At a time when many investors seem euphoric, others are warning that stock valuations have once again turned frothy. It may pay to take a look back at valuation and performance and consider your own risk tolerance.

A value-based approach that offers lower volatility and good long-term returns can be expected to be less flashy than one focused on the hottest technology stocks. But depending on how much it bothers you when the stock market gyrates, it may be a better way for you to invest. Lower volatility might help you to avoid the type of emotional reaction that can lead to selling into a declining market or attempting to time the market, both of which tend to be losing strategies.

Aaron Dunn is a co-head of the value equity team at Eaton Vance, which is based in Boston and is a unit of Morgan Stanley. During an interview, he explained how he and Brad Galko, who co-heads the team, select stocks for the Eaton Vance Focused Value Opportunities Fund. The fund’s performance benchmark is the Russell 1000 Value Index

RLV,

+1.08%.

First, let’s take a broad look at how aggregate forward price-to-earnings ratios have moved for exchange-traded funds tracking several broad indexes over the past 10 years:

The valuations are lower than their 2020 peaks. But for all but one, the valuations still appear to be high when compared with their 10-year averages:

|

ETF

|

Ticker

|

Current forward P/E

|

10-year average forward P/E

|

Current valuation to 10-year average

|

|

SPDR S&P 500 ETF Trust

|

SPY,

+0.64%

|

19.06

|

15.93

|

120%

|

|

iShares Russell 1000 ETF

|

IWB,

+0.80%

|

18.94

|

16.02

|

118%

|

|

iShares Russell 1000 Value ETF

|

IWD,

+1.07%

|

14.33

|

13.94

|

103%

|

|

iShares Russell 1000 Growth ETF

|

IWF,

+0.50%

|

26.63

|

19.00

|

140%

|

|

Source: FactSet

|

All of the listed ETFs listed here are trading well above their 10-year average P/E valuations except the iShares Russell 1000 Value ETF, which is only slightly higher. These numbers back the notion that the broad market is expensive and that a value approach may be more reasonable. It is also worth keeping in mind that during 2022, when the SPDR S&P 500 ETF Trust

SPY,

+0.64%

declined 18.2% and the iShares Russell 1000 ETF

IWB,

+0.80%

fell 19.2%, the iShares Russell 1000 Value ETF

IWD,

+1.07%

pulled back 7.7% and the Eaton Vance Focused Value Opportunity Fund’s Class I shares were down only 3.3%, all with dividends reinvested.

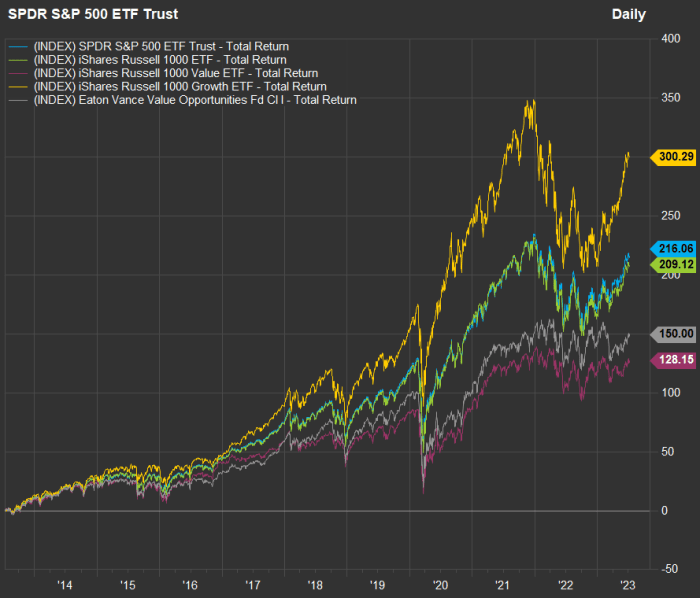

If we look at 10-year total returns, the nonvalue indexes, so heavily weighted to the largest technology-oriented companies, have been excellent performers for investors who could remain committed through thick and thin:

|

Fund

|

Ticker

|

3-year average annual return

|

5-year average annual return

|

10-year average annual return

|

|

SPDR S&P 500 ETF Trust

|

SPY,

+0.64%

|

13.2%

|

11.4%

|

12.3%

|

|

iShares Russell 1000 ETF

|

IWB,

+0.80%

|

12.5%

|

11.0%

|

12.1%

|

|

iShares Russell 1000 Growth ETF

|

IWF,

+0.50%

|

11.2%

|

14.0%

|

15.0%

|

|

iShares Russell 1000 Value ETF

|

IWD,

+1.07%

|

13.7%

|

7.3%

|

8.7%

|

|

Eaton Vance Value Opportunities Fund – Class I

|

EIFVX,

+0.92%

|

14.8%

|

8.7%

|

9.7%

|

|

Source: FactSet

|

For five and 10 years, the growth-oriented approaches have shined. But for three years, which includes the 2022 disruption, the Eaton Vance Value Opportunities Fund has fared best, even outperforming its benchmark.

