Dogecoin (DOGE) has recently seen a major recovery from a critical accumulation zone, which a crypto analyst believes could set the stage for a stronger rally to or above $1. The massive price surge comes after months of consistent declines, during which the dog-themed meme coin has failed to break through resistance amid volatility and persistent market sell-offs.

Dogecoin Rebounds 46% From Accumulation Zone

Market analyst Crypto Patel has released a fresh evaluation of Dogecoin’s price behavior, pointing to a key accumulation zone that has sparked a notable recovery in the meme coin. The analyst highlighted a significant shift in Dogecoin’s momentum and price direction after it climbed roughly 46.94% from a strong support area and accumulation zone near $0.0375. The jump included a recent 8.57% daily increase, which propelled DOGE toward $0.113.

Related Reading

Crypto Patel has said that short-term traders can consider taking profits at current high levels. In contrast, long-term traders are encouraged to view any decline from $0.113 to the $0.06 to $0.08 range as a gradual accumulation opportunity, with expectations that the meme coin’s next bullish targets will extend to $1 and $2.

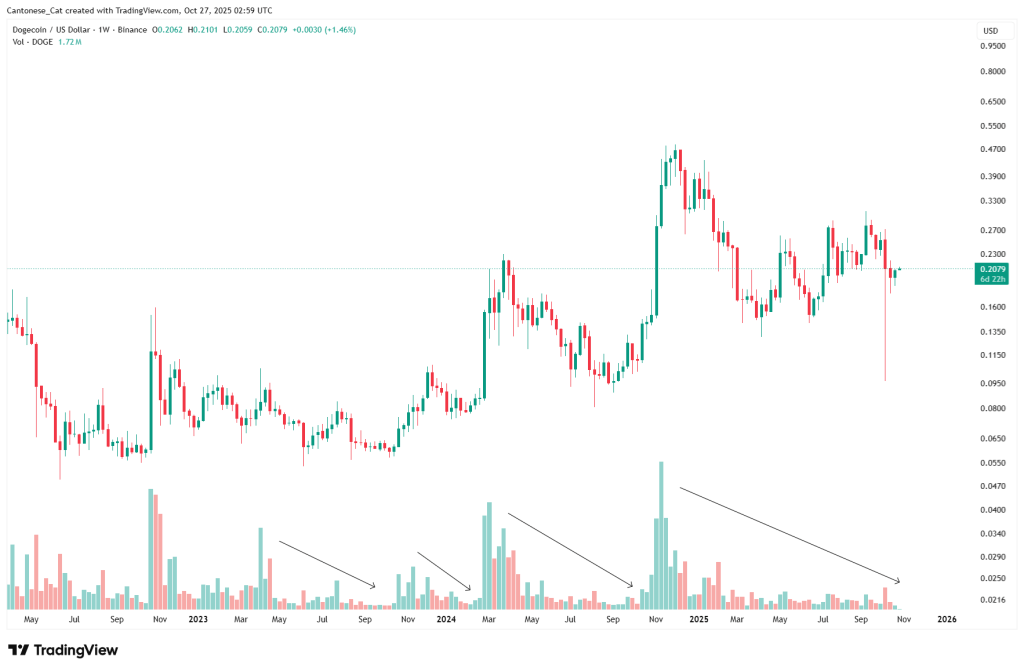

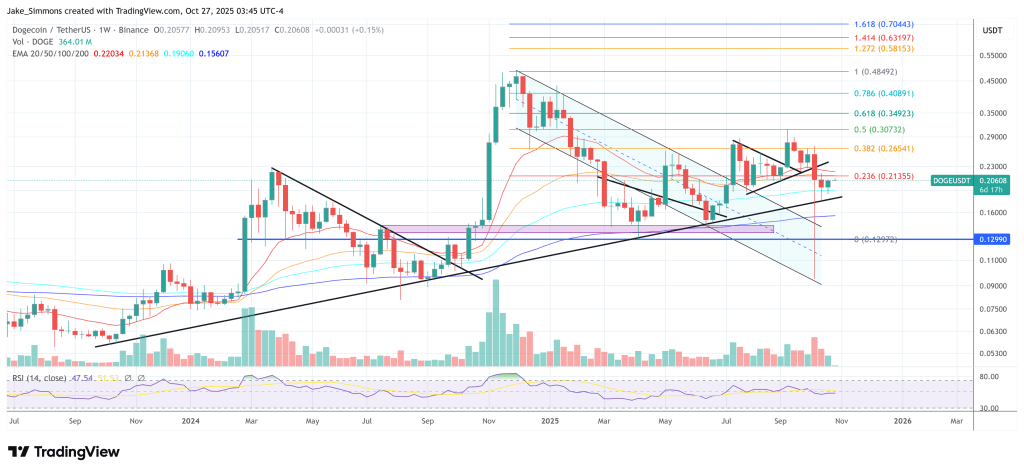

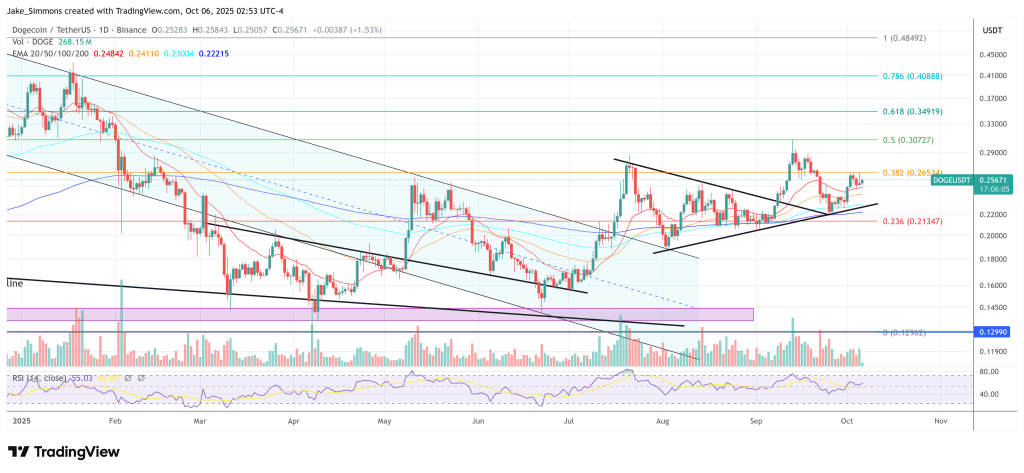

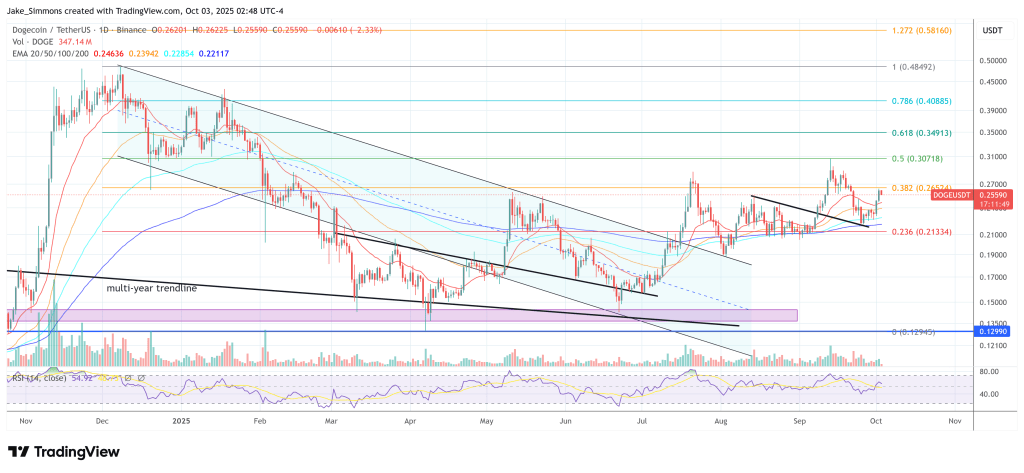

