |

AMZN, |

-36% | 62.1 | 64.9 |

| Advanced Micro Devices Inc. |

AMD, |

-61% | 14.7 | 43.1 |

| ASML Holding N.V. ADR |

ASML, |

-52% | 22.7 | 41.2 |

| Danaher Corp. |

DHR, |

-23% | 24.3 | 32.1 |

| Alphabet Inc. Class C |

GOOG, |

-33% | 17.5 | 25.3 |

| Linde PLC |

LIN, |

-21% | 22.2 | 29.6 |

| Microsoft Corp. |

MSFT, |

-32% | 22.5 | 34.0 |

| Nvidia Corp. |

NVDA, |

-62% | 28.9 | 58.0 |

| UnitedHealth Group Inc. |

UNH, |

2% | 21.5 | 23.2 |

| Source: FactSet | ||||

You can click on the tickers for more about each company. Click here for Tomi Kilgore’s detailed guide to the wealth of information available free on the MarketWatch quote page.

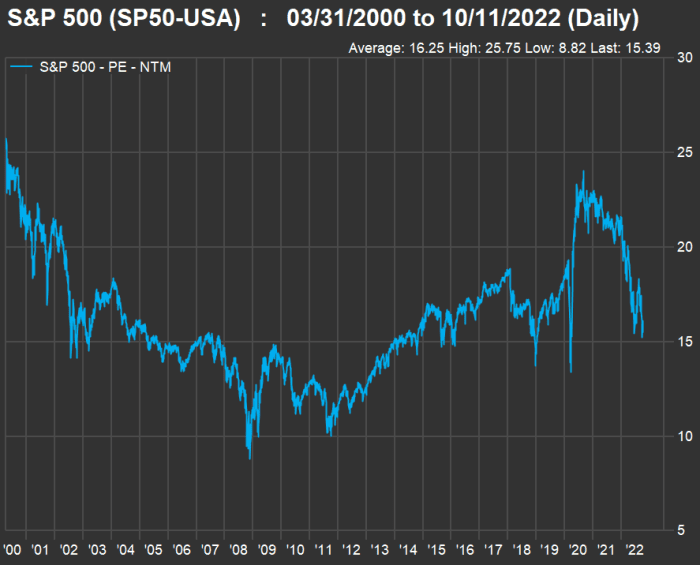

The forward P/E ratio for the S&P 500 declined to 16.9 as of the close on Oct. 14 from 24.5 at the end of 2021, while the forward P/E for SOXX declined to 13.2 from 27.1.

Don’t miss: This is how high interest rates might rise, and what could scare the Federal Reserve into a policy pivot