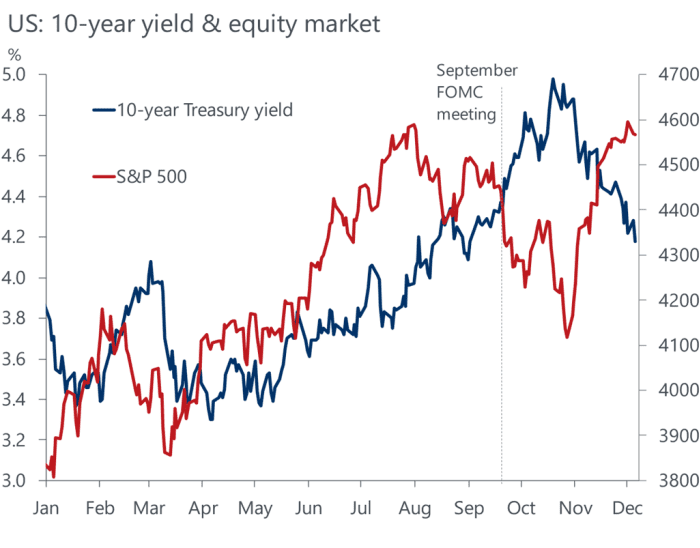

A rally in the U.S. stock and bond markets in the past week defied the bears and fueled hopes for more gains to come by year-end and in 2024 as Wall Street bought into the idea that the economy will pull off a “soft landing” after a run of interest-rate hikes by the Federal Reserve.

But market skeptics are putting investors on alert that the “soft-landing” scenario is still at risk with consumer spending and job growth slowing, along with corporate earnings.

“The equity market is misguided,” said Josh Schachter, senior portfolio manager at Easterly Investment Partners, in a phone interview with MarketWatch. “The markets are behaving in almost a bipolar fashion — some asset classes such as bonds

BX:TMUBMUSD10Y,

oil

BRN00,

-0.29%,

and dollar

DXY,

are being priced for a recession, while other assets such as equities and bitcoin

BTCUSD,

+2.16%,

are priced risk-on.”

U.S. stocks built on their November gains in the past week, with the S&P 500 index

SPX

ending at new 2023 high on Friday and the Dow Jones Industrial Average

DJIA

logging its fifth week in the green. The rebound in stocks was due in part to bond investors starting to believe the Fed is done raising interest rates and is likely to begin cutting them by the first quarter of 2024.

Meanwhile, the narrative that a resilient labor market and steadier-than-expected economic growth should keep a recession at bay has gained traction, bolstering the “goldilocks” scenario for the financial markets.

See: These two leading indicators suggest a U.S. recession has already begun, according to Wall Street’s favorite permabear

However, signs are emerging that consumer spending, which accounts for about 70% of the U.S. economic output and has boosted the economy this year, has likely run its course following the post-pandemic recovery. Credit card and car loan delinquency rates are rising, student loan payments have resumed, consumer spending is cooling, and there are warnings from top retailers.

Joseph Quinlan, head of CIO market strategy for Merrill and Bank of America Private Bank, said the “softness” in the U.S. consumer sector is visible but not huge, referring to that as “a canary in a coal mine,” he told MarketWatch via phone on Thursday.

The pullback in consumer spending is welcome news for Fed officials, who have increased interest rates 11 times since March 2022 to get inflation back to its preferred target of 2%. However, some analysts are worried that high interest rates and a decline in pandemic savings could eventually translate to weaker consumers in 2024, potentially another sign of a long-predicted slowdown in the U.S. economy.

“One of the things I’m most concerned about is consumers’ ability to continue to pace the economy — you’ve got several headwinds that haven’t really borne completely out yet,” said Jason Heller, senior executive vice president at Coastal Wealth. “Does the consumer continue to behave the way they behaved the last 36 months? I think you will eventually see a slowdown in consumer spending which is going to mandate a slowdown in the labor market.”

Lauren Goodwin, economist and portfolio strategist at New York Life Investments, acknowledged that a modest slowdown in inflation and employment growth means that a “Fed relief rally” in stocks can be sustained, but her concern is this late-cycle limbo is no different than those of the past, which is a moment of “goldilocks” before the very reason that inflation is moderating — slowing economic growth and employment — becomes clear in the data.

See: ‘We Are Still Headed for a Pretty Hard Landing,’ Ex-Treasury Secretary Larry Summers Says

That’s why the November employment report, which will be released by the Bureau of Labor Statistics next Friday at 8:30 a.m. Eastern, will be key for investors to watch. The U.S is expected to add 172,500 jobs in November after a 150,000 increase in the prior month, according to economists polled by Dow Jones. The percentage of jobless Americans seeking work is forecast to stay the same at 3.9%, leaving it at the highest level since the beginning of 2022.

See: U.S. job growth pick up on the radar this coming week

In fact, nonfarm payroll report publication days have been among the most volatile for stocks in 2023, compared with the release of monthly consumer-price index readings, which sparked some of the biggest daily up and down moves for the S&P 500 and other major indexes in 2022.

See also: Do CPI days still rock the stock market? How 2023 stacks up to 2022

This year, the S&P 500 saw an absolute average percentage change of 1.12% on employment situation release dates, compared with an average percentage move of 0.64% on CPI days, according to figures compiled by Dow Jones Market Data.

That said, analysts are skeptical if the employment data is able to tell “a radically different story” but suggest the labor market will remain relatively tight into 2024, said Quinlan and Lauren Sanfilippo at Merrill and Bank of America Private Bank, in a phone interview.

See: What 2024 S&P 500 forecasts really say about the stock market

Too much optimism in 2024 earnings growth

Corporate America and their shares are telling investors a different story about next year.

With an estimated average S&P 500 earnings growth of 11.7% next year, the U.S. stock market is nowhere near recessionary concerns, said Heller. “We’ve [the stocks] priced in pretty significant growth in 2024.”

Strategists at Merrill and Bank of America Private Bank are in the camp of expecting a “mid-single digit” earnings growth for the S&P 500 in 2024, as earnings have troughed and the economy will fall back to the 2%-level of real growth after high rates confine consumer spending and corporate profits, cooling a red-hot economy.

To be sure, Wall Street analysts tend to overestimate the earnings-per-share (EPS) for the S&P 500, said John Butters, senior earnings analyst at FactSet.

The current bottom-up EPS estimate for the S&P 500 in 2024 is $246.30. If that holds true, that would be the highest EPS number reported by the large-cap index since FactSet began tracking this metric in 1996.

However, over the past 25 years, the average difference between the EPS estimate at the beginning of the year and the actual EPS number has been 6.9%, meaning analysts on average have overestimated the earnings one year in advance, said Butters in a Friday note (see chart below).