In his latest remarks, Kraken co-founder Jesse Powell spoke about the current state of the cryptocurrency industry amidst a backdrop of significant regulatory actions.

Powell’s comments came shortly after a settlement between Binance and the U.S. Department of Justice, resulting in a $4.3 billion fine for Binance.

Jesse Powell Critiques Regulatory Landscape

In a recent post on X, Powell expressed his thoughts on the $4.3 billion fine settlement between Binance and the U.S. Department of Justice. Powell noted that this development makes the competitive landscape “feel a bit more fair today.”

“The last 12 months have answered 2 nagging questions from shareholders: 1. How are they going so fast? 2. How are they getting away with it?” Powell wrote. “It’s hard to keep faith while your market share dwindles and the only enforcement that’s happening is against the good guys.”

Powell also expressed concern about the ongoing threats to the crypto industry’s reputation, highlighting the need to “self-police” amidst what he perceives as inconsistent enforcement actions by regulatory bodies.

His comments included references to other major players in the crypto industry, like Coinbase and Ripple, which he described as “easy targets” for the SEC, while more significant offenders, particularly those operating offshore, seem to avoid similar levels of attention.

Kraken Faces New SEC Allegations Amidst Ongoing Regulatory Scrutiny

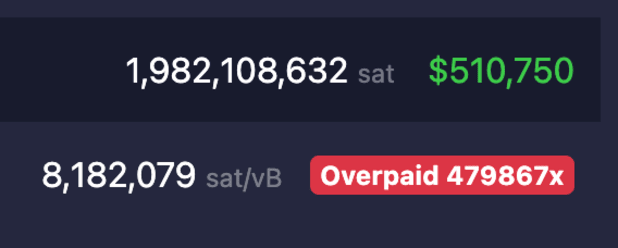

In February, Kraken’s parent companies were charged with failing to register their crypto asset staking-as-a-service program, leading to a $30 million settlement.

On November 21, the SEC filed a new complaint alleging that Kraken operates as an unregistered national securities exchange, broker, and clearing house.

In a separate post, Powell responded to this development, stating, “USA’s top decel is back with another assault on America.” He said, “Message is clear: $30m buys you about 10 months before the SEC comes around to extort you again.”

In a recent blog post, Kraken also contested the SEC’s allegation that its products were investment contracts, calling the claim legally incorrect and factually false. The company argued that the regulatory framework being applied by the SEC is non-existent, thereby creating an unfair and challenging environment for crypto firms operating in the United States.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

Wayne Jones

Source link