Each week we identify names that look bearish and may present interesting investing opportunities on the short side.

Using technical analysis of the charts of those stocks, and, when appropriate, recent actions and grades from TheStreet’s Quant Ratings, we zero in on three names.

While we will not be weighing in with fundamental analysis, we hope this piece will give investors interested in stocks on the way down a good starting point to do further homework on the names.

Plug Power Looks Unplugged

Plug Power Inc. (PLUG) recently was downgraded to Sell with a D+ rating by TheStreet’s Quant Ratings.

One of the better fuel cell names of late, Plug Power has fallen sharply on very strong turnover and it appears the downside is not finished. Money flow is weak while moving average convergence divergence (MACD) is on a sell signal.

There is just nothing here to support the stock until the May lows are reached. That level comes in around the $13 area, so a short right here at $18.60 makes a nice objective to the May lows. Put in a stop at $22.50 just in case. If that May low falls we’ll see PLUG make a run to single digits.

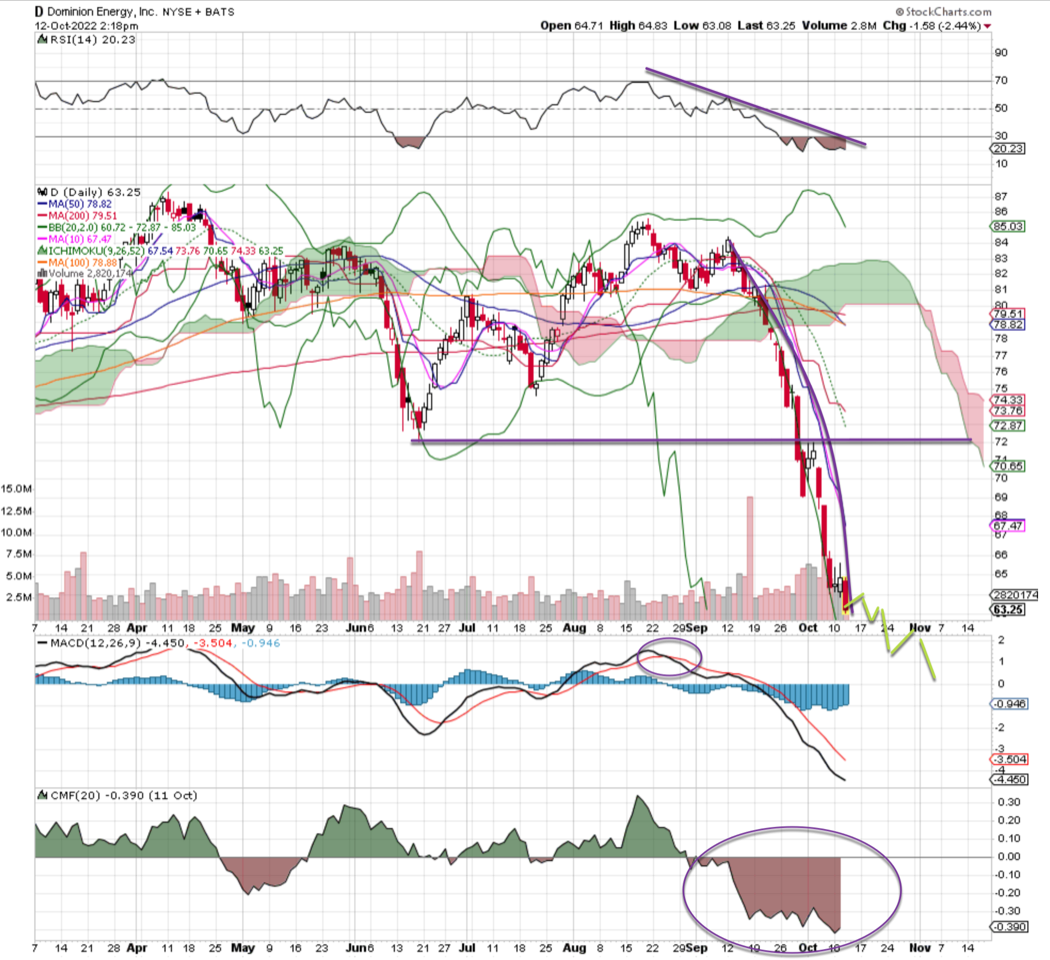

Dominion Energy Runs Out of Juice

Dominion Energy Inc. (D) recently was downgraded to Hold with a C+ rating by TheStreet’s Quant Ratings.

