The summer haze settling over stocks doesn’t look ready to budge Thursday, with the S&P 500 index

SPX,

-0.52%

in the throes of its longest losing streak since May.

On the bright side, the index is looking at a 6% gain for the June quarter, whose end is just a few days away.

In other corners of the market, the quarter has been less forgiving. Consumer staples, those things you can’t live without, have lost over 1%, perhaps reflecting the tougher economic times we are living in. Within that sector, though, is beer and one name that has indeed had a quartarius horriblis.

Anheuser-Busch InBev’s

ABI,

+1.82%

BUD,

-0.05%

U.S.-listed shares are down about 15%, as Bud Light sales have tumbled following consumer backlash to a social-media campaign featuring trans activist Dylan Mulvaney in April.

But our call of the day from Deutsche Bank says it’s time to buy this unloved stock, even if those Bud Light sales never recover. A team of analysts led by Mitch Collett have upgraded Anheuser-Busch shares to buy from hold and lifted their price target to €60 euros from €59 euros (they didn’t offer an ADR price target).

Recent underperformance of the stock “implies a permanent reduction in ABI’s U.S. business. Our proprietary survey data suggests these headwinds are likely to fade even if we do not expect the U.S. business ever to fully recover from its current challenges,” said Collett.

The analysts pointed to recent Nielson data that showed ABI’s U.S. business currently down 12%, with Bud Light sales off 24% and the rest of its portfolio down 7%. But an analysis of distribution data shows ABI itself isn’t “losing shelf presence” as sales velocity is the primary driver of the decline, which bodes well if consumer sentiment improves, said Deutsche Bank.

Those declines are about a 12% headwind to ABI’s annual net income, which is in line with European underperformance seen by the stock, added Collett and the team.

Read: Bud Light dethroned as top-selling beer by Modelo, as boycott cuts into sales

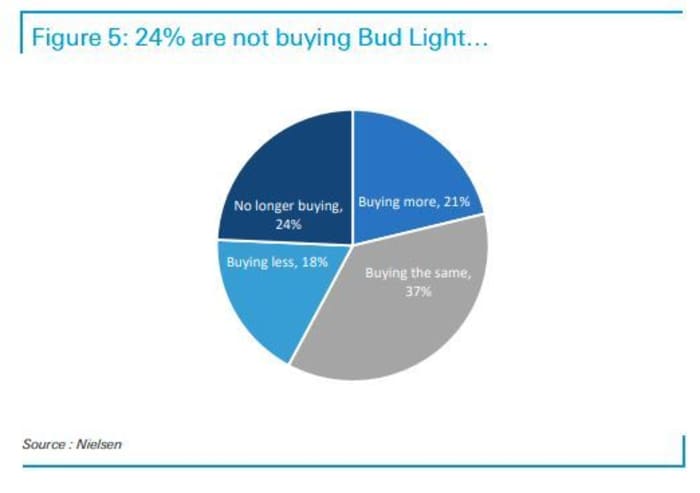

Deutsche Bank conducted its own survey that showed 24% of Bud Light consumers are no longer buying that brand, with 18% buying less, but 21% buying more and 37% buying the same amount. Those findings are largely consistent with Nielson;s, said the analysts.

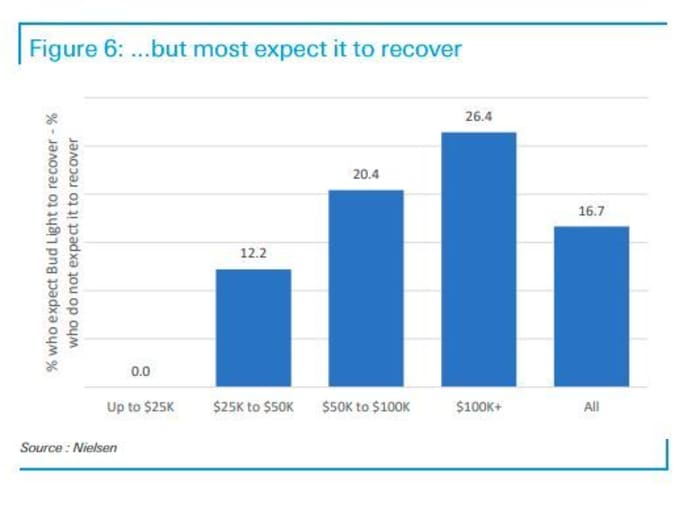

Deutsche Bank’s own survey also showed that 42% of Bud Light drinkers expect to be buying Bud Light again in three to six months, versus 29% who see that as unlikely. And 50% expect that battered beer’s reputation will recover in time, versus 30% who says it won’t. “We believe this bodes well for the brand, recapturing some of its lost share,” said Collett and the team.

