Figure 1: Rank Technology Solutions

Third-party tools dominate pre-trade TCA use

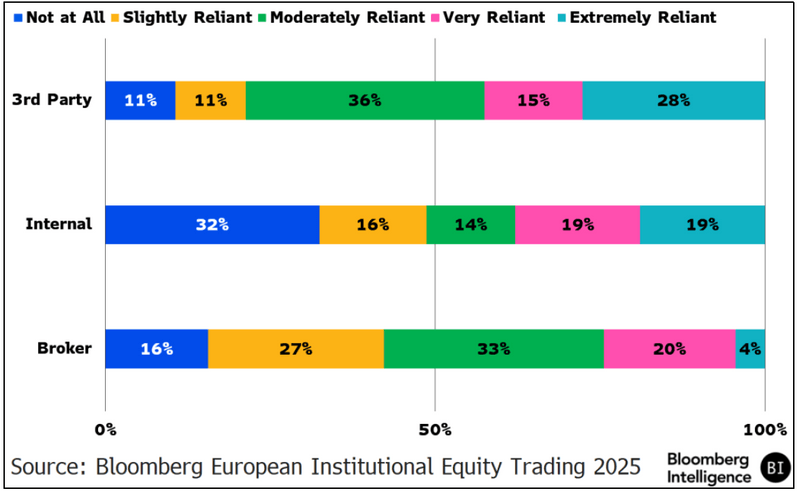

Traders consider third-party tools the most essential for transaction cost analysis, with 43% saying they are very or extremely reliant on them. Broker tools are least popular, with only 24% highly reliant and more than 40% citing slight or moderate use. This low reliance might reflect concerns over conflicts of interest in measuring performance.

Figure 2: How Reliant Are You on Help to Estimate Pre-Trade?

Despite wider adoption, pre-trade TCA models still face credibility issues among traders. A large asset manager told us they have yet to see an effective model and often raise the point at industry conferences, where peers tend to agree. The lack of consensus on model quality highlights deeper skepticism. Though tools are increasingly embedded in workflows, few are viewed as robust enough to reliably predict market impact, particularly in complex or large trades.

Though 64% of traders estimate pre-trade costs, just 52% apply that analysis at the point of execution, based on our survey. This 12% gap suggests that, for some, TCA serves more as a compliance checkbox than a genuine input into trading decisions. Among traders who forgo pre-trade TCA before executing, several cited either low confidence in the outputs or a stronger reliance on intuition. The disconnect highlights that, though adoption of pre-trade tools is increasing, belief in their practical value still lags, particularly when execution speed and minimizing information leakage are a priority.

Post-trade TCA is close to universal across the European buyside, with 86% of traders reporting they conduct it. Adoption is strongest among medium-sized companies (92%), followed by small (85%) and large (83%). Still, a minority across all company sizes don’t engage in post-trade analysis, often citing limited internal resources or a belief that market impact is too small to measure. Overall, post-trade TCA appears embedded in most European buyside execution review processes, even if confidence in the outputs varies among traders.

