[ad_1]

An Arlington woman says her 10-year-old Cavalier King Charles spaniel died after a veterinarian prescribed one medication but a CVS pharmacy dispensed a different drug.

(Courtesy Miroslava Mircheva)

Courtesy Miroslava Mircheva

(Courtesy Miroslava Mircheva)

Courtesy Miroslava Mircheva

(Courtesy Miroslava Mircheva)

Courtesy Miroslava Mircheva

(Courtesy Miroslava Mircheva)

Courtesy Miroslava Mircheva

An Arlington, Virginia, woman says her 10-year-old Cavalier King Charles spaniel died after a veterinarian prescribed one medication but a CVS pharmacy dispensed a different drug.

“Daisy was the most innocent, pure and loving dog,” Miroslava Mircheva told WTOP.

Mircheva said her service dog was so important to her, she flew her pet to London for heart surgery. “The surgery was successful.”

At the six-month post operative checkup, the veterinarian told Mircheva that Daisy had developed an arrhythmia: “He explained that it would be managed with medication.”

Mircheva said her vet wrote a prescription, and sent it directly to her local CVS to be filled.

But after the first dose, “the dog started experiencing symptoms the same day,” she said, “including labored breathing, lethargy and excessive thirst.”

She sent a photo of the pill bottle to her veterinarian. “He called me 10 or 15 minutes later that day, and said he called CVS to let them know that the medication was wrong.”

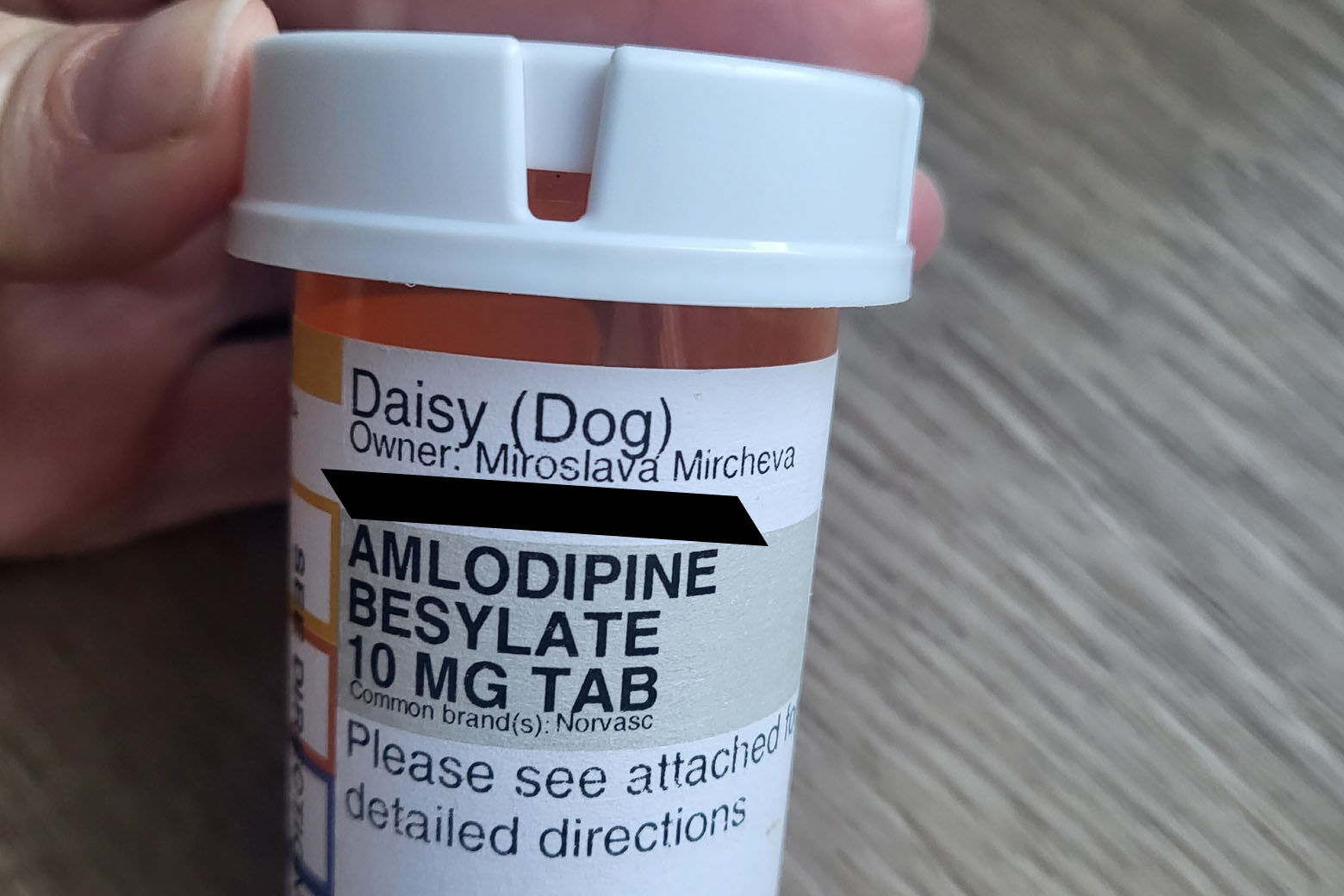

Mircheva provided a photo to WTOP of a prescription for amiodarone, which is used to treat heart arrhythmia. A second photo shows a prescription bottle for amlodipine, a blood pressure medicine.

“It’s completely different medicines, with different milligrams,” Mircheva explained.

Both medicines can be prescribed for humans and dogs, according to Merck, a pharmaceutical company that researches and compiles human and veterinary medicine manuals.

Mircheva brought Daisy to an emergency clinic on the evening of April 11. She said cardiology and toxicology critical care teams tried to save her pet, but Daisy died in the morning of April 13.

Mircheva told WTOP’s Mike Murillo she got a call from someone at CVS on Wednesday.

“He apologized,” she said. “But what threw me off is he said these prescriptions are difficult to read.”

She was taken aback by that comment. “Difficult to read is for somebody like me, that doesn’t know anything about medication. I’m not a physician or a pharmacist — we trust them for our health, and our family, and our dogs, as well.”

Mircheva said, “A statement like that from CVS, people that are responsible for health and well-being, to say that prescriptions are difficult to read, is unacceptable to me.”

In a statement, Amy Thibault, lead director of external communications for CVS Health told WTOP the company has “comprehensive policies and procedures in place to support prescription accuracy,” and that they prioritize patients’ health.

“We apologized to Ms. Mircheva when she noticed that her dog received the wrong medication. We’re looking into how this happened to help prevent a similar error in the future,” the statement read. “Prescription errors are a rare occurrence, but if one does happen, we use what we learn from it to continuously improve quality and patient safety.”

Mircheva was not satisfied with that response.

“CVS needs to make some changes, and implement some new procedures for accountability, so this never happens again,” she said.

She said she had spent thousands of dollars on her dog’s care, including approximately $26,000 for the surgery in London, in addition to travel and local emergency veterinarian care, “then to have it ruined.”

Without referring to any possible lawsuits, Mircheva noted, “Under Virginia law, she was property. But for me, she was family. And you don’t leave family behind.”

WTOP’s Mike Murillo contributed to this report.

Get breaking news and daily headlines delivered to your email inbox by signing up here.

© 2024 WTOP. All Rights Reserved. This website is not intended for users located within the European Economic Area.

[ad_2]

Neal Augenstein

Source link