DrinkPAK, which cans White Claw, High Noon and Monster Energy, is investing $195 million in a facility at the Bellwether District. It’s the first tenant at the redeveloped refinery.

Michael Tanenbaum

Source link

DrinkPAK, which cans White Claw, High Noon and Monster Energy, is investing $195 million in a facility at the Bellwether District. It’s the first tenant at the redeveloped refinery.

Michael Tanenbaum

Source link

DRACUT — The Zoning Board of Appeals has published a draft decision signaling it is ready to approve the contentious Murphy’s Farm Chapter 40B proposal for apartments in East Dracut. Final approval is expected at the board’s Dec. 4 meeting.

As published, the number of apartments has been downsized from 268 units to 200. The original proposal called for 300 units.

One of the goals of the decades-old 40B law is to increase the stock of affordable housing in the state. Murphy’s Farm will have 20 low-income units and 20 moderate-income units.

Chapter 40B gives the ZBA power to issue comprehensive permits that supersede the normal permitting process.

The draft document lists more than 90 conditions the developer, O’Brien Homes of Andover, must comply with to be granted a comprehensive permit.

If approved by the ZBA and accepted by the developer, an agreement would bring to an end almost three years of public hearings, neighborhood meetings and property tours.

But the developer can appeal to the state Housing Appeals Committee — which operates under the Executive Office of Housing and Livable Communities — if the proposal would make the project economically unviable.

Asked about the prospect of an appeal, developer Kevin O’Brien said, “The town’s got to do what it’s got to do. And we have to do what we have to do.”

Selectman Tony Archinski, who has attended most of the hearings, told The Sun, “I have spoken to the town manager and secured funding for legal issues should the builder appeal the decision.”

Speaking for the Citizens Against Reckless Development in Dracut, Michelle Boermeester stated, “We appreciate that the ZBA recognized the project as far too dense and moved to condition the development at 200 units. This reduction helps alleviate some of the anticipated density and traffic impacts on direct abutters and on the broader Dracut community. While we would have preferred an outright denial of the permit, the Board’s conditions represent meaningful modifications and will leave it to the developer to decide whether to accept the terms or pursue an appeal.”

She added, “Even so, we remain concerned that the project—despite the reduction—still is overly dense for this area. We also believe the ZBA did not fully address public safety considerations. The current layout includes extended roadways without cul-de-sacs, leaving no margin for error for emergency response vehicles to maneuver, compromising public safety.”

Aside from reducing the number of units in the complex, the proposal would make the developer pay $7,500 for sewer connections for each market-rate apartment. Connection fees for affordable units would be waived. The developer would pay a total of $1.125 million for sewer connections.

Connection to the Kenwood Water District will cost $5,500 for the first unit and $4,125 for each additional unit. The estimated total for 200 units is $826,375. The connection fee for each building must be paid in full prior to connection to the town system.

Prudence Brighton

Source link

The developer of a Walmart Neighborhood Market in rapidly growing east Mooresville wants to add a restaurant and a gas station/convenience store nearby.

Iredell Avenue Residential Development LLC will seek a rezoning from the Mooresville Board of Commissioners on Monday for a Wendy’s and a 7-Eleven in its Harris Crossing development on Coddle Creek Highway (N.C. 3) at Harris Crossing Boulevard, Mooresville Planning & Community Development documents show.

At a neighborhood meeting held by the developer in May, residents raised concerns about traffic, safety, noise and potential pollution, according to the town documents.

The developer said existing trees, a proposed berm and an eight-foot-tall wall with landscaping on both sides would create sound and visual barriers along the southern end of the nearly five-acre property.

A proposed 50-foot-wide buffer of trees and other vegetation “would deter the possibilities of vagrants trying to walk through and get to the existing backyards of the adjacent homes along the east side of the property,” according to town planning documents.

On May 27, the Mooresville Planning Board sided with residents in recommending the rezoning be denied by the town board.

The Mooresville Board of Commissioners will consider the rezoning at 6 p.m. Monday at Town Hall, 413 N. Main St.

Joe Marusak

Source link

“Basically, everybody goes to bed, they wake up in the morning and there’s a bridge there,” said Michael Altomari, assistant construction engineer at PennDOT

The bridge will not be open to pedestrians and cyclists for about another year after the arch is installed. Additional work will include constructing the approach spans, decking and railings. The bridge cables also will need to be adjusted to their proper tension, and lights and security cameras will be installed for visibility and safety.

Provided Image/PennDOT

Provided Image/PennDOT

A rendering shows plans for the South Street Bridge Extension, a 258-foot span that will carry the city’s existing structure from the east side of Interstate 95 across Christopher Columbus Boulevard to the Delaware River waterfront at Lombard Circle.

StreetView/Google Maps

StreetView/Google Maps

The existing South Street Pedestrian Bridge was constructed in the mid-1990s, creating a path over Interstate 95 with a staircase leading down to Columbus Boulevard. The extension will take the bridge across Columbus Boulevard.

Planners initially considered building the bridge across Columbus Boulevard using a temporary pier in the middle of the road to support ongoing work. That plan would have required traffic control, disruptions and the use of shielding to protect drivers below. The old train tracks from the defunct Philadelphia Belt Line Railroad, now owned by CSX, also would have posed challenges.

“This is the smart way to do it, I think,” Altomari said of the overnight method.

PennDOT spokesperson Brad Rudolph said the agency has a time-lapse camera pointed at the location around the clock and will be able to show the public how the arch was moved into place.

PennDOT believes easy access to the waterfront from South Street will maximize the use of new amenities and limit reliance on cars to get to them. The bridge will be about a 10-minute walk north along Columbus Boulevard to get to the future Park at Penn’s Landing.

On the east side of the bridge, PennDOT plans to build a “corkscrew”-style circle that allows people on bikes and wheelchairs to ease off the span gradually. Trees and bushes will be planted in the area, which sits right up against the river.

Provided Image/PennDOT

Provided Image/PennDOT

The east side of the bridge extension will have a circular ‘corkscrew’ design with landscaping next to the waterfront.

The existing South Street Pedestrian Bridge, owned by the city and accessed via Front Street, also will be rehabilitated as part of the project. It will remain unchanged except for the removal of its aluminum “Stroll” sculptures, which will be displayed at another location to be determined. PennDOT will rebuild the parking lot at the site of the existing bridge and maintain the new section over Columbus Boulevard.

When the Park at Penn’s Landing opens, it will have an ice rink, public gardens, memorials, children’s play area, amphitheater, food trucks, cafe and a mass-timber pavilion. There also will be a number of open spaces for performances, festivals, fairs and other events.

Provided Image/DRWC

Provided Image/DRWC

A rendering shows an aerial view of the Park at Penn’s Landing that will open in 2030.

Bonito and Altomari are confident the I-95 cap project is on schedule for completion in 2029, followed by about a year to build out the park. PennDOT and its partners – including the Delaware River Waterfront Corp., the William Penn Foundation and the city — anticipate the park will bring new foot traffic to the length of the waterfront for a safer, more welcoming atmosphere.

“The development of that area is going to draw people, which will also draw developers,” Altomari said. “There’s a lot of piers down in that area, places that maybe have been in a little disrepair or not worth the investment to somebody. Now they might be.”

Michael Tanenbaum

Source link

Development of the massive One Beverly Hills residential and hotel complex reached a milestone over the weekend as construction started going vertical.

The work to erect the two tallest towers in Beverly Hills started Friday with an overnight continuous pour of 3,800 cubic yards of concrete, the equivalent of 41,000 wheelbarrows-full. It was the first of multiple foundation pours that will take place over the next 12 months, developer Cain said.

