One of the hottest movies of the summer is the staggeringly good biopic “Oppenheimer,” about the man who oversaw the frantic race to develop the atomic bomb during World War II.

The atom bomb dropped on Hiroshima, Japan on Aug 6, 1945 was a fission-style device. This also happens to be the same basic physics behind nuclear reactors that are in use today. It’s a reminder that technology can be, at its essence, agnostic: Whether it is used for malevolent or benevolent purposes (in nuclear fission’s instance, an instrument of death or clean, carbon-free electricity) depends upon the intent of the user.

Fission reactors generate about 10% of the world’s electricity today. The United States gets even more of its electricity this way, about a fifth.

These percentages are likely to rise as global demand for electricity — and concerns about global warming and climate change — rise. This will present opportunities for long-term oriented investors. The lion’s share of this demand — about 70%, says the Paris-based International Energy Agency (IEA), will come from India, which the United Nations says is now the world’s most populous country, China, and Southeast Asia. Put another way, “the world’s growing demand for electricity is set to accelerate, adding more than double Japan’s current electricity consumption over the next three years,” says Fatih Birol, the IEA’s executive director.

While fossil fuels remain the dominant source of electricity generation worldwide — the Central Intelligence Agency estimates that it provides about 70% of America’s electricity, 71% of India’s and 62% of China’s, for example—the IEA report says future demand will be met almost exclusively from two sources: renewables and nuclear power. “We are close to a tipping point for power sector emissions,” the IEA says. “Governments now need to enable low-emissions sources to grow even faster and drive down emissions so that the world can ensure secure electricity supplies while reaching climate goals.”

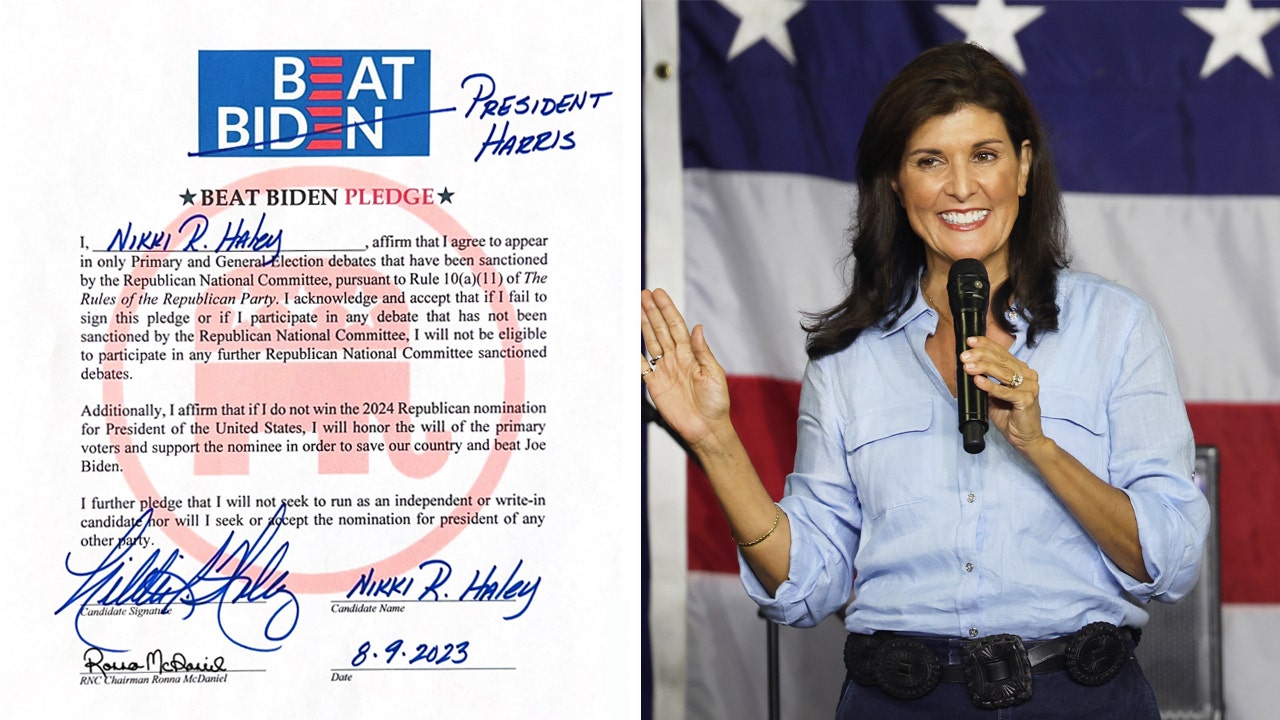

“ The Biden administration is a big booster of nuclear energy. ”

It’s helpful that the Biden administration is a big booster of nuclear energy, which the White House sees as an integral part of its broader effort to move the U.S. economy away from fossil fuels. The Department of Energy says that the country’s 93 reactors generate more than half of America’s carbon-free electricity. But price pressures from wind, solar and natural gas (which the feds call “relatively clean” even though it emits about 60% of coal’s carbon levels) have putseveral reactors out of business in recent years.

The bipartisan infrastructure bill that Biden signed into law in November 2021 includes $6 billion, spread out over several years, for the so-called Civil Nuclear Credit Program, designed to keep reactors — and the high-paying jobs that come with them — running. If a plant were to close, it would “result in an increase in air pollutants because other types of power plants with higher air pollutants typically fill the void left by nuclear facilities,” the administration says. U.S. Energy Secretary Jennifer Granholm has said the Biden administration is “using every tool available” to get the country powered by clean energy by 2035.

The private sector is beginning to stir. Last week, Maryland-based X-Energy said it would build up to 12 reactors in Central Washington state, for Energy Northwest, a public utility. These wouldn’t be the behemoth-type reactors we’re used to seeing, but “advanced small, nuclear reactors.” X-Energy, which is privately held, has also been selected by Dow

DOW,

to construct a similar facility in Texas.

Other companies are also rolling out new technology to meet demand. Nuclear fusion — a breakthrough in that it creates more energy than the Oppenheimer-era fission model and at a lower cost — is likely to be the basis for reactors in the years ahead; the Washington, D.C.-based Fusion Industry Association thinks the first fusion power plant could come online by 2030. After seven rounds of funding, one fusion company, Seattle-based Helion Energy, is currently valued at around $3.6 billion, and appears headed for a public offering.

Here too, the Biden administration is getting involved. In May, the Department of Energy announced $46 million in funding for eight other fusion companies. “We have generated energy by drawing power from the sun above us. Fusion offers the potential to create the power of the sun right here on Earth,” says Granholm.

There are several opportunities here for long-term investors. You can pick your way through any number of publicly held companies, including more traditional utilities, or spread your bet across the industry through a handful of exchange-traded funds. The largest of these is the Global X Uranium Fund

URA,

with about $1.6 billion in assets. It’s up about 9% year-to-date. The VanEck Uranium + Nuclear Energy Fund

NLR,

is up almost 10% and sports a 1.8% dividend yield. These are respectable year-t0-date returns, even though they lag the S&P 500

SPX,

(up close to 19%) by a wide margin.

More: Net-zero by 2050: Will it be costly to decarbonize the global economy?