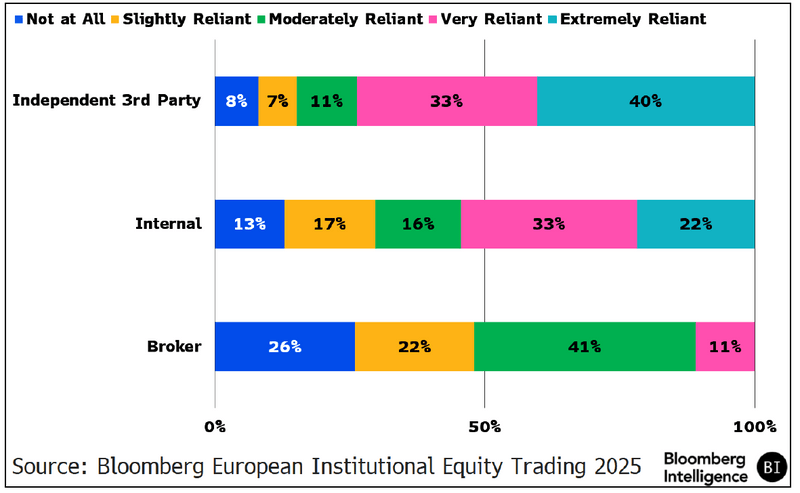

Post-trade TCA remains a largely outsourced function, with 73% of respondents saying they are either very or extremely reliant on independent third-party providers. Internal analysis sees a moderate level of reliance at 55%, reflecting its resource-intensive nature. Meanwhile, broker-provided TCA ranks lowest in trust, with only 11% of respondents indicating high reliance — a likely result of ongoing concerns over conflicts of interest. The technical and data demands of conducting meaningful post-trade TCA in-house help explain continued reliance on third-party providers.

Figure 3: Who’s Helping You Measure Your Post-Trade TCA?

One trader we spoke with said of TCA analysis that the number of unknowns in execution, particularly when using algos, can distort the reliability of outputs. Though they use TCA, they admitted they don’t trust it enough to guide decision-making. In their view, execution complexity and TCA’s limited visibility make it difficult to fully assess performance, as too many factors fall outside its scope. According to the trader, assessing an algo’s effectiveness often requires dismantling it manually, something no standard TCA tool can replicate.

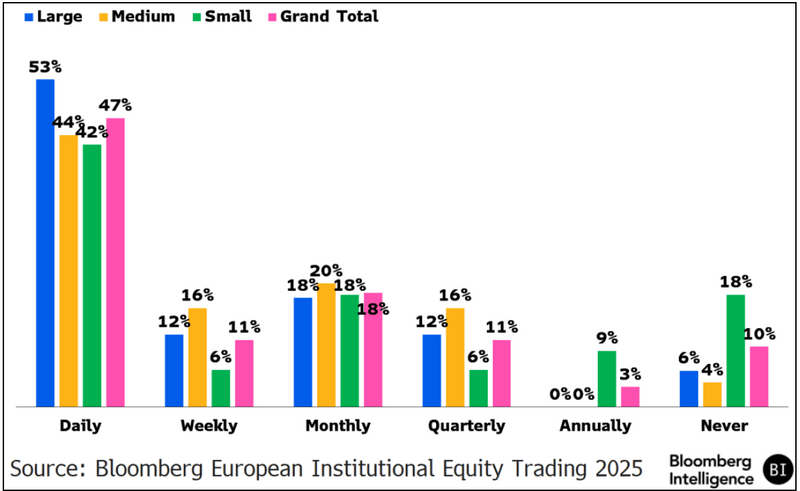

Nearly half (47%) of European buyside traders report running post-trade TCA on a daily basis, with frequency varying by company size. Large ones are the most consistent, with 53% conducting daily analysis, reflecting the scale and complexity of their execution activity. Medium and small companies are notably less reliant, with daily usage 9% and 11% lower, respectively. At the other end, 18% of small companies never estimate post-trade costs — the highest non-usage rate in the sample. Monthly post-trade TCA, meanwhile, is the most evenly adopted frequency across company size, cited by 18% of traders overall.

Figure 4: How Often Do You Measure Post-Trade TCA?

