The halting effort to regulate A.I.

For corporate America, the biggest trend to latch onto at the moment is artificial intelligence, stoked by the popularity of ChatGPT. (Among the latest adopters is Instacart, which is building a ChatGPT-powered chatbot into its grocery-shopping app.) But worries about the dangers of widespread A.I. use are growing as well.

There’s one big hitch: Governments — notably Washington — haven’t kept pace with regulations for the technology. That could lead to dire consequences: “By failing to establish such guardrails, policymakers are creating the conditions for a race to the bottom in irresponsible A.I.,” Carly Kind, the director of the Ada Lovelace Institute, a policy research group, told The Times.

Washington has been largely hands off on A.I. rules, even as several lawmakers have pushed to tighten oversight. Representative Ted Lieu, Democrat of California, wrote in a Times Opinion guest essay in January that he was “freaked out” by A.I. tools’ growing ability to mimic humans.

But little has been done, The Times adds: No bill has been proposed to curb A.I.’s potential dangers or to protect individuals, and efforts to restrict facial-recognition applications have failed.

Regulators are stepping into the void:

-

Federal agencies, including the F.T.C., the F.D.A. and the Consumer Financial Protection Bureau, are using laws already on the books to police some types of corporate A.I. use.

-

The European Union appears poised to pass a bill regulating some aspects of A.I., including facial recognition and aspects linked to critical public infrastructure. The legislation would require A.I. companies to conduct risk assessments of their technology — and violators could be fined up to 6 percent of their global revenue.

-

And private companies are also flexing their muscles: Apple has delayed approval of an email app that uses ChatGPT technology to auto-generate text, according to The Wall Street Journal. The tech giant is reportedly worried that the app could generate content inappropriate for children.

Meanwhile, companies are pushing back against potential legislation. Alphabet’s chief, Sundar Pichai, visited Brussels in 2020 to call for “sensible regulation” of A.I. And that same year, scores of tech companies lobbied against facial-recognition rules in the U.S. (“We aren’t anti-regulation, but we’d want smart regulation,” Jordan Crenshaw of the U.S. Chamber of Commerce told The Times.)

Don’t expect Washington to act anytime soon. Representative Don Beyer, Democrat of Virginia, who failed to garner support for a bill requiring audits of A.I., said the issue “doesn’t feel urgent for members.”

Representative Jay Obernolte, a California Republican (and Congress’s only member with a master’s degree in A.I.) added that lawmakers don’t even understand the technology: “You’d be surprised how much time I spend explaining to my colleagues that the chief dangers of A.I. will not come from evil robots with red lasers coming out of their eyes.”

HERE’S WHAT’S HAPPENING

The E.U. is reportedly poised to approve Microsoft’s deal for Activision Blizzard. European merger authorities appear satisfied with the tech giant’s willingness to sign licensing deals with rivals for top titles like “Call of Duty” and are unlikely to demand asset sales, according to Reuters. Regulators in Britain and the U.S. are still scrutinizing the $69 billion takeover.

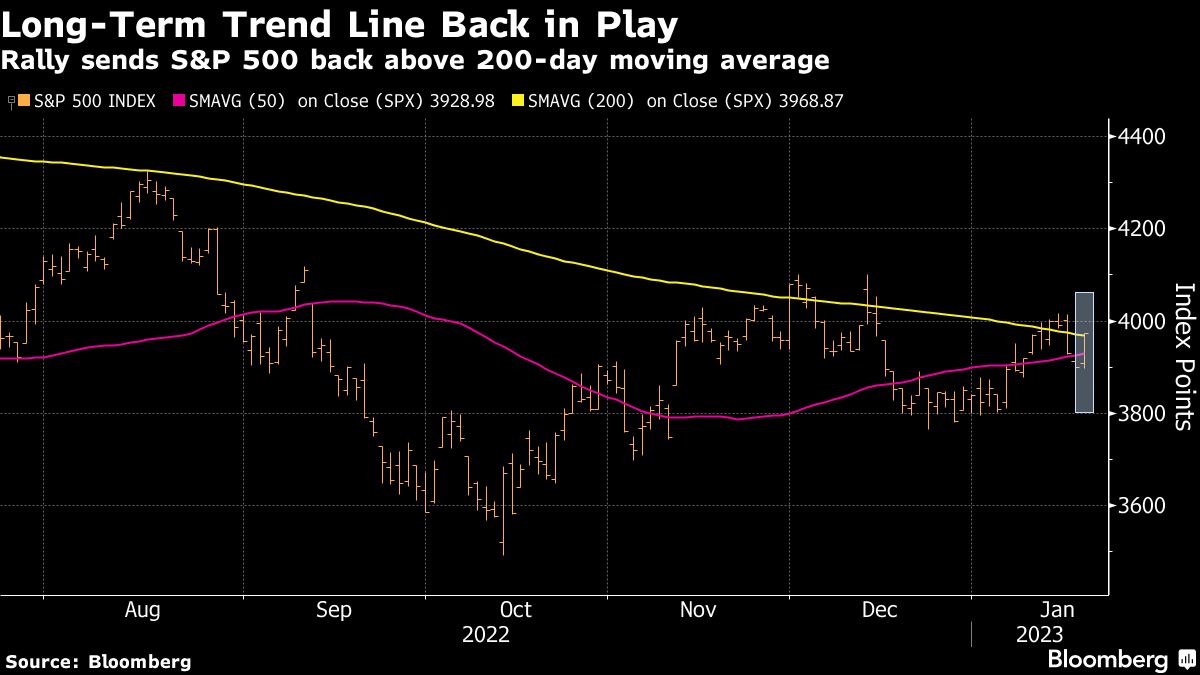

Higher interest rates can’t be ruled out, a Fed official warns. If the upcoming jobs and consumer spending reports come in strong, the central bank may be forced to keep raising borrowing costs, said Christopher Waller, a Fed governor. Investors’ fears about higher rates have added to market volatility in recent weeks.

