It was another year of high-conviction bets — and fast reversals.

From bond desks in Tokyo and credit committees in New York to currency traders in Istanbul, markets delivered both windfalls and whiplash. Gold hit records. Staid mortgage behemoths gyrated like meme stocks. A textbook carry trade blew up in a flash.

Investors bet big on shifting politics, bloated balance sheets and fragile narratives, fueling outsized stock rallies, crowded yield trades, and crypto strategies built on leverage, hope, and not much else. Donald Trump’s White House return quickly sank — and then revived — financial markets across the world, lit a fire under European defense stocks, and emboldened speculators fanning mania after mania. Some positions paid off spectacularly. Others misfired when momentum reversed, financing dried up or leverage cut the wrong way.

As the year draws to a close, Bloomberg highlights some of the most eye-catching wagers of 2025 — the wins, the wipeouts and the positions that defined the era. Many of those bets leave investors fretting over all-too-familiar fault lines as they prepare for 2026: shaky companies, stretched valuations, and trend-chasing trades that work, until they don’t.

Crypto: Trumped

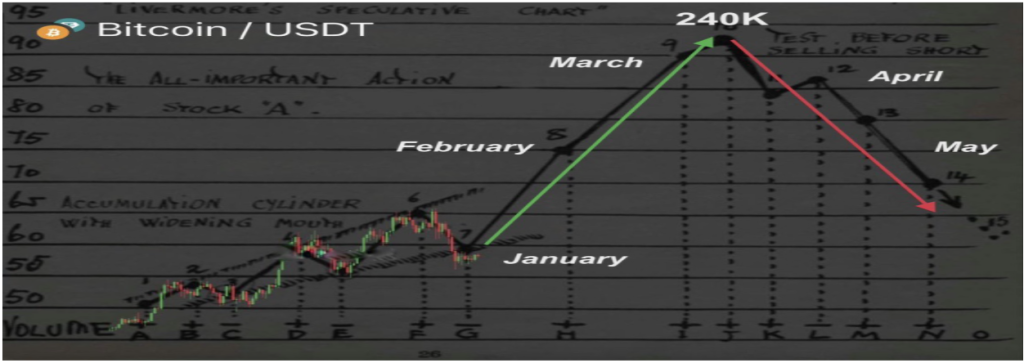

It looked like one of crypto’s more compelling momentum bets: load up on anything and everything tied to the Trump brand. During his presidential campaign and after he took office, Trump went all-in on digital assets — pushing sweeping reforms and installing industry allies across powerful agencies. His family leaned in, championing coins and crypto firms that traders treated as political rocket fuel.

The franchise came together fast. Hours before the inauguration, Trump launched a memecoin and promoted it on social media. First Lady Melania Trump soon followed with her own token. Later in the year, Trump family–affiliated World Liberty Financial made its WLFI token tradable and available to retail investors. A set of Trump-adjacent trades followed. Eric Trump co-founded American Bitcoin, a publicly traded miner that went public via a merger in September.

Each debut sparked a rally. Each proved ephemeral. As of Dec. 23, Trump’s memecoin was floundering, off more than 80% from its January high. Melania’s was down nearly 99%, according to CoinGecko. American Bitcoin had sunk about 80% from its September peak.

Politics gave the trades a push. The laws of speculation pulled them back down. Even with a friend in the White House, these trades couldn’t escape crypto’s core pattern: prices rise, leverage floods in, and liquidity dries up. Bitcoin, still the bellwether, is on track for an annual loss after slumping from its October peak. For Trump-linked assets, politics offered momentum, but no protection. — Olga Kharif

AI Trade: The Next Big Short?

The trade was revealed in a routine filing, yet its impact was anything but routine. Scion Asset Management disclosed on Nov. 3 that it held protective put options in Nvidia Corp. and Palantir Technologies Inc. — stocks at the center of the artificial intelligence trade that’s powered the market’s rally for three years. While not a whale-sized hedge fund, Scion commands attention due to the person who runs it: Michael Burry, who earned fame as a market prophet in The Big Short book and movie about the mortgage bubble that led to the 2008 crisis.

The strike prices were startling: Nvidia’s was 47% below where the stock had just closed, while Palantir’s was 76% below. But some mystery lingered: Due to limited reporting requirements, it was unclear if the puts — contracts that give an investor the right to sell a stock at a certain price by a certain date — were part of a more complicated trade. And the filing offered just a snapshot of Scion’s books on Sept. 30, leaving open the possibility that Burry had since trimmed or exited the positions. Yet skepticism about the lofty valuations and massive spending plans of major AI players had been building like a pile of dry kindling. Burry’s disclosure landed like a freshly struck match.