The project near the intersection of Santa Monica and Wilshire boulevards broke ground early last year and has so far included demolition, drilling geothermal wells, installing utility lines and digging a deep hole to house underground parking.

One Beverly Hills will be anchored by the Aman Beverly Hills, a 78-room, all-suite hotel that will be the brand’s first West Coast property.

One Beverly Hills Gardens

(Foster + Partners)

The tower residences will also be branded and serviced by Aman, a Swiss company owned by Russian-born real estate developer Vlad Doronin, which Forbes describes as “the world’s most preeminent resort brand,” and attracts affluent guests such as Bill Gates, Mark Zuckerberg, and George and Amal Clooney.

The two towers — 28 and 31 stories — will have a total of fewer than 200 condos.

Interspersed among the property will be as many as 45 stores and restaurants, including a Dolce & Gabbana boutique, Los Mochis restaurant and Casa Tua Cucina restaurant and marketplace.

“Over the next few months, you will start to see the buildings emerge from the ground,” said Jonathan Goldstein, chief executive of London-based Cain. “Reaching vertical construction is a powerful moment for everyone involved.”

One Beverly Hills is one of the biggest real estate developments by cost under construction in North America, Goldstein said. He valued it at $10 billion upon completion.

One Beverly Hills aerial rendering.

(Kerry Hill Architects)

It was conceived by London-based architect Foster + Partners. The firm is led by Norman Foster, an English lord perhaps best known for designing a landmark lipstick-like skyscraper in London known as the Gherkin and the hoop-shaped Apple Inc. headquarters in Cupertino, Calif.

Set for phased completion beginning in 2027, the development connects the Beverly Hilton and Waldorf Astoria Beverly Hills hotels in a unified, landscaped compound.

City officials agreed to let Cain build by far the two tallest towers in Beverly Hills with the understanding that stacking the condominiums high would leave open space for 8.5 acres of gardens on the 17.5-acre site.

The most public aspect of One Beverly Hills will be the gardens designed by Los Angeles architecture firm Rios, which also designed the 12-acre Gloria Molina Grand Park in downtown Los Angeles and created a new master plan for Descanso Gardens in La Canada Flintridge.

One Beverly Hills will feature botanical gardens that reflect the diverse landscape of Southern California, with drought-resistant native plants fed solely on recycled water, including rainfall and the runoff from residents’ sinks and showers. The gardens are designed to have more than 200 species of plants and trees, including palms, oaks, sycamores, succulents and olives.

Set within the historic grounds of the former Beverly Hills Nurseries, which later became the Robinsons-May department store, the gardens will feature two miles of walkways, trails, sitting areas and water features.

“We’re entering an exciting new chapter with the One Beverly Hills project, and I’m delighted to see it moving closer to becoming a reality,” said Beverly Hills Mayor Sharona Nazarian. “This is an important addition to Beverly Hills, and I’m proud of the progress we’re making.”

Roger Vincent

Source link

Gaithersburg, Maryland’s Lakeforest Mall site will soon be transformed to a development including condos, mixed-use, an expanded transit center and green space.

Montgomery County, Maryland’s Lakeforest Mall site, which was once home to a mall that featured an indoor skating rink and retail outlets Hecht’s and Woodward and Lothrop, will soon be transformed.

About 45 years after it opened, the 100-acre site in Gaithersburg, which was once the largest mall in Montgomery County, is the focus of redevelopment that will include an expansion of the transit center that’s currently there and mixed-use development, including condos, retail outlets and green space.

The redevelopment includes a partnership between the county and WRS Inc. Real Estate Investments, according to a news release from County Executive Marc Elrich.

The new transit center will serve eight Ride On bus routes that use the current Lakeforest Transit Center and will include capacity for the planned MD 355 Flash Bus Rapid Transit, or BRT, corridor.

According to county officials, the first phase of the transit center redevelopment is expected to take one year.

Get breaking news and daily headlines delivered to your email inbox by signing up here.

© 2025 WTOP. All Rights Reserved. This website is not intended for users located within the European Economic Area.

Kate Ryan

Source link

The College of Physicians of Philadelphia, the medical society that owns and operates the Mütter Museum, will start construction next year to expand its campus and create new gallery spaces inside a historic former church next door.

The organization said Monday it plans to unite its current home at 19 South 22nd St. — between Market and Chestnut streets — with the adjacent Swedenborgian Church and Parish House at 2129 Chestnut St. The college bought the property for a reported $9.3 million in 2023 with the goal of making the campus more cohesive for its fellows and the public.

MORE: Ken Burns’ new series highlights some lesser-known revolutionaries from Philly and South Jersey

“We are not content to rest on our past,” President and CEO Larry Kaiser said in a statement. “We see a need to move forward with plans for innovation, inclusion, and renewed purpose.”

The college, established in 1787, is the nation’s oldest private medical society and houses a vast historical library used by physicians and public health researchers. The Mütter Museum was founded in 1863 to showcase a collection of more than 25,000 medical specimens, giving visitors a glimpse into the study and evolution of treatments for various maladies.

The Mütter Museum’s core gallery will get a “significant expansion” into the church that will allow for the display of thousands of more items held in stored collections, officials said. The vast majority of the college’s medical instruments, biological specimens, teaching models, texts and other archival materials are not publicly displayed.

Adding space will allow for new rotating galleries, a larger museum store and more opportunities for school groups to visit the Mütter.

The Gothic Revival church, built in 1881, was designed by renowned Philadelphia architect Theophilus Parsons Chandler Jr. and is listed on the National Register of Historic Places. It originally served as the Church of the New Jerusalem, an 18th century Christian sect that followed Swedish theologian Emanuel Swedenborg. The church closed in the mid-1980s and the building later underwent a renovation that converted some of its space into medical offices.

The College of Physicians of Philadelphia purchased the former Swedenborgian Church and Parish House, shown above, for a reported $9.3 million in 2023.

The college’s expansion comes on the heels of the museum’s two-year ethical review to examine and update policies for the display of human remains. The process led to a shake-up of the college’s executive leadership that brought Kaiser into the fold in January and installed a new team to oversee the museum’s future development.

Construction will be carried out in stages to minimize disruptions to the college, its visitors and the surrounding community, officials said. A fundraising campaign has already collected $27 million for the first phase, which includes creating a glass connector between the two buildings and opening up fully accessible entrances to both.

Other plans call for new classrooms and multi-purpose spaces that will serve college fellows, the public and attendees of future medical conferences in the city. The college did not provide a timeline for the completion of its work.

“We are thrilled about the opportunities the campus expansion provides to the Mütter Museum and Historical Medical Library,” said a joint statement from Mütter Museum directors Erin McLeary and Sara Ray. “This is a unique place where our visitors get the chance to see objects that spark curiosity, promote creativity, and encourage engagement with medical history.

Michael Tanenbaum

Source link

Mayor Cherelle Parker unveiled her vision to reverse the decadeslong decline of East Market Street on Friday, promising a process that will restore the corridor as Philadelphia’s economic and cultural anchor while accounting for the interests of people who live in the area.

Some residents, who say they still are recovering from the trauma caused by the process of the 76ers’ abandoned plans to build a new arena on East Market, feel this new situation is all too familiar.

MORE: Researchers create ‘digital monument’ to site of 2019 South Philly refinery explosion

After months of lobbying the city to build their $1.3 billion arena at 10th and Market streets, the Sixers abruptly withdrew the plan in favor of partnering with Comcast Spectacor, their current landlord at Xfinity Mobile Arena, to build an arena in South Philly. The joint venture includes commitments to invest in East Market Street.