A selective approach to value

The Eaton Vance Focused Value Opportunity Fund’s Class I

EIFVX,

+0.92%

shares are rated four stars (out of five) within Morningstar’s Large Value fund category. The fund’s Class A

EAFVX,

+0.93%

shares are rated three stars. The difference is that the Class I shares, which are typically distributed through investment advisers, have annual expenses of 0.74% of assets under management, while the Class A shares have an expense ratio of 0.99%. You can purchase Class I shares directly through brokerage platforms for a $50 fee.

Dunn said that when selecting stocks for the fund, he and Galko take a bottom-up approach to identify quality companies. The want to see high returns on invested capital (ROIC) over the long term, as well as a “good competitive position” for a company and a strong management team.

They also prefer companies with low debt. “We do not want to buy overlevered companies and be in a situation where we are diluting through equity raises and putting capital at risk,” he said.

Dunn added that he and Galko look closely at free cash flow generation. A company’s free cash flow is its remaining cash flow after capital expenditures. This is money that can be used to fund expansion, acquisitions, dividend increases or share buybacks, or for other corporate purposes.

“Philosophically, what this results in is that we hold up well in markets such as last year’s. And we find upside in stocks trading below intrinsic value,” he said.

“We focus on finding ideas where there is a good skew for upside relative to downside,” he added.

According to Morningstar, the fund’s active share when compared with IWD is high, at 91.45%. Active share is a measure of how much an actively managed fund differs in investment exposure from its benchmark index. If you are paying more for active management than you would to invest in an index fund, active share is something to consider. If it is low, you might be overpaying for a “closet indexer.” You can read about how Morningstar assesses active shares here.

The fund is concentrated, typically holding between 25 and 45 companies.

According to Morningstar’s most recent data, these were the fund’s top 10 holdings (out of 28 stocks) as of May 31:

|

Company

|

Ticker

|

% of Eaton Vance Focused Value Opportunity Fund

|

Forward P/E

|

2023 total return

|

|

Alphabet Inc. Class A

|

GOOGL,

+0.59%

|

5.0%

|

19.6

|

32%

|

|

Micron Technology Inc.

|

MU,

+1.79%

|

4.8%

|

N/A

|

25%

|

|

American International Group Inc.

|

AIG,

+1.15%

|

4.3%

|

8.1

|

-7%

|

|

Reinsurance Group of America Inc.

|

RGA,

-0.34%

|

4.2%

|

8.0

|

1%

|

|

Bristol Myers Squibb Co.

|

BMY,

+0.50%

|

4.1%

|

7.7

|

-11%

|

|

Wells Fargo & Co.

|

WFC,

+0.99%

|

4.0%

|

8.9

|

4%

|

|

ConocoPhillips

|

COP,

+2.96%

|

4.0%

|

10.5

|

-10%

|

|

Constellation Brands Inc. Class A

|

STZ,

+0.30%

|

3.9%

|

20.4

|

9%

|

|

NextEra Energy Inc.

|

NEE,

+0.67%

|

3.8%

|

21.9

|

-13%

|

|

Charles Schwab Corp.

|

SCHW,

-0.43%

|

3.8%

|

16.0

|

-30%

|

|

Source: FactSet

|

Click the tickers for more about each company, fund or index.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

There is no forward price-to-earnings ratio for Micron Technology Inc.

MU,

+1.79%,

because the company’s combined EPS for the next 12 months are expected to be negative.

Micron is a company in transition, caught up in diplomatic conflict between the U.S. and China, whose government directed some manufacturers in May to stop purchasing memory chips made by the company. Then again, in June, Micron highlighted its “commitment to China” when announcing a new investment in its plant in Xi’an.

Read: Micron recovery debated by analysts as bottom is called in memory-chip market

Dunn said downside for Micron’s stock was “mitigated” because of the company’s relatively low debt. He also said that as companies continue to adopt more cloud services and deploy artificial-intelligence technology, demand for memory chips will increase.

While there is no current forward P/E for Micron, the stock always trades at low valuations relative to most other large tech companies. Dunn touted Micron’s strong cash flow and said the stock was “underappreciated” and remained “an interesting play on cloud and AI.”

While it is not among the top 10 holdings listed above, Dunn highlighted Dollar Tree Inc.

DLTR,

+1.80%

as an example of the type of value stock he favors. The company “was not well run” following its acquisition of Family Dollar in 2015. But he has been impressed with its more recent turnaround efforts, including improvements in how products are shipped to stores, better efficiency and “a lot of work going on with culture, how they operate, how they treat employees [and] adding some shelf space to move more product.”

It is interesting to see NextEra Energy Inc.

NEE,

+0.67%

among the fund’s largest holdings. This has been quite a strong grower over the past 10 years, with a total return of 346% as the owner of Florida Power & Light has grown along with its customer base and has become a leader in the build-out of solar-power generation.

Dunn said the company is “still growing in the mid-single digits. For a utility company, that is a strong profile.”

When discussing Alphabet Inc.

GOOGL,

+0.59%,

the fund’s largest holding as of May 31, Dunn said that “it is really an advertising business with other businesses around it” and that its P/E valuation was “not extremely taxing.” He said Alphabet had been “less aggressive with cost cutting” than other technology giants and added that the company’s “targeted search” through Google and other properties, such as YouTube, “probably provides a better return on investment than broadcast advertising, and that really is the key.”

Don’t miss: This stock investing strategy has blown away the S&P 500. Here’s a way to refine it for quality.