Nvidia, the largest stock in the world, tumbled in reaction, as did Palantir, though they later regained ground. The Nasdaq also dipped.

It’s impossible to know exactly how much Burry made. One bread crumb he left was a post on X saying he paid $1.84 for the Palantir puts; those options went on to gain as much as 101% in less than three weeks. The filing crystallized doubts simmering beneath a market dominated by a narrow group of AI-linked stocks, heavy passive inflows and subdued volatility. Whether the trade proves prescient or premature, it underscored how quickly even the most dominant market narratives can turn once belief begins to crack. — Michael P. Regan

Defense Stocks: New World Order

A geopolitical shift has led to huge gains in a sector once deemed toxic by asset managers: European defense. Trump’s plans to take a step back from funding Ukraine’s military sent European governments into a spending spree, giving a huge lift to shares of regional defense firms — from the roughly 150% year-to-date rally in Germany’s Rheinmetall AG as of Dec. 23, to Italy’s Leonardo SpA more than 90% ascent during the period.

Money managers who once saw the sector as too controversial to touch amid environmental, social and governance concerns changed their tune and a number of funds even redefined their mandates.

“We had taken defense out of our ESG funds until the beginning of this year,” said Pierre Alexis Dumont, chief investment officer at Sycomore Asset Management. “There was a change of paradigm, and when there is a change of paradigm, one has to be responsible and also defend one’s values. So we’re focusing on defensive weapons.”

From goggle makers to chemicals producers, and even a printing company, stocks were snapped up in a mad rush. A Bloomberg basket of European defense stocks was up more than 70% for the year as of Dec. 23. The boom spilled into credit markets as well, with firms only tangentially linked to defense attracting hordes of prospective lenders. Banks even started selling “European Defence Bonds,” modeled on green bonds except in this case ringfenced for borrowers like weapons manufacturers. It marked a repricing of defense as a public good rather than a reputational liability — and a reminder that when geopolitics shifts, capital tends to follow faster than ideology. — Isolde MacDonogh

Debasement Trade: Fact or Fiction?

Heavy debt loads in major economies such as the US, France and Japan — and a lack of political appetite to confront them — pushed some investors in 2025 to tout gold and alternative assets like crypto, while cooling enthusiasm for government bonds and the US dollar. The idea gained traction under a bearish label: the “debasement trade,” a nod to historic episodes when rulers such as Nero diluted the value of money to cope with fiscal strain.

The narrative reached a crescendo in October, when concerns over the US fiscal outlook collided with the longest government shutdown on record. Investors searched for shelter beyond the dollar. That month, gold and Bitcoin both rose to records — a rare moment for assets often cast as rivals.

As a story, debasement offered a clean explanation for a messy macro backdrop. As a trade, it proved more complicated. Bitcoin has since slumped amid a broader retreat in cryptocurrencies. The dollar stabilized somewhat. Treasuries, far from collapsing, are on track for their best year since 2020 — a reminder that fears of fiscal erosion can coexist with powerful demand for safe assets, particularly when growth slows and policy rates peak.

Elsewhere, price action told a different story. Swings in metals from copper to aluminum, and even silver, were driven at least as much by Donald Trump’s tariff policies and macro forces as by concerns about currency debasement, blurring the line between inflation hedging and old-fashioned supply shocks. Gold, meanwhile, has kept powering ahead, reaching new all-time highs. In that corner of the market, the debasement trade endured — less as a sweeping judgment on fiat, more as a focused bet on rates, policy and protection. — Richard Henderson

Korean Stocks: K-Pop

Move over, K-drama. When it comes to plot twists and thrills, it’s hard to beat this year’s action in South Korea’s stock market. Fueled by President Lee Jae Myung’s efforts to boost the country’s capital markets, the benchmark equity index rocketed more than 70% in 2025 through Dec. 22, headed toward his aspirational goal of 5000 and handily topping the charts among major stock gauges worldwide.

It’s rare to see a political leader publicly set an index level as a goal, and Lee’s “Kospi 5000” campaign drew little attention when it was first announced. Now, more and more Wall Street banks including JPMorgan Chase & Co. and Citigroup Inc. think it’s achievable in 2026, helped in part by the global AI boom, which has increased demand for South Korean stocks as Asia’s go-to artificial intelligence trade.