“After we all got over the shock and awe of what was not going to happen on Market East, I immediately shifted into my eternally optimistic view about how we are going to be able to move things forward,” Parker said during a press conference at Jefferson Health’s Honickman Center.

The Market East Corridor Planning and Advisory Commission, led by Brandywine Realty Trust CEO Jerry Sweeney, will be tasked with creating a redevelopment plan that stretches from City Hall to the Delaware River. The planning process is expected to take about a year.

“All of us have connections to Market East and a significant stake in remaking this corridor into a valuable asset for the city,” Sweeney said.

Leaders from Comcast Spectacor, the 76ers and dozens of other institutions will now be responsible for planning construction, infrastructure upgrades and social services along a street that has had trouble keeping businesses in storefronts and has a large homeless population.

Parker said she learned from how she handled the contentious arena planning process, which drew resistance from communities in Chinatown and Washington Square West. She pledged to take a different approach to city planning that listens to government, businesses and residents.

“I don’t want anyone leaving here today saying that there is a plan that is baked, that is cooked, that is done, and (that) it is a plan that will be shoved down the throats of Philadelphians,” Parker said. “That is not what this is.”

Neighborhood advocates at Friday’s press conference said they have little faith that the city will follow through with its promises.

“There’s not a clear accountability measure for making sure that the actual citizens of Philadelphia are heard in this process,” said Katie Garth, a member of the Neighborhood Alliance of Washington Square West.

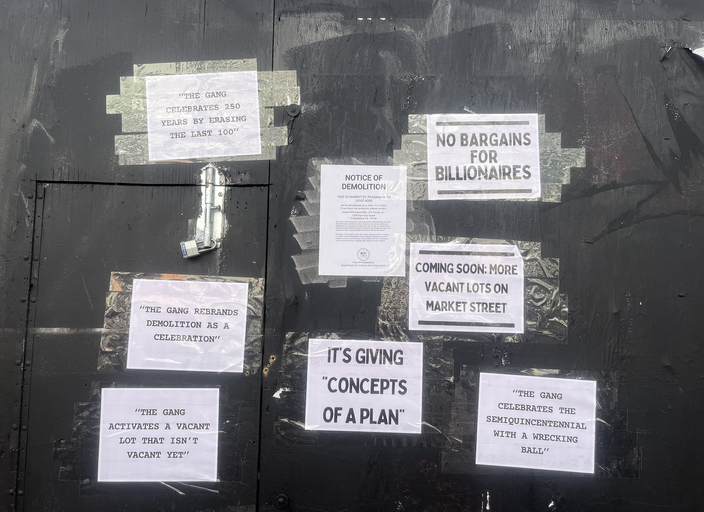

The Sixers and Comcast Spectacor already have plans to demolish several vacant buildings on the south side of Market Street, between Ninth and 10th streets, before the end of the year. The structures, which cover half the block, include the former Robinson department store and a former Reebok store.

The Philadelphia Department of Licenses & Inspections has a demolition notice posted for the buildings at 1020-1024 Market St., which Comcast Spectactor and the Philadelphia 76ers plan to knock down in the coming months to make way for a World Cup pop-up next summer. Opponents of the plan taped signs next to the notice on Friday morning.

Comcast’s chief legal officer, Thomas Reid, said the empty space will be used for activities related to the World Cup when the international soccer tournament comes to the city in June. He gave no other details, but said Comcast already has invested $60 million in properties on Market Street and will be a “turbocharged engine” for redevelopment as the city prepares to celebrate the nation’s 250th anniversary next year.

Beyond 2026, Comcast and the 76ers have not disclosed plans for the soon-to-be vacant lots.

“We think that that’s going to further blight the neighborhood. It’s going to make the situation worse with no real guarantees that it will get better,” said Laney Myers, with the historic preservation group RePoint Philadelphia.

The Design Advocacy Group, a volunteer organization of development and planning professionals in the city, published a letter last week calling the pending demolitions “impulsive.” They questioned why it took nearly a year for Parker to convene the advisory group and said the city should consider “strategic reuse” of the buildings slated to be torn down.

Michael Tanenbaum/PhillyVoice

Michael Tanenbaum/PhillyVoice

Comcast Spectacor and the 76ers plan to soon demolish several buildings along the 1000 block of Market Street as part of a long-term plan to revitalize the corridor.

Neighborhood leaders in attendance Friday said the city’s push for demolition is a bad start that shows little has been learned from the arena planning process, despite Parker’s claim that plans on Market Street have not been finalized.

“We are still suffering from PTSD over the arena debacle, and there’s a lot of deja vu happening right now,” Myers said.

As the Market East commission’s work gets underway, Parker said progress is already taking shape on East Market Street.

She pointed to the ongoing streetscape improvements along Market Street in Old City and the Philadelphia Parking Authority’s plan to invest $13 million to renovate the former Greyhound bus terminal on Filbert Street. She also praised the Convention Center for investing nearly $1 million in new lighting along the corridor.

City Councilmember Mark Squilla, whose 1st District covers East Market Street, said he will create an online portal where residents can share ideas about Market Street’s future.

“That allows us to take input from everybody, especially the adjoining communities that will be impacted the most,” he said.

Sweeney anticipates there will be competing ideas and conflicts in the months to come.

“No doubt, through our public engagement process, many strong opinions will be expressed,” he said. “All perspectives will have a full seat at the table to present ideas, raise concerns, share their hopes and aspirations, and then we will collectively determine our short- and long-term path forward.”

Michael Tanenbaum

Source link

LOS GATOS — A senior living community in Los Gatos that opened its doors earlier this year has been bought for more than $50 million by a big-time real estate investor from Chicago.

Ivy Park at Los Gatos has been bought for $54 million by an affiliate controlled by Harrison Street Real Estate, according to documents filed on Nov. 5 with the Santa Clara County Recorder’s Office.

The 114-unit complex is located at 400 Blossom Hill Road in Los Gatos and opened its doors in May.

An alliance of two Bay Area real estate firms, Vacaville-based Chronograph Properties and San Jose-based Swenson, developed the senior community and sold it to the Harrison Street affiliate.

The purchase price was well above the January 2025 assessed value of $38.4 million as calculated by the Santa Clara County Assessor’s Office. A county assessment is just one metric that can be used to provide a snapshot of a property’s value.

Harrison Street Real Estate, which is owned by Harrison Street Asset Management, was founded in 2005 and has been a frequent investor in senior living centers, according to the company’s website.

Over the 20 years since it was founded in 2005, the firm has invested approximately $14.6 billion in senior housing assets that total a combined 43,000 units, the company stated in August in connection with its purchase of a portfolio of senior living communities in the New York City area.

George Avalos

Source link

The Philadelphia Visitor Center on Monday revealed the schedule for the light show and Dickens Village at the former Macy’s space in the Wanamaker Building, while also adding that the annual Christmas festivities will be going on a two-year hiatus after this year as new owner TF Cornerstone turns the building into a mixed-use development.

After the department store closed in March, there were concerns that the decades-old holiday programming would be permanently discontinued.

MORE: Every Philly neighborhood to receive another deep clean by February

Organizers said the budget to install and put on the free events is approximately $600,000, which was “much greater than originally anticipated.” But thanks to more than 1,000 people contributing to a fundraising campaign, the attractions were able to return — at least for 2025. As for beyond 2027, efforts to establish long-term sustainability are in the works.

“The Philadelphia Visitor Center remains deeply committed to preserving these iconic attractions and is in conversation with building owner TF Cornerstone to continue these holiday traditions at the Wanamaker Building in future years,” the organization said in a statement Monday.

