The 10-year Treasury bond is on track for a third year of losses in 2023, something that hasn’t happened in 250 years of U.S. history.

In short, it has never happened, say strategists at Bank of America.

The return for investors putting money in that bond

BX:TMUBMUSD10Y

stands at negative 0.3% so far in 2023, after a 17% slump in 2022 and a 3.9% drop in 2021, the bank’s strategists, led by Michael Hartnett, pointed out in a note on Friday.

Here’s a visual on that:

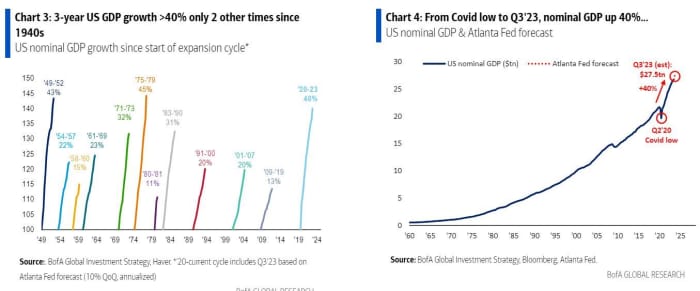

That reflects a “staggering 40% jump in U.S. nominal GDP growth” — factoring in growth and inflation — “since the COVID lows of 2020,” they said, providing this chart:

Bond returns have suffered this year as the Federal Reserve has continued its interest-rate-hiking campaign aimed at getting inflation under control. The “big picture in the 2020s vs. the 2010s is lower stock and bond returns, which we would expect to continue given political, geopolitical, social [and] economic trends,” said Hartnett and the team.

This year has been better for stocks

DJIA

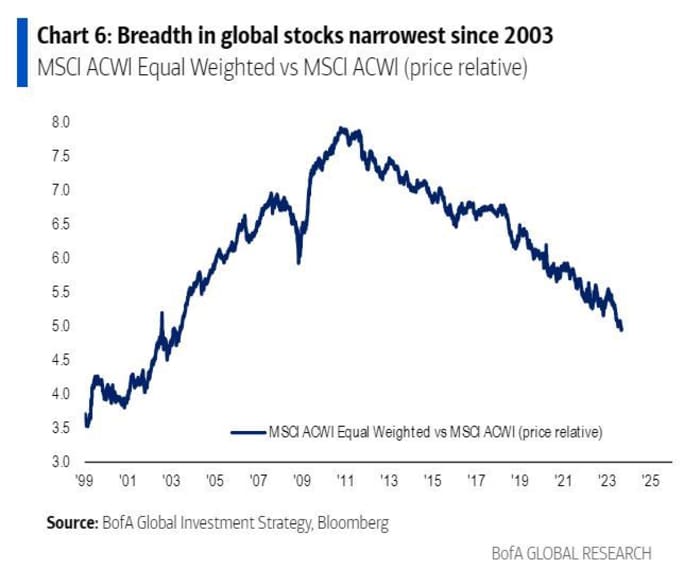

SPX,

but the bounce since COVID pandemic restrictions began to be lifted has been very concentrated in U.S. stocks, especially the technology sector, with breadth in global markets “breathtakingly bad,” the analysts said. Breadth refers to the number of stocks actively participating in a rally.

Breadth is the worst since 2003 for the MSCI ACWI, which captures large- and midcap-stock representation across 23 developed markets and 24 emerging ones.

As for the latest weekly flows into funds, Bank of America reported that $10.3 billion went to stocks, $6.5 billion to cash and $1.7 billion to bonds, with $300 million draining from gold

GC00,

The yield on the 10-year Treasury was holding steady on Friday at 4.102% after data showed the U.S. economy generated 187,000 jobs in August, but the unemployment rate rose to 3.8% from 3.5%, and job gains were revised lower for July and June.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/ANEAVTHFCLH7HWZ7B7TR2O7N7E.jpg)