U.S. stocks closed higher Tuesday, but off the session’s best levels, after more data suggested inflation may be slowing and mega-retailer Walmart offered a rosier annual forecast.

The Dow turned negative earlier in the session after the Associated Press reported that Russian missiles crossed into Poland and killed two people, ratcheting up geopolitical tension given Poland is a NATO country.

How stocks traded

-

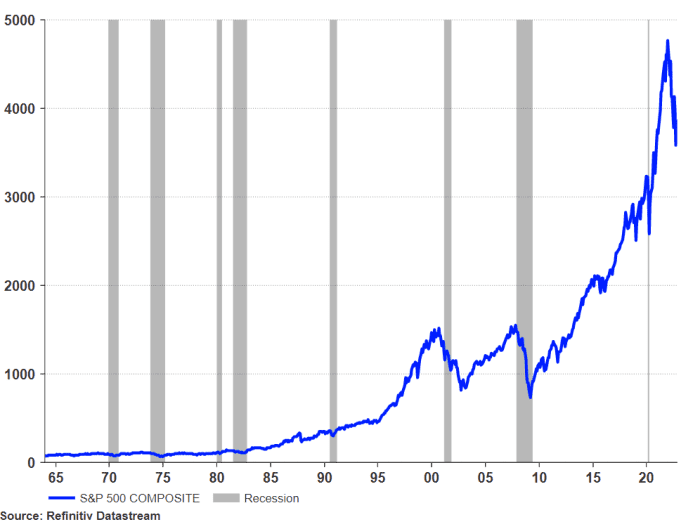

S&P 500 index

SPX,

+0.87%

rose 34.48 points, or 0.9%, to close at 3,991.73. -

Dow Jones Industrial Average

DJIA,

+0.17%

climbed 56.22 points, or 0.2%, ending at 33,592.92, after touching a nearly three-month high of 33,987.06 earlier. -

Nasdaq Composite

COMP,

+1.45%

climbed 162.19 points, or 1.5%, closing at 11,358.41.

On Monday, U.S. stocks finished near session lows after early gains evaporated. The Dow Jones Industrial Average fell 211 points, or 0.6%, while the S&P 500 declined 36 points, or 0.9% and the Nasdaq Composite dropped 226 points, or 2%.

What drove markets

U.S. stocks closed higher Tuesday, after another batch of inflation data showed that whole prices rises were slowing in October for the second straight month.

The Dow’s brief negative turn came after reports that Russian military bombarded Ukraine Tuesday. In the attack, missiles reportedly crossed into Poland, a member of NATO, the Associated Press said, citing a senior U.S. intelligence official.

“Geopolitical concerns obviously are never positive for the market,” said Peter Cardillo, chief market economist at Spartan Capital Securities.

On Tuesday, oil futures settled higher. West Texas Intermediate crude for December delivery rose to $1.05, or 1.2%, reaching $86.92 a barrel.

While markets had started to price in the toll of Russian’s nearly nine-month invasion of Ukraine, it had not priced in an potential escalation of the war, said Kent Engelke, chief economic strategist at Capitol Securities Management.

“Talk about geopolitical angst returning,” Engelke said, later adding, “If there were really missiles shot to Poland and that was really not an accident, wow, that is really increasing the scope of the war.”

A U.S. National Security Council spokesperson said the agency was aware of the news reports out of Poland, but that it cannot confirm the reports or any details at this time.

While international worries clouded the session, there was also encouraging domestic news.

The U.S. producer-price index climbed 8% over the 12 months through October, the Labor Department said Tuesday, easing from September’s revised 8.4% increase. Last week, stocks surged after the October consumer-price index rose more slowly than expected.

See: Wholesale prices rise slowly again and point to softening U.S. inflation

Tuesday’s PPI report helped support the notion that inflation has peaked, at least for now.

“Today, it’s really about the PPI and the market reaction to it,” Steve Sosnick, chief strategist at Interactive Brokers

IBKR,

said in a Tuesday morning interview before the reports of missiles crossing into Poland.

Markets ripped higher last Thursday after October’s consumer-price index showed signs of easing. The same dynamic was playing out Tuesday, but the response now has been “a bit more muted” because it’s an iteration on inflation data that investors already had been starting to see, Sosnick said.

So, is the economy really at peak inflation? It’s too early to say for sure, according to Sosnick. Still, the PPI numbers, paired with last week’s CPI reading “does add evidence to that narrative,” he added.

Walmart’s third quarter earnings also were buoying markets, Sosnick said. The massive retailer’s beat on earnings offers a glimpse at the minds and wallets of many American consumers. For anyone who worries about consumers “getting highly defensive” and not spending, Walmart’s numbers are “counter evidence.”

In other news, the first face-to-face meeting between President Joe Biden and President Xi Jinping helped support stocks listed in China and Hong Kong, as some of the tensions between the world’s two largest economies were seen to be easing.

The upbeat tone from Asia, which included Taiwan Semiconductor Manufacturing Company

TSM,

jumping 7.7% on news Warren Buffett had bought a $5 billion stake, underpinned European bourses, which closed higher for a fourth session in a row.

Analysts increasingly expect stocks to enjoy a positive end to the year. “The near-term picture still looks positive for U.S. benchmark indices and while momentum has reached intra-day overbought levels, this doesn’t imply a selloff has to happen right away,” said Mark Newton, head of technical strategy at Fundstrat.

Philadelphia Federal Reserve President Patrick Harker said Tuesday that he favored a 50 basis-point hike to the Fed’s benchmark rate in December. Atlanta Fed President Raphael Bostic said more rate hikes will be needed, even through there have been “glimmers of hope” on inflation.

Fed Vice Chairman for Supervision Michael Barr said Tuesday that the U.S. economy is likely to slow in coming months, and more workers will lose their jobs, in Senate testimony. The Fed is working with regulators to assess risks tied to cryptocurrency markets, following the collapse of FTX and its associated companies.

In other U.S. economic data, the New York Empire State manufacturing index for November showed a gauge of manufacturing activity in the state rose 13.6 points to 4.5 this month.

The yield on the 10-year Treasury note

TMUBMUSD10Y,

was down 6.7 basis points at 3.798%. Bond yields move inversely to prices.

Companies in focus

-

Walmart

WMT,

+6.54%

shares jumped after the giant retailer swung to a net third-quarter loss, due to $3.3 billion in charges related to opioid legal settlements, but reported adjusted profit, revenue and same-store sales that were well above expectations and a full-year outlook that was above forecasts. Walmart shares opened Tuesday at $145.61 and closed at $147.48, or 6.57% higher. -

Home Depot

HD,

+1.63%

rose after the home improvement retailer reported fiscal third-quarter earnings that beat expectations, citing strength in project-related categories, but kept its full-year outlook intact. Home Depot shares opened Tuesday at $304.06 and closed at $311.99. -

Chinese-listed technology traded sharply higher on Tuesday, including U.S.-traded ADRs for Alibaba Group Holding

BABA,

+11.17% ,

Baidu Inc.

BIDU,

+9.02%

and JD.com Inc.

JD,

+7.14%

The KraneShares CSI China Internet exchange-traded fund

KWEB,

+9.56%

also traded substantially higher.

—Jamie Chisholm contributed reporting to this article