In 2026 and 2027, the building will be under construction during the holiday season. Philadelphia approved zoning permits for New York-based TF Cornerstone in July to build around 600 apartments, with retail spaces and rooftop decks.

This year’s festivities will begin Friday, Nov. 28. The 10-minute light show, which was started in 1956, occurs every hour on the half hour. The Dickens Village lets guests wander through a re-creation of Charles Dickens’ classic book, “A Christmas Carol.” While the walkthrough experience is free to attend, time slots must be reserved online and are available five days in advance, with the last entry 30 minutes before closing.

Here are the hours of operations:

Nov. 28-Dec. 11: Open Wednesday-Sunday from noon-6 p.m. (Closed on Mondays and Tuesdays). Extended organ concerts at 12:45 p.m. and 4:45 p.m.

Dec. 12-Dec. 23: Open daily from noon-8 p.m. Extended organ concerts every day but Sundays at 12:45 p.m. and 4:45 p.m.

Dec. 24: Open from noon-4 p.m.

Molly McVety

Source link

A six-story building with offices, retail space and restaurants will anchor the corner of North University Drive at White Settlement Road (soon to be renamed Westside Drive) as part of the $1.7 billion Westpark Village development.

Documents filed with the city of Fort Worth this week, including artist renderings, describe the design as having a pedestrian-friendly plaza “flanked with restaurant patios, retail storefronts, and lobby entries.” The top floor would be “dedicated to a social club, offering wide views of the Fort Worth skyline from indoor and outdoor dining and social spaces.”

The site is the former location of the Fort Worth ISD administration building.

The project will kickstart in the beginning of 2026 with Phase I, which includes the 100,000-square-foot office building as well as a 308-unit residential building just to the north on University Drive and Shotts Street. The first phase is expected to be complete by 2028.

Led by Dallas-based developer Larkspur Capital and consultant The Keystone Group, the development will take about 15 years to complete in four parts.

It will also result in approximately $45 million in infrastructure improvements, according to the city of Fort Worth . The area, which is near the Trinity River, has historically experienced stormwater and flood problems.

The city invested a $125 million grant package to aid in remedying flood concerns in June. If everything goes to plan, the city expects the project to generate roughly $121 million in new property, hotel and sales taxes, according to the city’s economic development manager, Michael Hennig .

Larkspur’s development is the reason the Fort Worth City Council voted last week to rename a section of White Settlement Road to Westside Drive.

This first phase office space will have retail on the first floor, two restaurants and a private social club, according to Larkspur. It was designed by Austin-based firm Michael Hsu Office of Architecture. According to blueprints, there will be an office building and a restaurant space with outdoor seating, all separated by a garden area.

The apartment building, designed by Dallas-based architecture firm Corgan, will feature a mix of studio, one- and two-bedroom units. The first floor will have retail space and a restaurant on the southeast corner.

The development will have underground parking for a more sophisticated, pedestrian-friendly look, the developers say.

“Fort Worth has always had a rich cultural fabric, rooted in tradition,” said Colt McCoy, a partner at commercial real estate firm HPI, which is leasing the office space. “With Westside Village, the developers are creating a place where the city’s history and character meet forward-thinking design and modern amenities. It is setting the stage for Fort Worth’s next chapter of growth.”

Rachel Royster

Source link

Doug McKinnon has sold another of his Cherry Creek gateway corners.

The owner of real estate firm McKinnon & Associates last week sold 55-65 S. Colorado Blvd., two parcels that form the northwest corner of Colorado and Bayaud Avenue, for $3.2 million, according to public records.

The undeveloped site is 0.38 acres, so the deal works out to $191 a square foot.

McKinnon said the local buyer “will be utilizing the G-RO-5 zoning we put in place to develop an office building for his firm’s use on the site.”

The property was purchased by DEG Realestate LLC, an entity formed by Alla Feldman with an office address corresponding to a home within Cherry Creek Country Club. Reached by phone, Feldman declined to comment on the purchase.

No development plans have been submitted to Denver for the site.

The corner lot is one of four on the outskirts of Cherry Creek — all marketed as a redevelopment opportunity — that a McKinnon-led group bought in 2019 for $5.5 million. The other lots were the southwest corner of Colorado and Bayaud and the southwest and northwest corners of Colorado and First Avenue.

McKinnon got the sites rezoned in 2020 after striking an unusually detailed “good neighbor agreement” with surrounding residents. Then, he put “Cherry Creek Gateway” signage up at each of the properties indicating they were for sale.

In 2023, McKinnon sold the southwest corner of Colorado and Bayaud for $1.4 million.

He still owns the corners at Colorado and First. He bought a neighboring parcel there for $1.8 million in 2023, giving him a larger footprint at the intersection.

Get more real estate and business news by signing up for our weekly newsletter, On the Block.

Read more from our partner, BusinessDen.

Get more business news by signing up for our Economy Now newsletter.