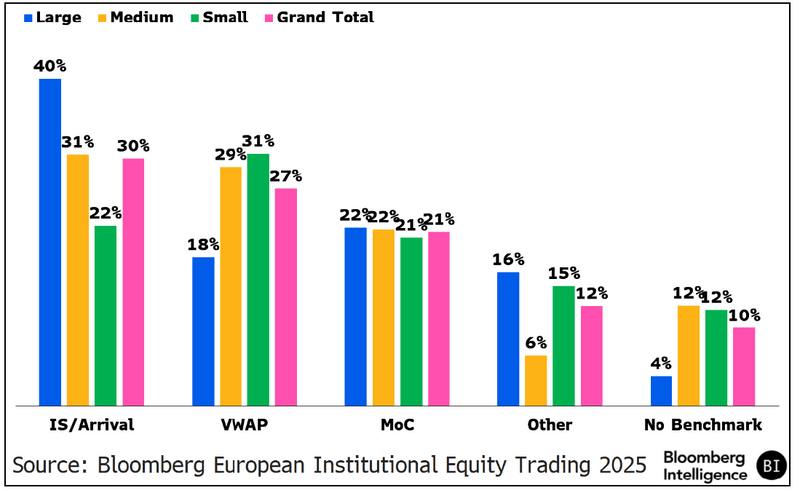

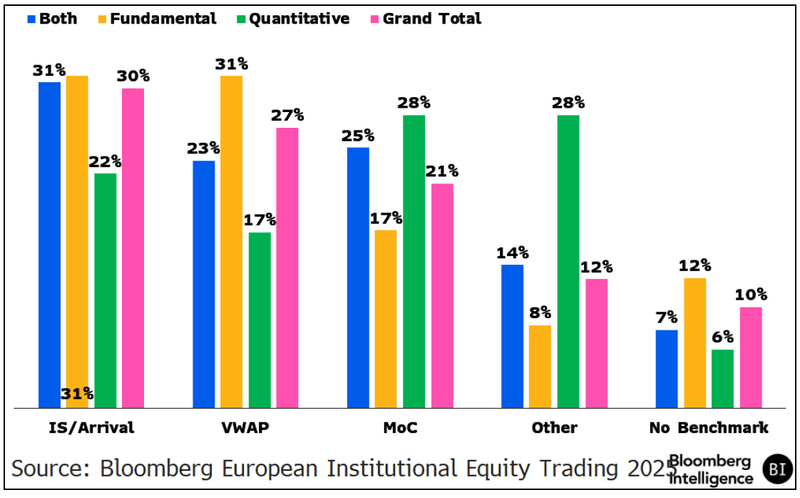

Arrival price leads, but VWAP gains momentum

Arrival price, also known as implementation shortfall (IS), remains the most-used execution benchmark among European buyside traders, with 30% reporting usage, a 7 percentage-point drop from last year. The benchmark is especially favored by large firms (40%), compared with just 22% of small firms. In contrast, VWAP (volume-weighted average price) has gained momentum, now ranking as the second-most used benchmark at 27%. It’s the top choice among small (31%) and medium-sized (29%) firms, signaling a growing preference for simpler, liquidity-weighted benchmarks among smaller participants. Market-on-close (MoC) benchmarks show consistent usage across firm sizes at 21%. Notably, 10% of traders surveyed say they don’t use any benchmark for measuring execution performance.

Figure 5: Benchmarks Used by Size

Traditional benchmarking on quant desks is declining, with just 17% using VWAP and 23% IS, compared with much higher usage among fundamental traders. MoC trades concentrate liquidity near market close, allowing quants to design execution around predictable volume spikes. That aligns well with algorithms targeting minimized market impact during specific trading windows.

Figure 6: Benchmarks Used by Investing Style

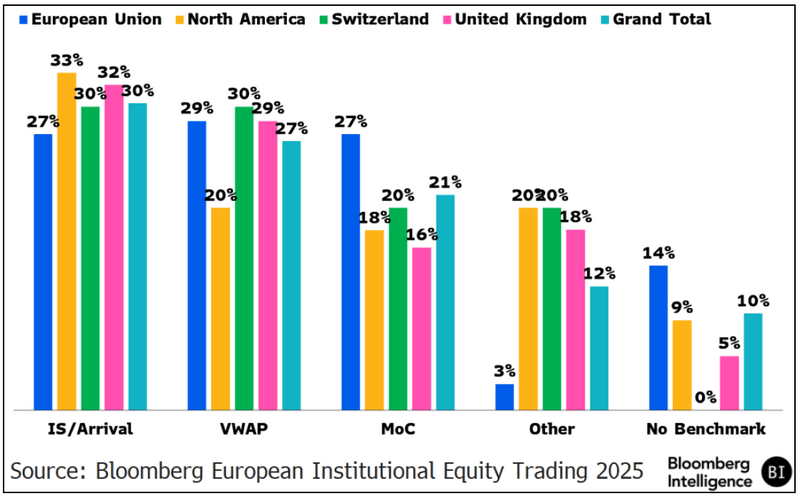

North American traders have a stronger preference for IS with 33% using it — 3 percentage points above the overall average (see Fig. 7). VWAP is less favored, with usage at just 20%, a full 7-percentage points below the global average. EU, UK, and Swiss traders show more balanced usage between IS and VWAP. MoC is most used in the EU (27%), suggesting stronger alignment with close-based execution. North American and Swiss traders (20%) have a higher preference for alternative or proprietary performance metrics to measure trade performance.

