Oil futures finished higher on Friday, but posted a third straight weekly loss. “Oil pundits forecasting widespread oil shortage this year is old news, and the reality is that physical markets are flush with the black gold,” said Manish Raj, managing director at Velandera Energy Partners. December West Texas Intermediate crude

CLZ23,

rose $1.43, or 1.9%, to settle at $77.17 a barrel on the New York Mercantile Exchange. For the week, prices for the front-month contract lost nearly 4.2%, according to Dow Jones Market Data.

Tag: Crude Oil Dec 2023

-

Oil prices fall for a third week in a row

+2.13% -

Oil falls, markets hold steady as Israel launches Gaza ground offensive

Oil futures dropped Sunday night as markets saw a calm opening following Israel’s launch of a ground offensive in Gaza that drew implied threats from Iran amid market fears of a wider conflict that could disrupt global crude supplies.

Oil declined as Israel “seems to be approaching the situation with caution, which has brought a sense of relief that the worst-case scenarios may not materialize,” said Stephen Innes, managing partner at SPI Asset Management, in a note.

Innes, however, said investors should remember “this is likely to be a long, drawn-out affair with many false dawns.”

West Texas Intermediate crude for December delivery

CL00,

-1.51% CLZ23,

-1.51%

fell 93 cents, or 1%, to $84.61 a barrel on the New York Mercantile Exchange on Sunday night. December Brent crude

BRNZ23,

-1.34% ,

the global benchmark, was off $1, or 1.1%, at $89.48 a barrel on ICE Futures Europe, dipping back below the $90-a-barrel threshold.Oil futures jumped nearly 3% on Friday, but suffered weekly declines, eroding the modest risk premium priced into the market.

Read: 4 reasons why oil prices have only seen a modest Middle East risk premium

Israeli solders had moved at least two miles deep into the Gaza Strip as of Sunday, the Wall Street Journal reported, after beginning a delayed ground incursion into the enclave aimed at routing Hamas following its Oct, 7 attack on southern Israel that left more than 1,400 dead and saw more than 200 Israelis taken hostage.

A sustained bombardment of the densely populated Gaza Strip by Israel has resulted in more than 8,000 casualties, according to Palestinian authorities. Israel has been under pressure by the U.S. and others to minimize civilian casualties.

U.S. stock-index futures ticked higher, with S&P 500 futures

ES00,

+0.32%

up 0.3%, while futures on the Dow Jones Industrial Average

YM00,

+0.20%

added 68 points, or 0.2%.The biggest worry among investors is a conflict that sees Iran become more directly involved. Iranian crude exports have rebounded from lows seen after the Trump administration withdrew the U.S. from a nuclear accord with Tehran and reimposed sanctions in 2018.

A renewed crackdown on Iran could take up to 1 million barrels a day of crude off the market, while a spiraling conflict could see Tehran threaten transportation chokepoints, particularly the Strait of Hormuz, or otherwise attack infrastructure in the region, while driving up a fear premium.

Iranian President Ibrahim Raisi, in a post on X written in English, said Saturday that Israel had “crossed the red lines, which may force everyone to take action.”

U.S. warplanes on Friday struck two locations in eastern Syria, which the Pentagon said were linked to Iran’s Revolutionary Guard Corps, following a string of attacks on U.S. air bases in the region that started last week.

U.S. stocks are poised to book another round of monthly losses as October draws to an end, though pressure has been attributed largely to a surge in Treasury yields. The S&P 500

SPX

last week joined the Nasdaq Composite

COMP

in correction territory, while the Dow

DJIA

is down more than 2% year to date.The rise in yields, which move opposite price, has come as U.S. government debt has failed to attract its usual haven-related buying amid rising Mideast tensions.

See: Israel-Hamas war sees investors shun most traditional havens, except for these two

-

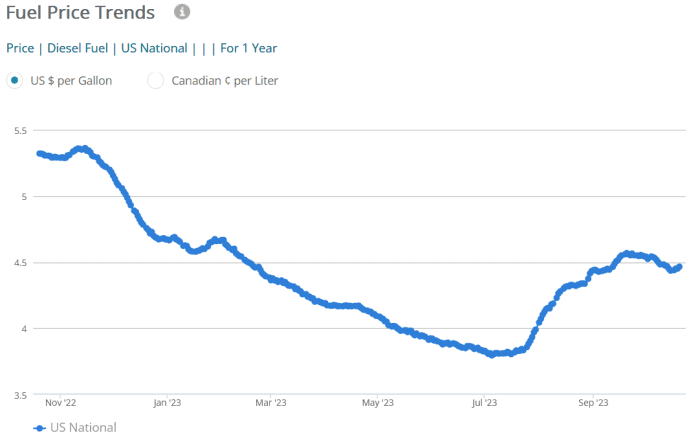

Here’s what the Israel-Hamas war has done to U.S. gasoline and diesel prices

Fuel prices, with the cost of gasoline and diesel at the pump both down from a month ago, don’t appear to be fazed by the escalating risks to oil supplies in the Middle East from the Israel-Hamas war, but they are.

