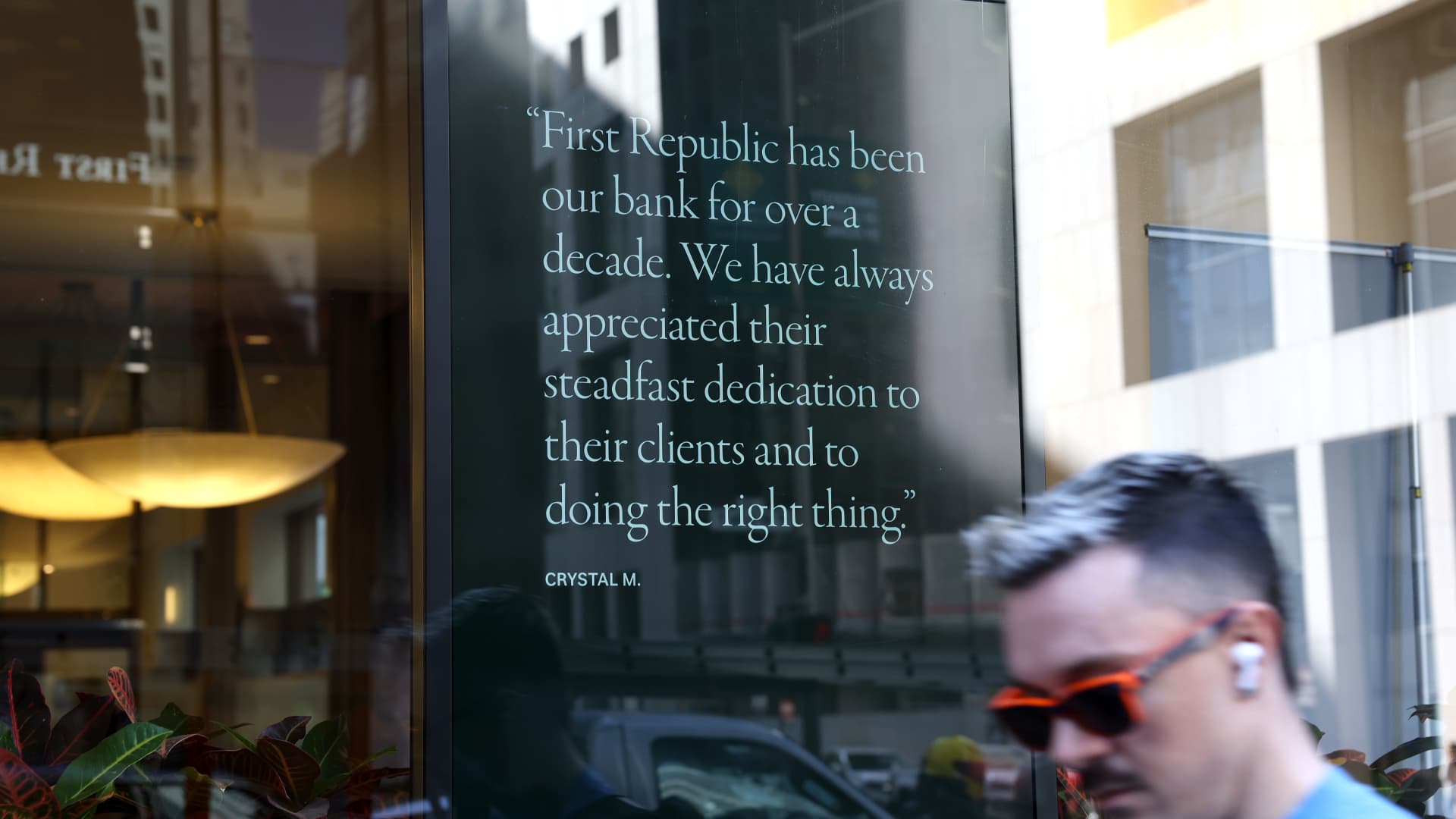

A pedestrian walks by a First Republic bank on April 26, 2023 in San Francisco, California.

Justin Sullivan | Getty Images News | Getty Images

This report is from today’s CNBC Daily Open, our new, international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

Big Tech continues its winning streak, but it wasn’t enough to ignite a broader rally in markets because of fears reignited by First Republic.

What you need to know today

- First Republic Bank has a plan to save itself, CNBC learned from sources. Advisors to First Republic are persuading big U.S. banks to buy bonds from First Republic at above-market prices. Though those big banks will lose money on the purchase, their losses would be much lower than the Federal Deposit Insurance Corp. fees banks would have to pay if First Republic fails.

- Meanwhile, First Republic’s stock continued its freefall. It plummeted 29.75% Wednesday to hit an all-time low of $5.69, giving the bank a market value below $1 billion.

- Meta’s first-quarter revenue rose 3% to $28.65 billion from a year earlier, the first time in three quarters that its sales increased. Adding to the good vibes, the company projected that revenue in the second quarter will come in higher than Wall Street’s expectations.

- It wasn’t uniformly good news for Meta: Net profit fell 24% to $5.71 billion, year on year, dragged down by the company’s Reality Labs unit — its metaverse division — which recorded an operating loss of $3.99 billion. But that wasn’t enough to dampen investors’ optimism: The company’s stock jumped 11.67% in extended trading.

- PRO First-quarter economic growth in the U.S. is likely to hit at least 2% year on year, according to analysts’ projections. Despite that solid number, there are signals that a recession is still coming.

The bottom line

Big Tech continues its winning streak, but it wasn’t enough to ignite a broader rally in markets.

On Wednesday, Microsoft rallied 7.24% on the back of a strong earnings report that was boosted by a jump in revenue from its Intelligent Cloud business segment. The tech company’s stock hit a 52-week high, putting it within a hair’s breadth of $300 per share. Amazon climbed 2.35% as investors hoped the e-commerce giant, which is the market leader in cloud services, would post strong numbers Thursday too.

Still, the tech-heavy Nasdaq Composite finished the day only 0.47% higher. (Meta, which also had an excellent first quarter, posted earnings after markets closed.)

Why didn’t the Nasdaq rise more from Big Tech’s better-than-expected first-quarter results? Probably because tech stocks were already doing so well.

“There was such a rally into their earnings season that I think you needed earnings to really clear a high bar to actually catalyze another leg higher,” said Ross Mayfield, investment strategy analyst at Baird. “That just hasn’t been the case, especially when you have other headwinds pressing down on the market.”

Indeed, fears around First Republic induced losses in other major indexes. The Dow Jones Industrial Average lost 0.68% and the S&P slipped 0.38%.

Banks might not be as exciting as technology companies. Financial institutions don’t constantly push us into the future, doing things like inventing eerily humanlike programs that chat with us. Instead, banks are doing what they’ve been doing for centuries: accepting deposits from, and loaning money to, people and companies.

But it’s that very function that makes banks so fundamental to the health of the economy. Any sign of weakness in a bank is enough to send waves of fear throughout investors and make them forget, if only temporarily, the promises of Big Tech.

Subscribe here to get this report sent directly to your inbox each morning before markets open.