NEW YORK (AP) — The U.S. stock market rallied on Monday, at the start of a week with shortened trading because of the Thanksgiving holiday.

The S&P 500 climbed 1.5% for one of its best days since the summer and added to its jump from Friday, finding some strength following a shaky few weeks. The Dow Jones Industrial Average rose 202 points, or 0.4%, and the Nasdaq composite jumped 2.7%.

Stocks got a lift from rising hopes that the Federal Reserve will cut its main interest rate again at its next meeting in December, a move that could boost the economy and investment prices.

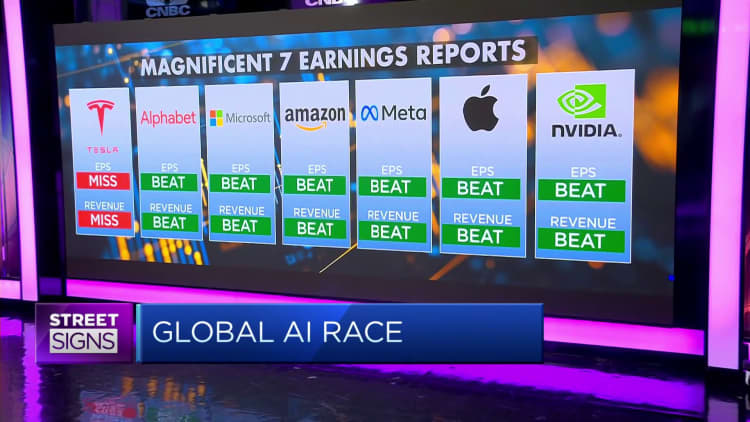

The market also benefited from strength for stocks caught up in the artificial-intelligence frenzy. Alphabet, which has been getting praise for its newest Gemini AI model, rallied 6.3% and was one of the strongest forces lifting the S&P 500. Nvidia rose 2.1%.

Monday’s gains followed sharp swings in recent weeks, not just day to day but also hour to hour, caused by uncertainty about what the Fed will do with interest rates and whether too much money is pouring into AI and creating a bubble. All the worries are creating the biggest test for investors since an April sell-off, when President Donald Trump shocked the world with his “Liberation Day” tariffs.

Despite all the recent fear, the S&P 500 remains within 2.7% of its record set last month.

“It’s reasonable to expect that stocks will experience periods of pressure from time to time, which, historically, is quite healthy for longer-term strength,” Anthony Saglimbene, Ameriprise chief market strategist, wrote in a note to investors.

Several more tests lie ahead this week for the market, which could create more swings, though none loom quite as large as last week’s profit report from Nvidia or the delayed jobs report from the U.S. government for September.

One of the biggest tests will arrive Tuesday, when the U.S. government will deliver data showing how bad inflation was at the wholesale level in September.

Economists expect it to show a 2.6% rise in prices from a year earlier, the same inflation rate as August. A worse-than-expected reading could deter the Fed from cutting its main interest rate in December for a third time this year, because lower rates can worsen inflation. Some Fed officials have already argued against a December cut in part because inflation has stubbornly remained above their 2% target.

Traders are nevertheless betting on a nearly 85% probability that the Fed will cut rates next month, up from 71% on Friday and from less than a coin flip’s chance seen a week ago, according to data from CME Group.

U.S. markets will be closed on Thursday for the Thanksgiving holiday. A day later, it’s on to the rush of Black Friday and Cyber Monday.

On Wall Street, U.S.-listed shares of Danish drugmaker Novo Nordisk fell 5.6% Monday after it reported that its Alzheimer’s drug failed to slow progression of the disease in a trial.

Grindr dropped 12.1% after saying it’s breaking off talks with a couple of investors who had offered to buy the company, which helps its gay users connect with each other. A special committee of the company’s board of directors said it had questions about the financing for the deal by the investors, who collectively own more than 60% of Grindr’s stock.

All told, the S&P 500 rose 102.13 points to 6,705.12. The Dow Jones Industrial Average climbed 202.86 to 46,448.27, and the Nasdaq composite jumped 598.92 to 22,872.01.

Bitcoin, meanwhile, continued it sharp swings. It was sitting around $89,000 after bouncing between $82,000 and $94,000 over the last week. It was near $125,000 last month.

In stock markets abroad, indexes were mixed in Europe and Asia.

Hong Kong’s Hang Seng jumped 2% for one of the world’s biggest moves. It got a boost from a 4.7% leap for Alibaba, which has reported strong demand for its updated Qwen AI app. Alibaba is due to report earnings on Tuesday.

In the bond market, Treasury yields eased a bit. The yield on the 10-year Treasury fell to 4.03% from 4.06% late Friday.

___

AP Business Writers Matt Ott and Elaine Kurtenbach contributed.