The electricity and natural gas supplier has been falling hard for about a month. The decline started in early September; now the stock is in a major tailspin with no buyers in sight.

The money flow shows the emphatic selling across the board. Relative strength is bending lower at a very steep angle; there seems to be more downside, if you can believe that! Support was knifed through at the $72 level and a waterfall move has happened since. How about a short play here at $63, adding more to the position with a move up to $67 and targeting the $50 level. Put in a stop at $65.

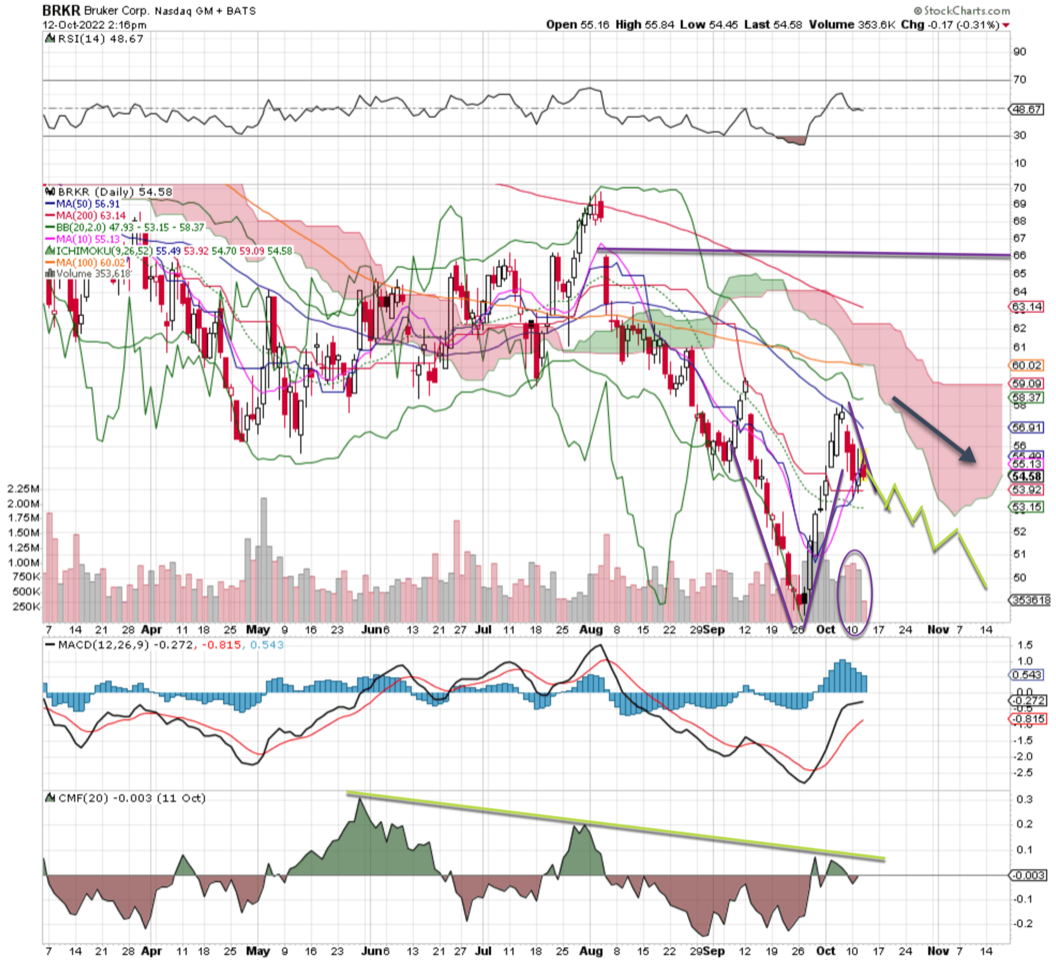

Bruker’s Diagnosis Isn’t Good

Bruker Corp. BRKR recently was downgraded to Hold with a C+ rating by TheStreet’s Quant Ratings.

The maker of scientific instruments and diagnostic tools has a very odd chart formation. We don’t often see these V patterns roll over so quickly, but that is the case here.

Withering money flow and a stall out in relative strength plagues the stock. Volume trends have strengthened and are leaning bearish, and the cloud is red, too — that foretells more downside to come. There is some support here at the apex of the V bottom, but not much more beyond that. Take a short here, put a stop in at $58 and ride this down to $45.

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.