Thomas Gounley

Source link

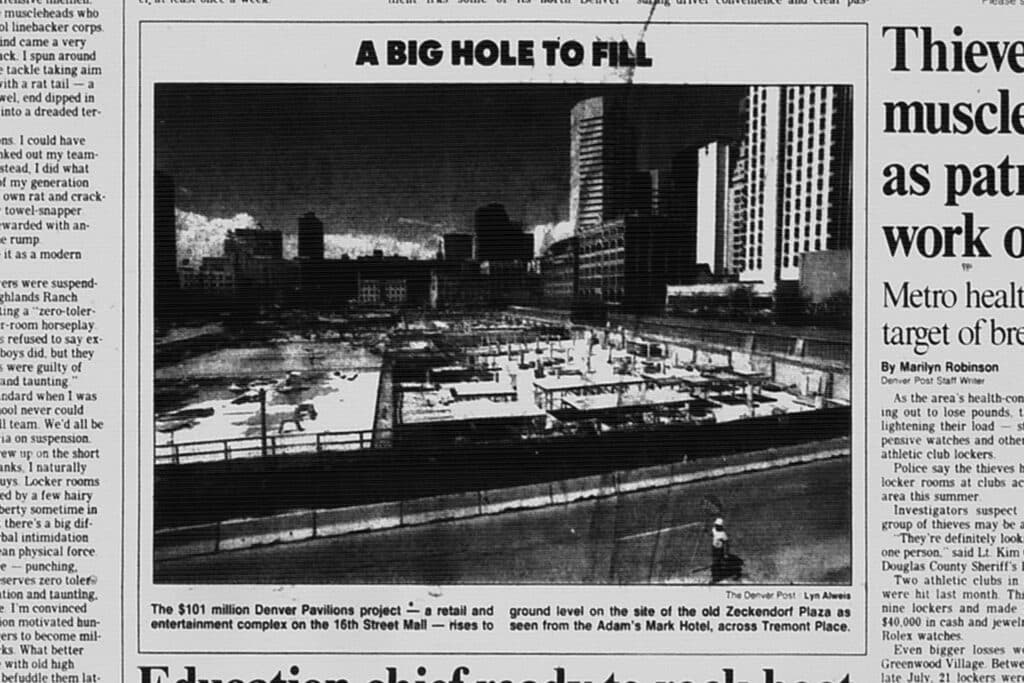

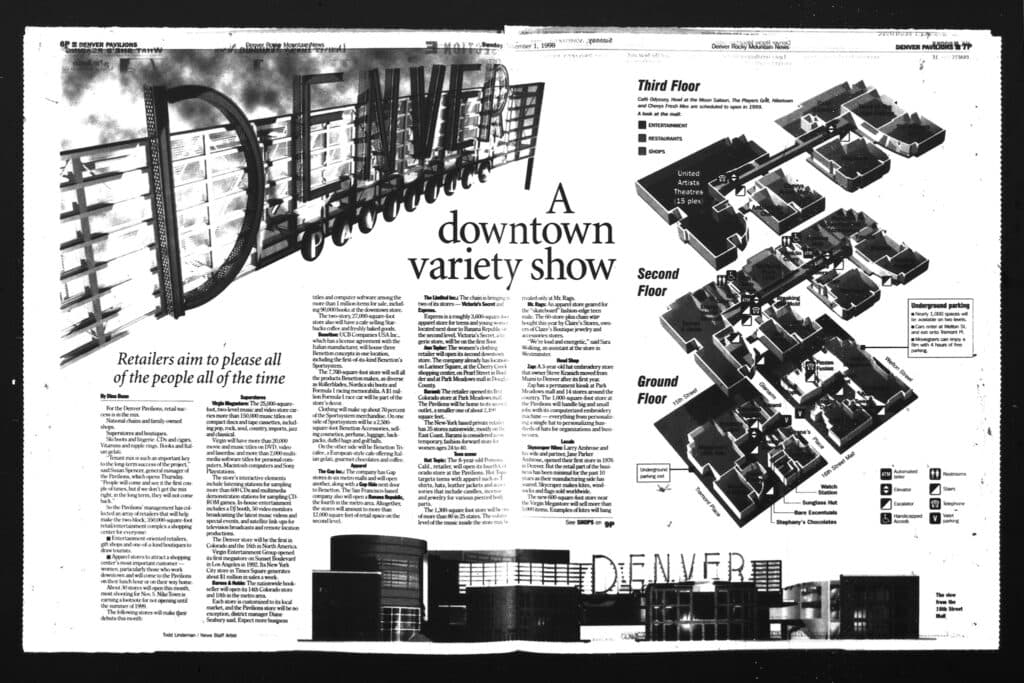

In November 1998, Denver’s leaders celebrated a moment they had planned for years: the opening of a three-story shopping mall — emblazoned with the city’s name in gigantic neon lettering.

“The Denver Entertainment & Fashion Pavilions,” sitting along 16th Street, was the finishing touch on a decades-long effort to reinvent Denver’s urban core, powering it out of the malaise of the ‘80s.

The local government and the property’s developers had pumped tens of millions of dollars into the project. In return, it was expected to draw hordes of locals and visitors alike — and their tax dollars.

“It was successful, until COVID,” recalled developer Susan Powers.

Now, that crown jewel is looking pretty tarnished. Pandemic-era closures, a surge in work-from-home culture and years of construction on 16th Street have left many of its storefronts vacant. The crowds that once gathered here have become harder to spot.

In March, the owner of the property — which is now known as Denver Pavilions — said it faced tough finances and a possible foreclosure. Then, a few weeks ago, a city authority announced it would buy Pavilions for $37 million, a fraction of its former value.

The purchase, which is still pending, is an attempt to rescue the flailing property from closure. Mayor Mike Johnston is relying on a reinvigorated downtown to rebound from a $200 million budget crisis, and a dead mall would be a threat to that recovery.

Officials say it would be a risk to sit on the sidelines and let Pavilions’ future play out on its own. But if Denver does succeed in buying the property, the city could be carrying a new liability into a fraught economic future. And there’s also a chance it all falls apart: City officials told Denverite that it hasn’t inked a deal with a financial lender involved with the mall.

Here’s how Denver’s prize mall fell into disarray — and what comes next.

City planners had been dreaming about a mall on 16th Street for decades, with the concept turning up as early as the 1980s. By the 1990s, the dream was becoming reality.

“A California developer plans a $90 million entertainment and retail project that promises to revitalize the long-suffering upper end of the 16th Street Mall,” the Rocky Mountain News read on Oct. 13, 1994.

Downtown’s image had suffered in the decade prior, thanks to an economy tied to the volatile oil business and growing investment in the suburbs. Large, longtime department stores had moved out. The closure of the Denver Dry Goods Building in 1987, a cavernous building filled with high-end shops and an elegant tea room, marked the end of an era.

“We wouldn’t be the department-store-focused downtown anymore,” said Powers, who ran the Denver Urban Renewal Authority (DURA) in the late ‘80s and ‘90s. “It took a long time for downtown, for everyone, for the administration and for us, to accept that.”

Bill Mosher, who headed the Downtown Denver Partnership at the time, said there was growing pressure to reimagine the corridor.

“We had lost all that retail, and there was the advent of the Cherry Creek Mall. There was talk of a new shopping mall at the corner of I-225 and I-25 that ended up being Park Meadows, further away,” he remembered. “Downtown felt really threatened. And so there was a real push to try and establish more and better retail on 16th Street.”

In 1994, Mosher told the Rocky Mountain News the Pavilions project would be a “shot in the arm” for downtown. Early announcements teased a “flagship” movie theater and “one-of-a-kind retailers and five-star restaurants.”

Still, Powers said it turned out to be harder to finance than expected. Though DURA promised millions to subsidize the project, developers had secured less than 20 percent of the money they needed by October 1995.

“It was lenders that didn’t believe in it,” she said.

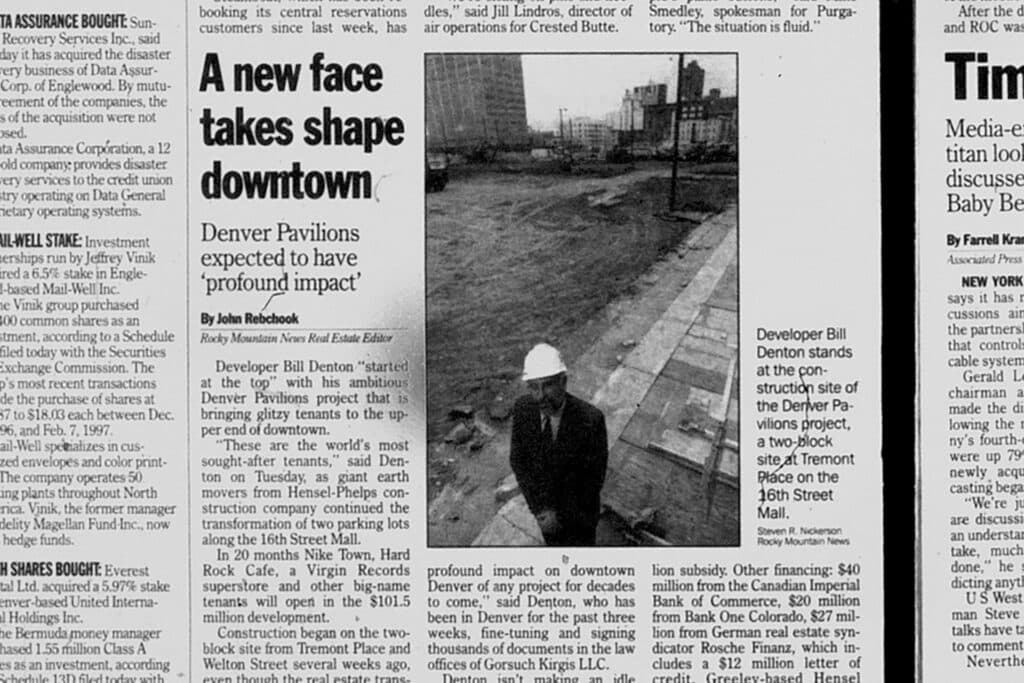

Securing the money took so long that Hensel Phelps, the construction company leading the project, eventually said “screw it” (in so many words) and started building before the financing was finalized, Powers said.

