Gold and silver have recently dominated headlines, outperforming both Bitcoin and altcoins in the broader crypto market. While both precious metals recorded new all-time highs in 2026, many altcoins failed to reach similar milestones. Bitcoin, by contrast, did achieve an ATH in 2025; however, following that peak, its price retraced sharply to new lows. With this in mind, analysts argue that the strength of gold and silver does not pose a threat to digital assets. Instead, they interpret the divergence as a major bullish signal for Bitcoin and altcoins.

Gold And Silver ATH Signals Bitcoin And Altcoins Upside

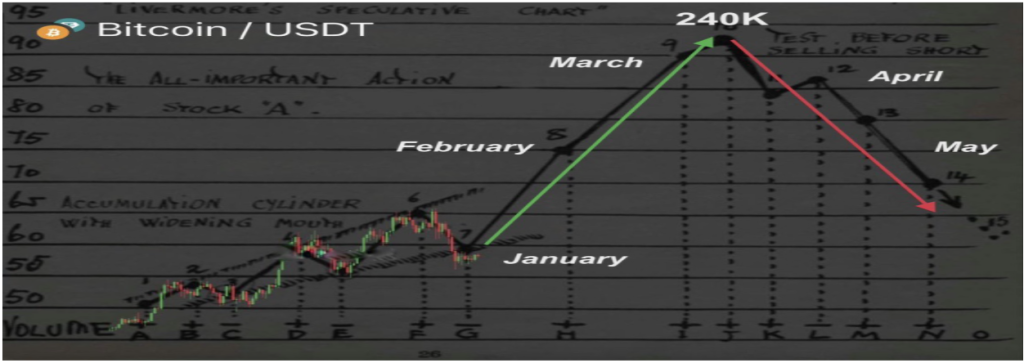

Crypto market expert Mark Chadwick delivered a detailed analysis of precious metals and cryptocurrencies on X this week, pointing to what he calls “the biggest price divergence” ever recorded between gold and Bitcoin. His chart and analysis suggest that a strong performance in gold could be a major indicator for a potential rally in cryptocurrencies.

Related Reading

Chadwick noted that gold has surged aggressively, reaching an ATH of over $5,600 in January 2026. This price rally has pushed the metal into extreme overbought levels on higher timeframes. In contrast, Bitcoin is facing prolonged weakness and negative sentiment in 2026, despite reaching an all-time high above $126,000 in October 2025.

The analyst suggested that this performance imbalance has reached levels that typically signal a major market shift. Gold and silver have been boosted by factors such as central bank accumulation, inflation hedging, and geopolitical pressures. At the same time, Bitcoin has been weighed down by tighter liquidity, reduced investor interest, and risk-off conditions. As a result, traditional safe-haven assets have entered overbought territory, leaving BTC and altcoins largely overlooked.

Chadwick argues that markets move in cycles driven by sentiment and positioning. When one asset becomes excessively overbought, returns diminish, and capital seeks higher upside elsewhere. In past macro cycles, periods of strong performance in gold and silver have often been followed by capital rotating into higher-risk assets once fear subsides.

Based on his analysis, Bitcoin’s current positioning reflects exhaustion rather than structural weakness. Chadwick believes that when manipulation ends and capital starts flowing out of gold and silver into BTC, it could set the stage for a sharp rebound in the leading cryptocurrency. Since altcoins typically follow Bitcoin’s performance, the analyst expects that once Bitcoin regains momentum, some of that profit could also rotate into select altcoins, fueling a price rally.

Related Reading

How High Bitcoin And Altcoins Could Rally

Chadwick has stated that Bitcoin’s price could easily surge 10x as capital flows back into it and market sentiment and liquidity improve. However, the chart outlines a short-term rally, projecting a 91.60% rise to $170,000 from the $82,000 region. The analyst also predicted that altcoins could rise 50-100x, reflecting a staggering potential for gains in the crypto market.

He concluded his analysis by emphasizing that smart money knows massive returns often come from diversification. From this perspective, the current ATHs of gold and silver do not undermine cryptocurrencies but signal an upcoming shift in capital.

Featured image created with Dall.E, chart from Tradingview.com

Sandra White

Source link