Howard Schultz won’t testify before the Senate over anti-union efforts. Starbucks has instead offered to send a trio of executives to answer questions about whether the coffee chain violated labor laws. Senator Bernie Sanders, independent of Vermont, has pushed for the company’s C.E.O. to testify at his committee’s hearing.

The F.D.A. reportedly rejected efforts by Elon Musk’s Neuralink to do human tests. The agency cited safety concerns in denying the start-up’s application to begin embedding its chips in the brains of paralyzed and blind patients to help them walk and see, according to Reuters. Some insiders are said to be skeptical that the company will ever win permission to start clinical trials.

The House ethics committee will investigate Representative George Santos. The inquiry into the embattled New York Republican will examine possible violations of rules governing campaign finance and conflicts of interest, as well as an accusation of sexual misconduct raised by a prospective congressional aide. It’s an escalation of bipartisan pressure on Santos, who has faced calls to resign following allegations that he fabricated much of his life story.

What a faltering lender means for crypto

The revelation this week that Silvergate Capital, once the crypto industry’s go-to bank, was in increasingly dire straits prompted a flurry of its top partners to cut ties. But Silvergate’s struggles have broader implications for the crypto world.

Shares in Silvergate fell 57 percent on Thursday after the company disclosed post-market on Wednesday that it couldn’t file its annual report on time and was confronting potential challenges to its ability to “continue as a going concern.”

It’s now increasingly isolated, as crypto companies like Coinbase, Circle and Paxos all said they would stop banking with the firm.

The bank is becoming an example of what regulators have warned about crypto. In January, three major banking authorities — the Fed, the F.D.I.C. and the Office of the Comptroller of the Currency — said that the cryptocurrency business “is highly likely to be inconsistent with safe and sound banking practices.”

Silvergate, which began to falter when FTX collapsed last fall, “led the U.S. agencies to move faster and harder to build firewalls between banks and crypto asset firms, firewalls that will cut off many companies from the payment system and retail customers,” Karen Petrou, co-founder of the Washington think tank Federal Financial Analytics, told DealBook.

Ms. Petrou, who has been tracking Silvergate’s troubles, added that crypto companies will likely struggle to work with traditional finance in the future. (Already, some British lenders have limited customers’ ability to buy cryptocurrency with bank cards.)

Those broader implications have hit the price of cryptocurrencies. Bitcoin is down over 4 percent on Friday, to $22,382, hitting a two-week low.

-

In other news, a bipartisan group of senators demanded information from Binance, the world’s biggest crypto exchange, about its finances and regulatory compliance capabilities amid concerns that the company’s platform suffers from a “hotbed of illegal financial activity.”

“For almost every C.F.O. that I’ve talked to who has had a policy of bringing people back to work, people are doing less than what they’ve been asked. If they’ve said they want to be back three days a week, they’re getting them back two.”

— Dave Stephenson, Airbnb’s chief financial officer and head of employee experience, on the challenge companies continue to face in getting employees back into the office to work.

China’s new guard

The annual meeting of China’s National People’s Congress, the rubber-stamp legislature, kicks off on Sunday and is set to confirm sweeping changes to the ranks of top government officials. Also high on the agenda: a host of new policy announcements and a new economic growth target for 2023.

Who is on the guest list — and who isn’t — reveals much about Chinese leader Xi Jinping’s grand plan to reorient the economy to increase self-sufficiency and assert greater state control of private enterprise, after securing an unprecedented third term in power in October.

Who’s in and who’s out? Out are some prominent internet entrepreneurs who were once regulars — including Pony Ma, the founder of Tencent, China’s most valuable listed company. In their place: executives from the industries Mr. Xi wants to double down on, like semiconductors, electric vehicles, and artificial intelligence (including a chip expert who recently suggested ways to get around punishing U.S. sanctions targeting the sector.)

Mr. Xi’s loyalists are set to assume control of the levers of power. The N.P.C. will also see the appointment of technocrats known mostly for their closeness to Mr. Xi and to the country’s most senior policymakers. Many are local politicians or officials with little overseas experience, stoking worries that they will move to assert greater state control of business and promote international isolation. In recent weeks, Mr. Xi has signaled plans to overhaul the financial sector, and urged more spending to produce domestic technologies to counter western sanctions.

The changes come as the economy faces difficulties. Three years of stringent restrictions under the zero-Covid policy, a crackdown on the tech and property sectors and growing tensions with the West have hammered the economy. Gross domestic product grew 3 percent last year, far off Beijing’s 5.5 percent target. The new target, to be unveiled at the N.P.C., will forecast anywhere from 5 to 5.5 percent growth.

Also worth keeping an eye on: The military budget will be announced against a backdrop of growing tensions over the future of Taiwan.

THE SPEED READ

Deals

Policy

Best of the rest

We’d like your feedback! Please email thoughts and suggestions to [email protected].

Andrew Ross Sorkin, Ravi Mattu, Bernhard Warner, Sarah Kessler, Michael J. de la Merced, Lauren Hirsch and Ephrat Livni

Source link