Though bankers wrung their hands about the project, Powers said city leaders were sure it would deliver for downtown.

“I think this is going to be a home run,” William Denton, a developer behind Pavilions, told the Rocky in 1994. “Denver has been locked in a Catch-22. You need good retail to attract good retail. We will take on that responsibility.”

It was completed two years later than expected, at a total cost of $105 million — including DURA’s $32 million public subsidy. And it had some issues at the start.

Niketown, one of its most anticipated offerings, delayed its debut until 10 months after Pavilions’ grand opening in 1998. The Colorado Cross Disability Coalition also sued United Artists over inaccessible movie theaters, which impacted the company’s flagship there. And chilly weather during the grand opening caused some to question its very configuration.

“I just wish this place had a dome,” 17-year-old Logan McCash told the Rocky on opening day. “I can’t be walking around in the cold.”

Still, throngs of people came to see it, waiting in line to sit in the Hard Rock Cafe and wandering into the Virgin Megastore.

“I’ll definitely be back,” Johnanna VanZaig, a local nurse on her day off, told Rocky reporter John Accola. “I think the scene is changing in Denver.”

Denverite reader James Kerley, who wrote to us about his memories of the place, said he was entranced to see it for the first time, as a kid on a school trip from out of town.

“It absolutely felt like a grand experience. I felt like I had finally made it to the big city, to a place where all the action was,” he said. “That experience stuck with me, and for years after I moved to the Denver area, that was the place I took every single visitor.”

“It felt like an exciting place to be,” reader Rachel Vigil remembered, “almost like a home base. I’m not sure it ever lived up to its intended vision, but I do sincerely love that odd mall.”

But it was never universally loved. Some people who wrote us called it “puzzling,” “uninviting” and an “ugly boondoggle.”

Mosher, the former Downtown Denver Partnership leader, said the mall did achieve what he and others promised. Ten years ago, he said, the property was valued at $140 million.

“I think it became part of the downtown experience and was successful,” he said. “It was essentially over 90 percent occupied and the sales numbers were upwards of $60 million, just within the last decade. You have to pay attention to that.”

But the mall’s hot streak ended in 2020, and the city’s leaders would soon face difficult decisions.

Mosher went on to work for the Trammell Crow development company in 2006 after 20 years leading the partnership.

Last year, Mayor Mike Johnston tapped him as the city’s chief projects officer and head of the Downtown Development Authority (DDA), which was created by the city to oversee investment in Union Station in the 1990s. It is tasked with managing a special tax fund that can only be spent on improvements to Denver’s central business district.

Early this year, Mosher said Pavilions’ ownership group came to the authority with a grim warning about their finances.

Pavilions is owned by an LLC that’s affiliated with local developer Gart Properties, which did not return a request for comment in this story. Mosher said it’s “no secret” that the group hasn’t made a payment on an $85 million loan since July and was headed toward default.

“It was pretty clear that the lender and the ownership group were coming to the DDA and sort of saying, ‘How do you want to handle this?’” Mosher said. “What we have been dealing with from the beginning is the notion that if we didn’t do something before the end of the year, it would go into some sort of a receivership, foreclosure-type position, and it would go back to the lender.”

What would happen if Pavilions became the center of a long legal fight, or if it were sold to someone who let it sit vacant?

Mosher and his colleagues came up with a plan: The DDA would pay $37 million to the ownership group to take possession of Pavilions, spend a year or two developing a master plan for the site and then resell it to a developer who would reliably take care of this important piece of 16th Street.

Part of the plan is to combine Pavilions’ parcel with two adjacent parking lots, potentially making it easier to sell to a future buyer. DDA set aside an additional $23 million to buy that land last July.

“The decision was, if we can’t step in and have an impact on 16th through Pavilions, what can we do?” he said. “That uncertainty is, obviously, what had driven us, a little bit out of fear.”

If it works out, Mosher said this plan would allow Pavilions’ owners to settle up with the bank, and it would allow the bank to move on without having to take control of the property and resell it. It would also give the DDA a chance to guide what Pavilions becomes, selecting a buyer who would follow a menu of options that the city will create in the next year.

Mosher told Denverite that negotiations are ongoing and hinge on whether Pavilions’ lender will agree to cede full control to the downtown authority.

Mosher has stressed that the DDA — not the city of Denver itself — would buy the property, though the two are closely linked.

Downtown voters recently expanded the DDA’s ability to collect a portion of downtown tax revenue and invest it in more than $500 million of projects.

The authority collects an “increment” of downtown property and sales taxes — diverting some of the growth in downtown tax revenues to be spent on downtown projects, instead of going to the city’s general fund.

The Denver City Council would have to approve the Pavilions purchase.

A worst-case scenario, Mosher said, would be that Pavilions falls into neglect.

Outdoor malls around the nation have experienced similar struggles, he said. The Charlotte Epicentre, in North Carolina, was also a game changer before it began to decline in 2016, spiraling as vacancies invited violence that led to more vacancies. Its owners defaulted on an $85 million loan in 2021, and it has yet to recover despite new ownership and a rebrand.

Mosher said the DDA’s involvement would ensure the property continues to contribute to downtown’s economy, but he stressed it should not be a long-term project: The DDA hopes to resell the property within a year or two after it’s purchased.

“Our goal is to get Pavilions back into private sector hands,” Mosher said. “The DDA and this mayor have felt some urgency to deal with downtown, now that 16th Street is open. How do we put a spark back and some confidence back into the private sector and spur redevelopment in downtown?”

But the authority would take on a different risk in purchasing Pavilions, said Glenn Mueller, a former University of Denver economics professor who tracks commercial real estate in the nation’s 54 largest cities. The question is whether the DDA can actually sell the property as it hopes.

“I understand the Denver development authority wanting to keep something from going dark, because then the city loses property taxes,” he said. “The question is, within one year, is there a retail owner and or developer who would be interested in taking this over?”

Mueller is not watching this deal closely, but he told Denverite that retail is generally a riskier gamble than other sectors. The fact that the mall is only 60 percent occupied doesn’t help, he added — nor do recent economic forecasts.

“There is still a good chance that we go into a recession,” Mueller said. “When there’s a recession, people don’t have money, they don’t spend. They stop spending and all the retailers get hit hard.”

Mosher said the DDA is hedging against a downturn and is prepared to own the property for as long as five years, if necessary. The authority’s plans include financing to cover $11 million in ongoing maintenance costs.

Jon Weisiger, who leads retail and mixed-use projects for the international real estate firm CBRE, said cities like Denver are poised to bounce back from COVID-era slumps. He said the DDA was wise to consider purchasing the property.

“Investment is favoring outdoor strip retail space or even unique curbside opportunities that are well located in a thriving environment. We’re seeing, definitely, a trend towards more of that,” he told Denverite. “Retail’s actually been the right spot in the investment horizon for a lot of buyers.”

Part of that recovery is tied to new housing projects downtown, like office conversions, that could help replace spending from white-collar workers who haven’t returned since the pandemic.

“This is kind of starting to flip in favor of more residential, in and around the downtown area,” he said. “It’s just a matter of trying to work with retailers that live in both worlds, because you can do some dinner business and you can do some breakfast business, and that is definitely changing before our eyes.”

But, as always in this town, there’s a debate about who those changes are meant to benefit.

V Reeves, a housing advocate with Housekeys Action Network of Denver, said they understand the city thinks it can fund needed services with tax revenue from a property like Pavilions — things like recently slashed budgets for eviction prevention and rental assistance. They just don’t believe it will actually happen.