Figure 7: Benchmarks Used by Region

Volatility-driven benchmark misses make work for traders

One trader at a large asset-management firm told us that higher volatility has led to a rise in benchmark misses, making it harder to distinguish between genuine execution issues and volatility induced noise. That trader now expends more effort investigating missed benchmarks like VWAP to validate whether outcomes are justifiable, which is a time-consuming process. Instead of assuming a poor trade, they look at liquidity and market timing to assess if the “miss” aligns with expectations. The shift has added complexity to post-trade analysis, with traders expected to not only track performance, but also explain the story behind each deviation.

A majority (57%) of survey respondents report using transaction cost analysis (TCA) to actively improve trading outcomes, suggesting it plays a critical role in measuring and improving execution quality. Meanwhile, 35% treat it as a checkbox exercise or a process driven by compliance obligations to meet best-execution requirements, instead of performance enhancement. Just 8% view TCA as a tool to support transparency, noting they primarily engage with it when clients request access to execution performance logs.

Asked about the impact of tariff-driven volatility, 48% of traders cited higher costs, mainly from wider spreads. Another 39% said their TCA was largely unaffected, implying liquidity was sufficient to absorb shocks without notable cost swings. The remaining 13% reported a modest increase, though not enough to prompt structural changes in execution. The divergence suggests that order size and trading style shapes outcomes more than volatility itself — some desks absorbed shocks, while those executing larger orders saw a measurable drop in quality.

One trader at a small asset management firm told us they track TCA metrics daily to use the insights as a real-time health check. On a monthly basis, they conduct a deeper dive, reviewing strategy alignment and anomalies. Annually, they compile a TCA scorecard to evaluate broker performance and reallocate flow away from those whose results show persistent underperformance. This approach creates a feedback loop that directly influences routing decisions and reinforces how TCA can serve as a bridge between execution and broker relationship management.

Small funds concentrate trading flow more than large

Traders at small institutions send about 38% of algorithmic trading flow to their top broker, compared with 23% at large funds and 33% at medium-sized peers. On average, traders use five brokers for 81% of such flow, though at large funds the top five account for just 75.6%. Small funds are most concentrated, routing nearly 90% (88.7%) of flow to their top five providers.

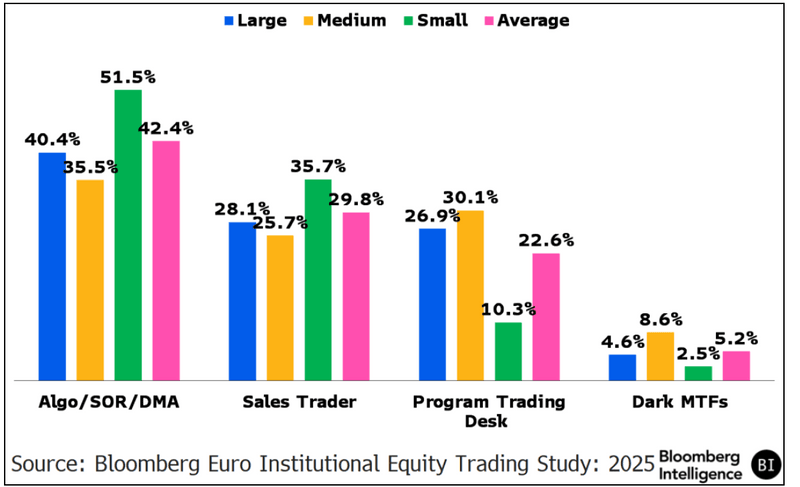

Funds trading in the UK and Europe are executing a plurality of their shares (42.4%) via broker algorithms or through direct market access (DMA) channels to the market. They’re sending 29.8% of flow to brokers for high-touch execution, 22.6% to program trading desks and 5.2% to dark, multi-lateral trading facilities (MTFs). This year, smaller funds routed a bit more than half of their flow via low-touch channels (algo/DMA), as large funds sent 11.1% less. Funds used program-trading desks when they needed multiple orders executed simultaneously, typically tied to an index or an event.