There is one notable absence from the Kospi’s world-beating rally: local retail investors. While Lee often reminds voters that he was once a retail investor himself before entering public office, his reform agenda has yet to persuade domestic investors that the market is a durable buy-and-hold proposition. Even as foreign money has poured into Korean equities, local mom-and-pop investors have been net sellers, channeling a record $33 billion into US stocks and chasing higher-risk bets ranging from crypto to leveraged exchange-traded funds overseas.

One side effect has been pressure on the currency. As capital flowed outward, the won weakened, a reminder that even blockbuster equity rallies can mask lingering skepticism at home. — Youkyung Lee

Bitcoin Showdown: Chanos v Saylor

There are two sides to every story. In the case of short-seller Jim Chanos’s arbitrage play involving Bitcoin hoarder Michael Saylor’s Strategy Inc., there were also two big personalities, and a trade that was fast becoming a referendum on crypto-era capitalism.

In early 2025, as Bitcoin soared and Strategy’s shares went through the roof, Chanos saw an opportunity. The rally in Strategy had stretched the premium the company’s shares enjoyed relative to its Bitcoin holdings, something the legendary investor saw as unsustainable. So he decided to short Strategy and go long Bitcoin, announcing the move in May when the premium was still wide.

Chanos and Saylor started publicly trading barbs. “I don’t think he understands what our business model is,” Saylor told Bloomberg TV in June about Chanos, who in turn, called Saylor’s explanations “complete financial gibberish” in an X post.

Strategy’s shares hit a record in July, marking a 57% year-to-date gain, but as the number of so-called digital asset treasury firms exploded and crypto token prices fell from their highs, Strategy shares — and those of its copycats — began to suffer and the company’s premium to Bitcoin shrank. Chanos’s wager was paying off.

From the time Chanos made his short call on Strategy public through Nov. 7, the date he said he exited from the position, Strategy shares dropped 42%. Beyond the P&L, it illustrated a recurring crypto boom-and-bust pattern: balance sheets inflated by confidence, and confidence sustained by rising prices and financial engineering. It works until belief falters — at which point the premium stops being a feature and starts being the problem. — Monique Mulima

Japanese Bonds: Widowmaker to Rainmaker

If there was one bet that repeatedly burned macro investors in the past few decades, it’s the infamous “widowmaker” wager against Japanese bonds. The reasoning behind the trade always seemed simple. Japan carried a vast public debt, and so the thinking was that interest rates just had to rise sooner or later to lure in enough buyers. Investors, therefore, borrowed bonds and sold them, expecting prices to fall once reality asserted itself. For years, however, that logic proved premature and expensive, as the central bank’s loose policies kept borrowing costs low and punished anyone who tried to rush the outcome. No longer.

In 2025, the widowmaker turned rainmaker as yields on benchmark government bonds surged across the board, making the $7.4 trillion Japan debt market a short-seller’s dream. The triggers spanned everything from interest rate hikes to Prime Minister Sanae Takaichi unleashing the country’s biggest burst of spending since pandemic restrictions eased. Yields on benchmark 10-year JGBs soared past 2% to reach levels not seen in decades, while those on 30-year paper advanced more than a full percentage point to an all-time high. A Bloomberg gauge of Japanese government bond returns fell more than 6% this year through Dec. 23, the worst-performing major market in the world.

Fund managers from Schroders to Jupiter Asset Management to RBC BlueBay Asset Management discussed selling JGBs in some form during the year and investors and strategists are betting the trade has room to run, as benchmark policy rates edge higher. On top of that, the Bank of Japan is trimming its bond purchases, pressuring yields. And with the nation boasting the highest government debt-to-GDP ratio in the developed world by a wide margin, bearishness to JGBs is likely to persist. — Cormac Mullen

Credit Scraps: Playing Hardball Pays

Some of 2025’s richest credit payoffs didn’t come from turnaround bets, but from turning on fellow investors. The dynamic, known as “creditor-on-creditor violence,” paid off big for funds like Pacific Investment Management Co. and King Street Capital Management, who waged a calculated campaign around KKR-backed Envision Healthcare.

When Envision, a hospital staffing company, ran aground after the Covid-19 pandemic, it needed a loan from new investors. But raising new debt meant pledging assets already spoken for. While many debt holders formed a group to oppose the new financing, Pimco, King Street and Partners Group broke ranks. Their support enabled a vote to allow the collateral — a stake in Envision’s valuable ambulatory-surgery business Amsurg — to be released by the old lenders and used to back the new debt.