“They’re seeking a means to an end, and saying this is to eventually be able to fund the projects that we actually need. We’re spending millions and millions of dollars when we are asking for a fraction of that to address those very things,” they said. “I don’t think that that’s the economic engine that [Mayor Johnston] is intending it to be. Because we have found, again, trickle-down economics is not an effective solution.”

Denver City Council recently rejected a plan to build affordable housing a few blocks away from Pavilions, because Johnston planned to buy the property with emergency funds that have already been used too often.

Still, city leaders are adamant that projects like the Pavilions are the path forward. Downtown is supposed to be a tax revenue machine — it’s just going through a reimagining.

In the same way Denver had to move on from the days of the mighty department store, former DURA chief Sue Powers said it will have to find a new identity in this moment of change. She said the risks are worth it.

“It’s everybody’s responsibility now to step up and say, ‘We value our downtown. And it won’t look like it did 10 years ago. But there’s a really important historical role that it’s played, and it’s an important part of our economy, so let’s figure out how to fix it,’” she said. “I don’t think there’s a choice in this community, any more than there was in 1987, to let downtown die. That’s just not an option. Not an option.”

The Denver City Council hasn’t yet set a date to consider the plan.

Birkdale Village in Huntersville has a new owner – a global property investment firm with $92 billion in assets — less than a year after its sale to an Atlanta-based real estate giant.

Terms were not disclosed Wednesday of developer Jamestown’s sale of the property to Houston-based Hines U.S. Property Partners.

Hines announced the acquisition in a news release Wednesday afternoon, calling the iconic mixed-use development near Lake Norman a “premier” community that is 99% leased.

In May, Birkdale Village was up for sale less than a year after getting a new owner, The Charlotte Observer reported.

Two months prior, the Huntersville Board of Commissioners approved Jamestown’s request to add to the development a 125-room, full-service hotel, 150 multi-family units, 26,715 square feet of commercial space and an office building.

In August 2024, Jamestown announced the acquisition of Birkdale Village owner North American Properties’ Atlanta subsidiary. Terms of the deal were not disclosed.

Jamestown’s projects have included some of the most iconic buildings in the U.S., such as One Times Square, where the New Year’s Eve ball drops in New York City.

Jamestown also is a joint owner of two North Carolina properties: Optimist Hall in Charlotte and the mixed-use development, Raleigh Iron Works.

Birkdale Village was a joint venture partnership with Jamestown, Nuveen Real Estate and North American Properties, Jamestown said.

The community was among the first of its kind in the Charlotte area when it was built in 2003 by Charlotte firms Crosland and Pappas Properties.

In 2022, North American Properties’ invested $20 million to transform the 52-acre property into an entertainment destination with the addition of an outdoor stage, green space and retail kiosks. Retailers include Apple, lululemon, Pottery Barn and Williams Sonoma.

Birkdale Village had a total assessed value of $37.3 million in 2023, Mecklenburg County public tax records show. Its current assessed value is under review, according to the county.

Notable Hines buildings are The Lipstick Building in New York City, a 34-story building that opened in 1986 at 885 Third Ave., known for its curvy design; and the largest skyscraper in Texas, the 75-story JPMorgan Chase Tower in Houston.

.

This story was originally published October 22, 2025 at 5:09 PM.

Joe Marusak,Catherine Muccigrosso

Source link

Israel must allow the United Nations’ aid agency to deliver humanitarian aid in Gaza, the International Court of Justice said Wednesday, labeling the country as an occupying power.

The nonbinding opinion by the top U.N. court, requested by the U.N. General Assembly last year to clarify the protections member states must provide their staff, carries little practical weight. A bigger issue is the stability of the fragile cease-fire deal between Israel and Hamas that took effect Oct. 10. It was tested earlier this week after the Israeli military launched a series of airstrikes, saying Hamas militants had killed Israeli soldiers.

Copyright ©2025 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

James Hookway

Source link

ENGLEWOOD — Metro Denver budtender Quentin Ferguson needs Regional Transportation District bus and trains to reach work at an Arvada dispensary from his house, a trip that takes 90 minutes each way “on a good day.”

“It is pretty inconvenient,” Ferguson, 22, said on a recent rainy evening, waiting for a nearly empty train that was eight minutes late.

He’s not complaining, however, because his relatively low income and Medicaid status qualify him for a discounted RTD monthly pass. That lets him save money for a car or an electric bicycle, he said, either of them offering a faster commute.

Then he would no longer have to ride RTD.

His plight reflects a core problem of lagging ridership that RTD directors increasingly run up against as they try to position the transit agency as the smartest way to navigate Denver. Most other U.S. public transit agencies, too, are grappling with a version of this problem.

In Colorado, state-government-driven efforts to concentrate the growing population in high-density, transit-oriented development around bus and train stations — a priority for legislators and Gov. Jared Polis — hinge on having a swift public system that residents ride.

But transit ridership has failed to rebound a year after RTD’s havoc in 2024, when operators disrupted service downtown for a $152 million rail reconstruction followed by a systemwide emergency maintenance blitz to smooth deteriorating tracks that led to trains crawling through 10-mph “slow zones.”

The latest ridership numbers show an overall decline this year, by at least 3.9%, with 40 million fewer riders per year compared with six years ago. And RTD executives’ newly proposed, record $1.3 billion budget for 2026 doesn’t include funds for boosting bus and train frequency to win back riders.

Frustrations intensified last week.

“What is the point of transit-oriented development if it is just development?” said state Rep. Meg Froelich, a Democrat representing Englewood who chairs the House Transportation, Housing and Local Government Committee. “We need reliable transit to have transit-oriented development. We have cities that have invested significant resources into their transit-oriented communities. RTD is not holding up its end of the bargain.”

At a retreat this past summer, a majority of the RTD’s 15 elected board members agreed that boosting ridership is their top priority. Some who reviewed the proposed budget last week questioned the lack of spending on service improvements for riders.

“We’re not moving the needle. Ridership is not going up. It should be going up,” director Karen Benker said in an interview.

“Over the past few years, there’s been a tremendous amount of population growth. There are so many apartment complexes, so much new housing put up all over,” Benker said. “Transit has to be relied on. You just cannot keep building more roads. We’re going to have to find ways to get people to ride public transit.”

RTD Chief Executive and General Manager Debra Johnson, in emailed responses to questions from The Denver Post, emphasized that “RTD is not unique” among U.S. transit agencies struggling to regain ridership lost during the COVID-19 pandemic. Johnson blamed societal shifts.

“Commuting trends have significantly changed over the last five years,” she said. “Return-to-work numbers in the Denver metro area, which accounted for a significant percentage of RTD’s ridership prior to March 2020, remain low as companies and businesses continue to provide flexible in-office schedules for their employees.”

In the future, RTD will be “changing its focus from primarily providing commuter services,” she said, toward “enhancing its bus and services and connections to high-volume events, activity centers, concerts and festivals.”

A recent survey commissioned by the agency found exceptional customer satisfaction.

But agency directors are looking for a more aggressive approach to reversing the decline in ridership. And some are mulling a radical restructuring of routes.

Funded mostly by taxpayers across a 2,345 square-mile area spanning eight counties and 40 municipalities — one of the biggest in the nation — RTD operates 10 rail lines covering 114 miles with 84 stations and 102 bus routes with 9,720 stops.

“We should start from scratch,” said RTD director Chris Nicholson, advocating an overhaul of the “geometry” of all bus routes to align transit better with metro Denver residents’ current mobility patterns.

The key will be increasing frequency.