Figure 8: UK/Europe Buyside Equity Order Flow Allocation

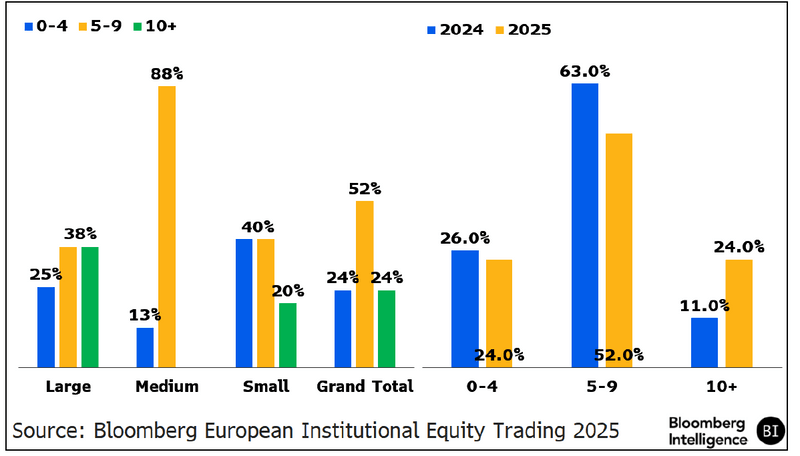

Large European buyside funds increased their use of algorithmic-trading providers by 21% year over year, averaging 10.2 providers in 2025 vs. 8.4 in 2024. The rise may reflect efforts to boost liquidity access. Midsized funds trimmed average broker use to 7 from 9.4, while smaller funds increased slightly to 6.1 from 5.1. Overall, average provider use ticked up to 7.9 from 7.8.

Among large, medium and small European buyside institutions surveyed, 25% plan to increase use of trading-algorithm providers in 2026, while 13% expect to cut back. Growth is driven mainly by smaller firms, with 34% planning to expand next year.

The push reflects a desire to foster broker competition through customized algorithms and algo wheels — systems that rotate orders across different brokers’ algorithms to measure performance and direct flow to those delivering the best results. Customized algorithms allow providers to distinguish themselves based on service quality, while wheels broaden order routing across brokers, improving liquidity in tougher markets.

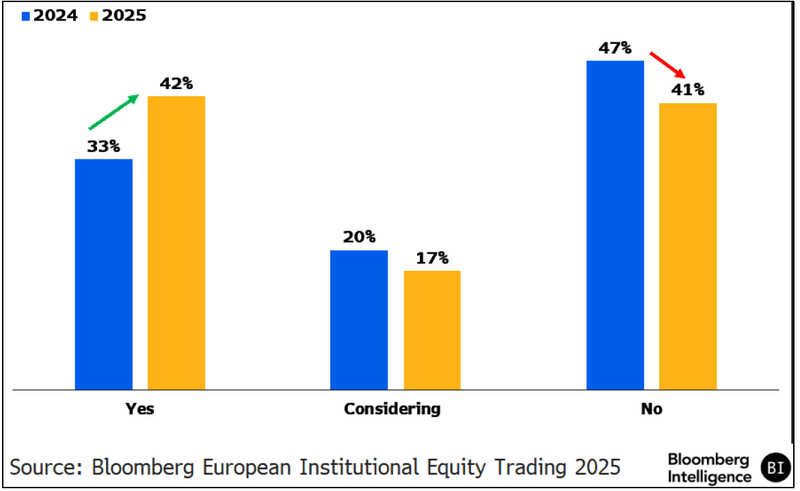

Algorithm wheels — tools that automate order allocations and allow unbiased A/B testing of algorithms — are gaining traction in Europe, according to feedback in our survey. In 2025, 42% of buyside firms were using an algo wheel, up from 33% in 2024. In last year’s survey, 20% said they were considering one, but that figure has dipped to 17%. Traders cite reduced manual input and less bias in broker selection as key benefits. These features also support best execution obligations, which may be helping to drive broader use across the region.

Figure 9: Are You Using an Algo Wheel?