Analysts at RBC Capital also recently pushed back on the selloff for the stock, saying the hit to the shares and forecasts for the stock are “excessive,” as they don’t see Bud Light’s troubles hurting AB InBev outside the U.S.. They said AB InBev is a “nerve-racking buying opportunity.”

Ahead of Thursday’s open, U.S.-listed Bud shares were up about 1.3%, tracking gains from its Belgian shares.

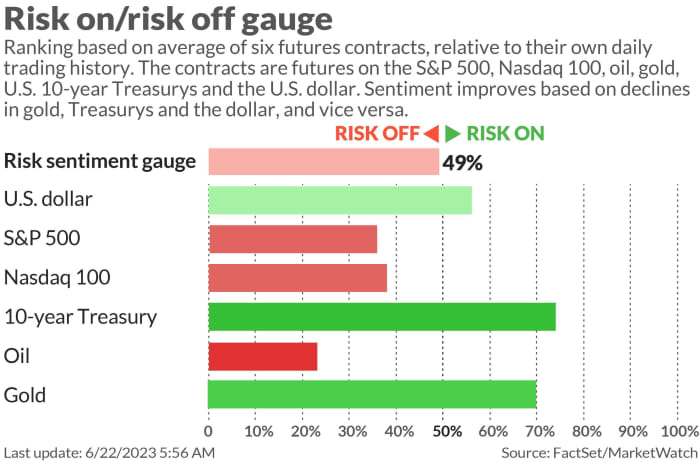

The markets

U.S. stock index futures

ES00,

-0.25%

YM00,

-0.27%

NQ00,

-0.31%

are drifting lower, with bond yields

TMUBMUSD02Y,

4.730%

TMUBMUSD10Y,

3.743%

on the rise and oil prices

CL.1,

-1.82%

also weaker. The Norwegian krone

USDNOK,

-0.80%

is up 1.5% against the dollar after the country’s central bank hiked interest rates 50 basis points. Switzerland also hiked rates, but the Swiss franc is steady

USDCHF,

+0.12%.

The British pound

GBPUSD,

is higher after the Bank of England also hiked interest rates by 50 basis points. The Turkish lira was falling slightly after the central bank, under new management, hiked interest rate to 15% from 8.5%, against forecasts for a hike to 20%.

China markets were closed for a holiday, with losses elsewhere, such as Japan

NIK,

-0.92%

and Australia

XJO,

-1.63%.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Federal Reserve Chair Jerome Powell’s second day of testimony on Capitol Hill kicks off at 10 a.m. Eastern. On Wednesday, he said higher interest rates should be expected , but didn’t offer any clues on timing. U.S. weekly jobless benefit claims and current account data are due at 8:30 a.,m. ET, with leading indicators also at 10 a.m., alongside a speech from Cleveland Fed President Loretta Mester. Richmond Fed President Tom Barkin will speak at 4:30 p.m.

The Bank of England will announce an interest-rate decision at 7 a.m. ET and after worse-than-expected inflation data on Wednesday, a 50 basis-point hike hasn’t been ruled out.

Darden Restaurants

DRI,

+0.36%

will report ahead of the open, with Smith & Wesson

SWBI,

+0.52%

due after the close.

Tesla stock

TSLA,

-5.46%

is down 2% in premarket trading on the heels of the EV maker’s worst loss in two months.

Joining recent actions by other big stakeholders cashing in on big gains for Nvidia

NVDA,

-1.74%,

a board member just sold $51 million in stock.

Best of the web

Amazon allegedly duped people into subscribing to Prime and made it nearly impossible to cancel. Here’s how the feds say they did it.

The Biden administration is reportedly exploring whether it can mount a campaign against Chinese tech giants like Alibaba and Huawei.

A giant drilling machine is moving Stockholm toward an emissions-free future

Wife of missing Titanic exploring sub pilot Stockton Rush is reportedly a descendant of two first-class passengers who died on the ship.

The tickers

These were the top searched tickers on MarketWatch as of 6 a.m. :

|

Ticker

|

Security name

|

TSLA,

-5.46%

|

Tesla

|

MULN,

+24.24%

|

Mullen Automotive

|

NVDA,

-1.74%

|

Nvidia

|

AMC,

-1.31%

|

AMC Entertainment

|

APE,

-2.30%

|

AMC Entertainment preferred holdings

|

NIO,

-2.99%

|

Nio

|

PLTR,

-7.28%

|

Palantir Technologies

|

MANU,

+1.11%

|

Manchester United

|

SPCE,

-4.99%

|

Virgin Galactic Holdings

|

AAPL,

-0.57%

|

Apple

|

Random reads

Are Elon Musk and Mark Zuckerberg ready for a cage match?

It’s summertime. Let your kids get bored.

Tokyo streets now offer the chance to snuggle an alpaca

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.