The funds became holders of Amsurg-backed debt that eventually converted into Amsurg equity. Then Amsurg sold to Ascension Health this year for $4 billion. The funds who spurned their peers generated returns of around 90%, by one measure, demonstrating the payoff from waging such internecine battles. The lesson: in today’s credit markets, governed by loose documentation and fragmented creditor groups, cooperation is optional. Being right is not always enough. The bigger risk is being outflanked. —Eliza Ronalds-Hannon

Fannie-Freddie: Revenge of the “Toxic Twins”

Fannie Mae and Freddie Mac, the mortgage-finance giants that have been under Washington’s control since the financial crisis, have long been the subject of speculation over when and how they would be released from the government’s grip. Boosters such as hedge fund manager Bill Ackman loaded up on the two in the hopes of scoring a windfall on any privatization plan, but the shares languished for years in over-the-counter trading as the status quo prevailed.

Then came Donald Trump’s re-election, which catapulted the stocks into a meme-like zeal on optimism the new administration would take steps to free up the companies. In 2025, the excitement ratcheted up even more: The shares soared 367% from the start of the year to their high in September — 388% on an intraday basis — and remain big winners for 2025.

Driving the momentum to its peak this year was word in August that the administration was contemplating an IPO that could value the enterprises at around $500 billion or more, involving selling 5% to 15% of their stock to raise about $30 billion. While the shares have wavered from their September high amid skepticism about when, and whether, an IPO will actually materialize, many remain confident in the story.

Ackman in November unveiled a proposal he pitched to the White House, which calls for relisting Fannie and Freddie on the New York Stock Exchange, writing down the Treasury’s senior-preferred stake and exercising the government’s option to acquire nearly 80% of the common stock. Even Michael Burry joined the party, announcing a bullish position in early December and musing in a 6,000-word blog post that the companies which once needed the government to save them from insolvency may be “toxic twins no more.” — Felice Maranz

Turkey Carry Trade: Cooked

The Turkish carry trade was a consensus favorite for emerging-market investors after a stellar 2024. With local bond yields above 40% and a central bank backing a stable dollar peg, traders piled in — borrowing cheaply abroad to buy high-yield Turkish assets. That drew billions from firms like Deutsche Bank, Millennium Partners and Gramercy — some of them on the ground in Turkey on March 19, the day the trade blew up in minutes.

It was on that morning that Turkish police raided the home of Istanbul’s popular opposition mayor and took him into custody, sparking protests — and a frenzied selloff in the lira that the central bank was unable to contain. “People got caught very much by surprise and won’t go back in a hurry,” Kit Juckes, head of FX strategy at Societe Generale SA in Paris, said at the time.

By the end of the day, outflows from Turkish lira-denominated assets were estimated at around $10 billion, and the market never really recovered. As of Dec. 23, the lira was some 17% weaker against the dollar for the year, one of the world’s worst performers. The episode served as a reminder that high interest rates can reward risk-takers, but they offer no protection against sudden political shocks. — Kerim Karakaya

Debt Markets: Cockroach Alert

Credit markets in 2025 were unsettled not by a single spectacular collapse, but by a series of smaller ones that exposed uncomfortable habits. Companies once considered routine borrowers ran into trouble, leaving lenders nursing steep losses.

Saks Global restructured $2.2 billion in bonds after making only a single interest payment, and the restructured debt is itself now trading at less than 60 cents on the dollar. New Fortress Energy’s newly-exchanged bonds lost more than half their value in the span of a year. The bankruptcies of Tricolor and then First Brands wiped out billions in debt holdings in a matter of weeks. In some cases, sophisticated fraud was at the root of the collapse. In others, rosy projections failed to materialize. In every case, investors were left to answer for how they justified taking large credit gambles on companies with little to no proof they’d be able to repay the debt.

Years of low defaults and loose money eroded standards, from lender protections to basic underwriting. Lenders to both First Brands and Tricolor had failed to discover the borrowers were allegedly double-pledging assets and co-mingling collateral that backed various loans.

Those lenders included JPMorgan, whose chief executive Jamie Dimon put the market on alert in October when he colorfully warned of more trouble to come, saying, “When you see one cockroach, there are probably more.” A theme for 2026. — Eliza Ronalds-Hannon

–With assistance from Benjamin Harvey, Kerim Karakaya, Youkyung Lee, Cormac Mullen, Michael P. Regan, Isolde MacDonogh, Eliza Ronalds-Hannon, Yvonne Yue Li and Matt Turner.

More stories like this are available on bloomberg.com

©2025 Bloomberg L.P.

Bloomberg

Source link