£25 trillion funds say AI won’t oust traders, analysts

AI is gaining traction on European trading desks, but buyside traders say human insight will remain central, especially in investment research. Our survey, covering funds with £25 trillion in assets, found nearly two-thirds expect research to keep relying on judgment and in-person observations that models can’t replicate, with only 4% seeing full automation. Adoption is rising in operational efficiency, investment analysis and broker algos, yet use remains largely experimental. Execution is viewed as the most likely near-term application, though AI is broadly seen as a complement to existing processes rather than a replacement for jobs or decision making. The cautious outlook shows desks are prioritizing productivity and efficiency over structural change.

Most buyside traders see little change ahead for trading-desk jobs, with a solid 58% expecting head count to stay the same, signaling that AI is viewed more as a tool to boost productivity than a driver of workforce shifts. Only 12% expect an increase in employment, while nearly one-third anticipate reductions, either slight or significant. Overall sentiment shows skepticism about AI’s short-term effect on staffing, with most desks not expecting meaningful near-term disruption.

European buyside traders anticipate faster AI adoption in execution than in investment decision-making, with 26% expecting execution decisions within the next two years compared with 7% for investment decisions. Of respondents, 57% anticipate AI adoption for investment decisions in 2-3 years and a notable 33% see it taking more than five. Though there’s a higher concentration for AI in execution in years 4-5, traders appear more comfortable introducing AI in execution workflows, where performance is easier to monitor and control, than for investment decisions.

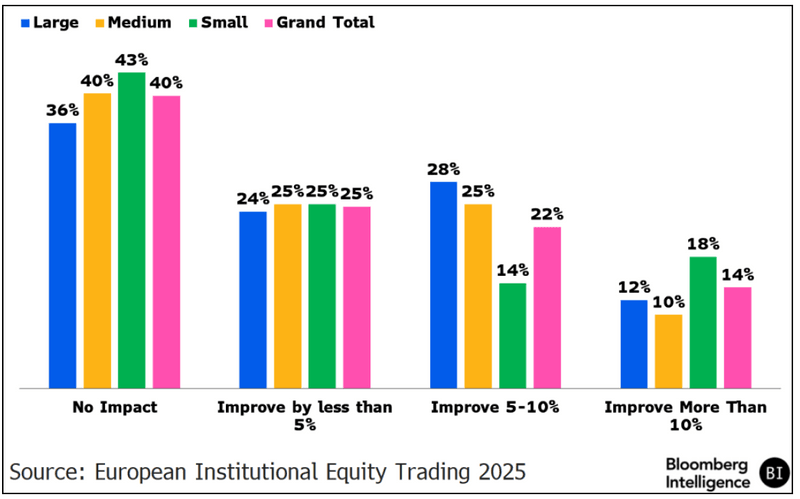

AI’s potential to generate revenue is viewed with skepticism across European trading desks, with just 14% of respondents saying AI will increase revenue by more than 10%. Nearly two-thirds expect no impact or gains below 5%. The cautious view spans firm sizes, with 40% of small companies and 36% of large ones seeing no effect at all. This perspective highlights a broader belief that AI will serve as a complement to existing processes and a productivity enhancer rather than a direct driver of revenue growth in trading operations.