The accumulation zone, marked in green on the analyst’s chart, represents a multi-year base that has held since earlier cycles, with the Dogecoin price respecting it as a higher-timeframe support. Crypto Patel noted that DOGE previously recorded two major breakouts before reaching this zone. The first breakout occurred at the lower boundary of a descending channel between points 1 and 2 on the chart, followed by a second breakout from a later consolidation phase that pushed prices higher.

After these moves, Dogecoin’s price pulled back and retested key levels before settling into the current accumulation zone. The meme coin is now showing renewed bullish momentum after months of decline, with price action pointing toward a move to higher levels.

Fibonacci extensions and measured move projections further indicate the likelihood of a significant upside, with one target on the chart pointing to $0.567, representing a potential 409% rally. Another target suggests an even higher price increase toward $2 and possibly $4 if bullish momentum persists.

Related Reading

Although Dogecoin recovered to $0.11, its price has since declined to $0.10. CoinMarketCap’s daily chart shows that DOGE has declined by more than 11% over the past 24 hours.

Analyst Highlights Possible Invalidation Level

In his chart, Crypto Patel highlighted a potential invalidation area, warning that if it is crossed, Dogecoin could pull back and resume its previous downtrend. The invalidation level sits near $0.056, just below the accumulation zone. The analyst noted earlier that despite the recent recovery, the DOGE price could still revisit the $0.06 range, suggesting that a weekly close below this area could weaken the meme coin’s broader macro bullish structure.

Featured Image from Pixabay, chart from Tradingview.com

Sandra White

Source link