“We should design the routes how we think would best serve people today, and then we could take that and modify it where absolutely necessary to avoid disruptive differences with our current route map,” he said.

Then, in 2030, directors should appeal to voters for increased funding to improve service — funds that would be substantially controlled by municipalties “to pick where they want the service to go,” he said.

Reversing the RTD ridership decline may take a couple of years, Nicholson said, comparing the decreases this year to customers shunning a restaurant. “If you’re a restaurant and you poison some guests accidentally, you’re gonna lose customers even after you fix the problem.”

The RTD ridership numbers show an overall public transit ridership decrease by 5% when measured over the 12-month period from August 2024 through July 2025, the last month for which staffers have made numbers available, compared with the same period a year ago.

Bus ridership decreased by 2% and light rail by 18% over that period. In a typical month, RTD officials record around 5 million boardings — around 247,000 on weekdays.

The emergency maintenance blitz began in June 2024 when RTD officials revealed that inspectors had found widespread “rail burn” deterioration of tracks, compelling thousands of riders to seek other transportation.

The precautionary rail “slow zones” persisted for months as contractors worked on tracks, delaying and diverting trains, leaving transit-dependent workers in a lurch. RTD driver workforce shortages limited deployment of emergency bus shuttles.

This year, RTD ridership systemwide decreased by 3.9% when measured from January through July, compared with that period in 2024. The bus ridership this year has decreased by 2.4%.

On rail lines, the ridership on the relatively popular A Line that runs from Union Station downtown to Denver International Airport was down by 9.7%. The E Line light rail that runs from downtown to the southeastern edge of metro Denver was down by 24%. Rail ridership on the W Line decreased by 18% and on R Line by 15%, agency records show.

The annual RTD ridership has decreased by 38% since 2019, from 105.8 million to 65.2 million in 2024.

“The sickness on RTD light rail is spreading to other parts of the RTD system,” said James Flattum, a co-founder of the Greater Denver Transit grassroots rider advocacy group, who also serves on the state’s RTD Accountability Committee. “We’re seeing permanent demand destruction as a consequence of having an unreliable system. This comes from a loss of trust in RTD to get you where you need to go.”

RTD officials have countered critics by pointing out that the light rail’s on-time performance recovered this year to 91% or better. Bus on-time performance still lagged at 83% in July, agency records show.

The officials also pointed to decreased security reports made using an RTD smartphone app after deploying more police officers on buses and trains. The number of reported assaults has decreased — to four in September, compared with 16 in September 2024, records show.

Greater Denver Transit members acknowledged that safety has improved, but question the agency’s assertions based on app usage. “It may be true that the number of security calls went down,” Flattum said, “but maybe the people who otherwise would have made more safety calls are no longer riding RTD.”

RTD staffers developing the 2026 budget have focused on managing debt and maintaining operations spending at current levels. They’ve received forecasts that revenues from taxpayers will increase slightly. It’s unclear whether state and federal funds will be available.

Looking ahead, they’re also planning to take on $539 million of debt over the next five years to buy new diesel buses, instead of shifting to electric hybrid buses as planned for the future.

RTD directors and leaders of the Southwest Energy Efficiency Project, an environmental group, are opposing the rollback of RTD’s planned shift to the cleaner, quieter electric hybrid buses and taking on new debt for that purpose.

Colorado lawmakers will “push on a bunch of different fronts” to prioritize better service to boost ridership, Froelich said.

The legislature in recent years directed funds to help RTD provide free transit for riders under age 20. Buses and trains running at least every 15 minutes would improve both ridership and safety, she said, because more riders would discourage bad behavior and riders wouldn’t have to wait alone at night on often-empty platforms for up to an hour.

“We’re trying to do what we can to get people back onto the transit system,” Froelich said. “They do it in other places, and people here do ride the Bustang (intercity bus system). RTD just seems to lack the nimbleness required to meet the moment.”

Meanwhile, riders continue to abandon public transit when it doesn’t meet their needs.

For Denver Center for the Performing Arts theater technician Chris Grossman, 35, ditching RTD led to a better quality of life. He had to move from the Virginia Village neighborhood he loved.

Back in 2016, Grossman sold his ailing blue 2003 VW Golf when he moved there in the belief that “RTD light rail was more or less reliable.” He rode nearly every day between the Colorado Station and downtown.

But trains became erratic as maintenance of walls along tracks caused delays. “It just got so bad. I was burning so much money on rideshares that I probably could have bought a car.” Shortly before RTD announced the “slow zones” last summer, he moved to an apartment closer to downtown on Capitol Hill.

He walks or rides scooters to work, faster than taking the bus, he said.

Similarly, Honor Morgan, 25, who came to Denver from the rural Midwest, “grateful for any public transit,” said she had to move from her place east of downtown to be closer to her workplace due to RTD transit trouble.

Buses were late, and one blew by her as she waited. She had to adjust her attire when riding her Colfax Avenue route to Union Station to manage harassment. She faced regular dramas of riders with substance-use problems erupting.

Morgan moved to an apartment near Union Station in March, allowing her to walk to work.

She still hoped to rely on RTD for concerts and nightlife, and to reach DIA for work-related flights at least once a month. But RTD social media posts have alerted her to enough delays on the A Line that she no longer trusts it, she said. To reduce her “anxiety” and minimize the risk of missing her flights, she shells out for rides — even though these often get stuck in traffic.

She and her boyfriend recently tried RTD again, riding a train to the 38th and Blake Station near the Mission Ballroom. They attended “an amazing concert” there, she said, and felt happy as they walked to the station to catch the train home.

A man on the platform collapsed backward, hitting his head. He was bleeding. She called 911. Her boyfriend and other riders gathered. She ran across the street to an apartment building and grabbed paper towels. RTD isn’t really to blame, but “I just wish they had a station platform attendant, or someone. I do not know head-injury first aid,” Morgan said.

The train they’d been waiting for came and went. An ambulance arrived. They got home late, the evening ruined, she said.

“His head cracked open. He had skin flaps hanging off his head. This was stuck in my head, at least for the rest of the night.”

Get more Colorado news by signing up for our Mile High Roundup email newsletter.

Bruce Finley

Source link

TEL AVIV—Israel conducted dozens of airstrikes across Gaza on Sunday and halted humanitarian aid into the enclave after it accused Hamas of killing troops inside Israeli-controlled areas in what is shaping up to be the biggest test yet of the fragile cease-fire.

The Israeli military said two soldiers were killed in southern Gaza, where militants targeted troops inside Israeli-controlled areas with an antitank missile and gunfire. Another soldier was severely injured, the military said.

Hamas made two other attempts to attack Israeli soldiers on Sunday, the military said.

Israel decided to halt humanitarian aid, which Israeli officials confirmed, following calls from Israeli politicians across the political spectrum for Prime Minister Benjamin Netanyahu to respond forcefully to the attack against troops.

Copyright ©2025 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

[ad_2] Dov LieberTEL AVIV—Israel and Hamas on Tuesday accused each other of violating the cease-fire that was part of the deal that released all 20 living hostages from Gaza, with Israel reducing the humanitarian aid promised under the agreement to increase pressure on Hamas to return more bodies of deceased hostages.

Israelis celebrated the return of the living hostages on Monday, in what for many marked an end to the two-year Gaza war. But the families of the deceased hostages who are supposed to be returned to Israel as part of President Trump’s 20-point plan for peace said they were angered that only four of 28 bodies had been returned.

Copyright ©2025 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

[ad_2] Anat Peled Provided Image/Mütter Museum

Provided Image/Mütter Museum

Provided Image/Arielle Harris

Provided Image/Arielle Harris