Figure 10: AI to Improve: Revenue Generation

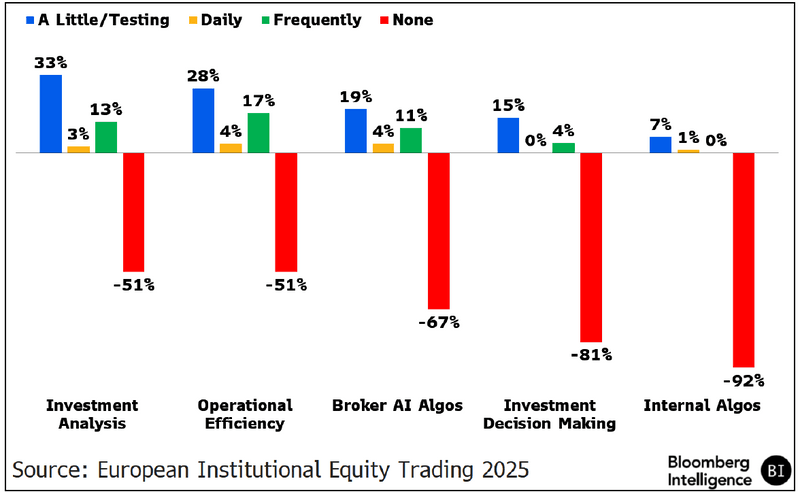

Data from our study show AI adoption on trading desks remains limited and mostly in testing. Most buyside respondents report no use of AI in key areas, such as internal algos (92%), investment decision-making (81%) and broker algos (67%) (see Fig. 11). The highest AI adoption rates were in investment analysis (33%) and operational efficiency (28%), but even there, use is largely experimental. Frequent or daily AI use remains rare, suggesting that while interest in AI is growing, institutional trading workflows are still in early-stage adoption.

Figure 11: How Much Do You Use AI on the Trading Desk?

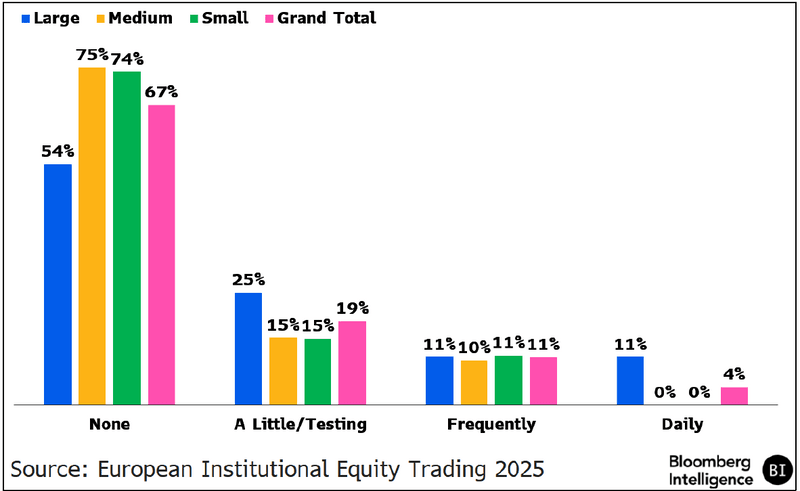

AI is beginning to gain ground in investment analysis, with adoption on par with operational efficiency, as 51% of buyside firms report some level of use. Compared with other functions, the split across firm sizes is more balanced, though large firms show slightly lower uptake overall. Around a third of traders report testing AI for investment analysis, with 13% being frequent users. Daily adoption remains rare, indicating that while European buyside firms are starting to incorporate AI, the transition is still gradual and exploratory for most. Large firms lead the way in using AI for operational efficiency, with 38% actively testing, 14% using it frequently and 10% applying them daily. Small firms show the highest rate of frequent use of AI to improve operational efficiency (22%), yet uptake across medium and smaller firms remains uneven. Nearly 60% of these reported no use at all, highlighting a wide gap in adoption across firm sizes.

Large buyside companies appear more open to exploring AI in broker algos, which execute client orders by slicing trades, routing them across venues and managing costs. About 25% are testing such tools, while another 11% report frequent or daily use. That contrasts with smaller peers, where 75% of medium firms and 74% of small ones report no use at all. Adoption overall remains limited, but early trials at larger institutions suggest groundwork is being laid for broader integration. Across all sizes, just 11% report frequent use, underscoring that AI adoption is still in its early stages. This share is likely to rise as technology matures and competition drives faster innovation.

Figure 12: Using AI: Broker Algos

Larger funds use more brokers in algo-wheel rotation

The survey shows no medium-sized institution included more than 10 brokers in its algorithmic trading wheel. Smaller firms clustered in the 0-4 and 5-9 ranges, with 40% of respondents, while 20% reported more than 10. Larger firms showed broader distribution, with 38% in the 5-9 and 10-plus buckets and 25% in 0-4. Larger institutions typically manage higher trading volumes across stocks with varying liquidity, making multiple brokers useful.

Figure 13: Brokers on Wheel by Institution Size

Bloomberg

Source link