[ad_1]

U.S. homes may be wildly unaffordable for first-time buyers, but mortgage bonds backed by those same properties could be dirt cheap.

Shocks from the Federal Reserve’s dramatic rate increases have walloped the $8.9 trillion agency mortgage-bond market, the main artery of U.S. housing finance for almost the past two decades.

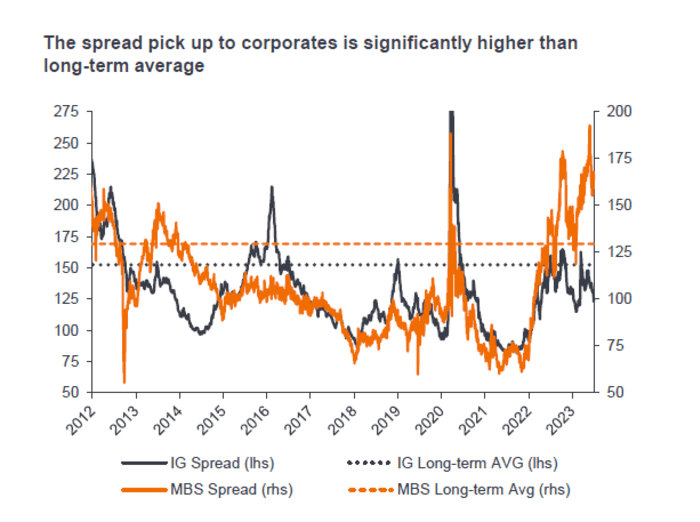

Spreads, or compensation for investors, have hit historically wide levels, even through the sector is underpinned by home loans that adhere to the stricter government standards set in the wake of the subprime-mortgage crisis.

Bond prices also have tumbled, sinking from a peak above 106 cents on the dollar to below 98, despite guarantees that mean investors will be fully repaid at 100 cents on the dollar.

From $106 to $98 cents, agency mortgage-bond prices are falling.

Bloomberg, Goldman Sachs Global Investment Research

“It’s really, really struggled,” Nick Childs, portfolio manager at Janus Henderson Investors, said of the agency mortgage-bond market during a Thursday talk on the firm’s fixed-income outlook.

Yet Childs and other investors also see big opportunities brewing. While mortgage bonds have gotten cheaper with the sector’s two anchor investors on the sidelines, the stalled housing market should breed scarcity in the bonds, which could help lift the sector out of a roughly two-year slump.

Prices have tumbled since rate shocks hit, but also since the Fed continued winding down its large footprint in the sector by letting bonds it accumulated to help shore up the economy roll off its balance sheet.

Banks awash in underwater securities have pulled back too. The repricing of similar bonds helped hasten the collapse of Silicon Valley Bank in March.

“Banks have been not only absent, but selling,” said Childs, who helps oversee the Janus Henderson Mortgage-Backed Securities exchange-traded fund

JMBS,

an actively managed $2 billion fund focused on highly rated securities with minimal credit risk.

“But we’re moving into an environment where supply continues to dwindle,” he said, given anemic refinancing activity and the dearth of new home loans being originated since 30-year fixed mortgage rates topped 7%.

The bulk of all U.S. mortgage bonds created in the past two decades have come from housing giants Freddie Mac

FMCC,

Fannie Mae

FNMA,

and Ginnie Mae, with government guarantees, making the sector akin to the $25 trillion Treasury market. But unlike investors in Treasurys, investors in mortgage bonds also earn a spread, or extra compensation above the risk-free rate, to help offset its biggest risk: early repayments.

While homeowners typically take out 30-year loans, most also refinanced during the pandemic rush to lock in ultralow rates, instead of continuing to make three decades of payments on more expensive mortgages. If someone refinances, sells or defaults on a home, it leads to repayment uncertainty for bond investors.

“To put this another way, the biggest risk to mortgages is now off the table, yet spreads are at or near historic wides,” said Sam Dunlap, chief investment officer, Angel Oak Capital Advisors, in a new client note.

That spread is now far above the long-term average, topping levels offered by relatively low-risk investment-grade corporate bonds.

Agency mortgage bonds are offering far more spread that investment-grade corporate bonds. But these mortgage bonds will fully repay if borrowers default.

Janus Henderson Investors

Agency mortgage bonds typically are included in low-risk bond funds and can be found in exchange-traded funds. While they have been hard hit by the sharp selloff in long-dated Treasury bonds

BX:TMUBMUSD10Y

BX:TMUBMUSD30Y,

there has also been hope that the worst of the storm could be nearly over.

Goldman Sachs credit analysts recently said they favored the sector but warned in a weekly client note that it still faces “high rate volatility and a dearth of institutional demand.”

As evidence of the U.S. bond selloff, the popular iShares 20+ Year Treasury Bond ETF

TLT

recently sank to its lowest level in more than a decade. It also was on pace for a negative 10% total return on the year so far, according to FactSet. Janus Henderson’s JMBS ETF was on pace for a negative 2.7% total return on the year through Friday.

“Frankly, why they fit portfolios so well is that because the government backs agency mortgages, there is no credit risk,” Childs said. “So if a borrower defaults, you get par back on that. It just comes through as a typical payment.”

[ad_2]