The decline in fuel prices seen nationally is actually a “bit above what would be ‘normal’ for this time of year,” said Patrick De Haan, head of petroleum analysis at GasBuddy. However, he believes “prices won’t fall as far as they would have had the attacks on Israel not happened.”

On Friday, the average retail price for a gallon of regular gasoline stood at $3.528, down 5.7 cents from a week ago, while the average retail diesel price was at $4.465 a gallon on Friday, down 7.8 cents from Sept. 30, according to data from GasBuddy.

U.S. retail gasoline prices have fallen so far this month.

GasBuddy

“Geopolitical risk is now heightened, changing the calculus” for the fuel market, said Brian Milne, product manager, editor and analyst at DTN.

‘Seasonal component’

In considering retail gasoline prices during the fourth quarter, the “seasonal component is less pronounced than in years past,” said Milne. Demand for gasoline tends to fall following the summer travel season. Combined with a “strong slate of refinery maintenance,” which led to less fuel supply on the market, the rise in crude oil prices has slowed the decline in fuel prices, said Milne.

If not for the heightened geopolitical risk in the Middle East, he said he might have expected to see gasoline prices decline by another 30 cents to 40 cents per gallon into late December because of lower demand.

Retail gas prices may fall another 20 cents a gallon or more, depending on the location within the U.S., if we avoid broader hostilities in the Middle East, said Milne.

However, if a conflict breaks out beyond Israel and the Gaza Strip, gasoline prices are likely to move sharply higher because of a spike in crude costs, he said.

For its part, oil has seen volatile trading following the Hamas attack on Israel on Oct. 7, with futures prices for U.S. benchmark West Texas Intermediate crude

CLZ23,

-0.42% CL.1,

-0.39%

higher for the week, but lower for the month.California prices ‘plummet’

For now, California, which typically is among the states that pays the most per-gallon for gasoline partly due to taxes on the fuel, is seeing prices “plummet” — down nearly 60 cents in the last three weeks, said GasBuddy’s De Haan.

“The West Coast is certainly seeing a much larger decline than is ‘normal’ and it’s due to the refinery situation now improving drastically,” as well as California’s RVP waiver, he said.

The California Air Resources Board allowed gasoline sold or supplied for use in California that exceeds the RVP, or Reid Vapor Pressure, limits through the end of Oct. 31, marking an early transition for the state from the lower RVP gas used in the summer to help cut gasoline emissions to the higher RVP gas used in the winter.

On Friday, the average price for a gallon of regular gasoline in California sold for $5.476, GasBuddy data show. That’s down 16.7 cents in just the last week.

Gas price outlook

De Haan said he does not expect to see a spike in gas prices nationally at this point, and there’s still room for prices to fall — just not as much following the Hamas attack on Israel.

“If we get to November and Iran gets involved in the situation, then we certainly could see gas prices impacted in some way as the current drops will likely be fully passed on by then, giving stations no ‘room’ to absorb higher prices reflected by a potential rise in oil,” said De Haan.

Still, falling demand, as well as “seasonality in general,” are what are pushing prices down, “enhanced by refinery improvements in areas” that saw price surges, he said.

Prices may even fall further after refinery maintenance season wraps up in mid-November, and refiners have to find places to put even more gasoline output, said De Haan.

He’s comfortable with the gasoline price forecasts GasBuddy issued in December of last year, which predicted a monthly national average for the fuel of $3.53 for October — matching the current price. The forecast also called for an average of $3.36 a gallon for November and $3.17 for December.

GasBuddy doesn’t have a forecast for 2024 yet, but prices may look similar to this year, as long as the situation in the Middle East doesn’t further crumble,” said De Haan.

View on diesel

Diesel, however, is another story.

Price for that fuel have dropped by 85.5 cents a gallon from a year ago to Friday’s $4.465 level, GasBuddy data show.

U.S. retail diesel prices are sharply lower than a year ago.

GasBuddy

While down from a year ago, diesel prices are currently at a “very high level historically” because global supply is low, said DTN’s Milne.

At this time in 2022 diesel fuel inventory was even tighter than it is now, and Europe was heading into winter without Russian natural gas after it was cutoff following the invasion of Ukraine, he said.

That led to a spike in natural-gas prices and prices for gasoil, a European heating oil, also surged, lifting heating oil and diesel prices globally, explained Milne.

Like gasoline, diesel prices could move “sharply higher if the war in Israel expands, and oil flow is put at greater risk,” he said.

De Haan, meanwhile, said diesel prices could climb closer to $5 a gallon if there’s a “squeeze,” with relief then [coming] in the spring/summer” seasons.