In the past, opening a savings account required spending hours in huge lines and filling up various documents. But in today’s digital age, banking technologies have made it possible to open Digital Savings Account from the convenience of your home, and with limited documentation work.

Digital Savings Account ensures a paperless, quick, and safe way to open an account. Not just that, account holders can also avail banking services like fast transfers, phone banking, SMS banking, etc. with the help of a Digital Savings Account.

Every account holder, whether a college student or a working adult, benefits from opening a Digital Savings Account. Below are some of the major benefits listed for you:

- More the savings, better the earnings. With a Digital Savings Account, you can get the benefits of a higher interest rate.

- It’s quite a hassle to visit the bank every time, know the status of your funds, and also fill out documents to transfer funds. With this account, you get easy access to your funds, anytime, anywhere.

- This account is completely safe, secure, and easy to use.

- Conveniently track expenses and pay utility monthly bills with ease. Even better, you can set up your online savings account to automatically pay your bills.

- Unlimited free transfers are possible with a Digital Savings Account, including RTGS, NEFT, and card payments.

Also, read about how Digital Savings Account differs from Regular Savings Account.

Step-by-step guide to open a Digital Savings Account

Opening a Digital Savings Account is simple. Here’s a step-by-step guide:

Step 1: Choose the bank you prefer to open your account with. Take time to research the interest rate offered, account fees, additional charges, minimum balance requirement, eligibility criteria, and level of support.

Step 2: Check the bank’s website or mobile application to understand how to easily open an account.

Step 3: Fill in the online form available by giving your exact details, such as name, date of birth, phone number, email ID, etc. By completing the online account opening form found on a bank’s website or mobile banking application, you can start a digital savings account right away.

Remember that the general eligibility requirement to open a digital savings account is that individuals must be above 18 years of age, and has to be an Indian resident. Most banks also provide Digital Savings Accounts to customers who are new to banking or who don’t already have a previously created account.

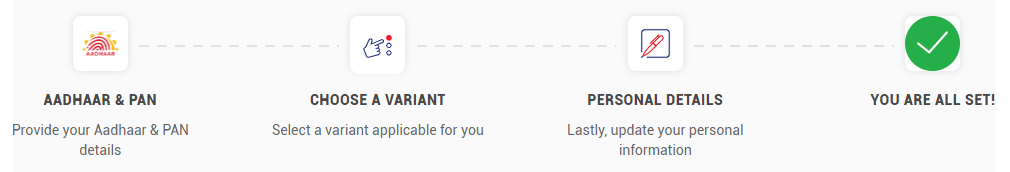

Step 4: Submit the required documents online for bank verification. You only need to submit PAN Card and Aadhaar Card details online. The Aadhaar-based One-Time Password (OTP) authentication mechanism allows banks to open a Digital Savings Account for customers immediately, following RBI regulations. Keep the documents handy before planning to open an account.

Step 5: Complete the KYC (Know Your Customer) process. Banks are required to undertake this procedure before allowing you to register an online account, which includes Video KYC if necessary (To avail additional benefits)

Step 6: After completing the KYC procedure, you will be given the login information for your online bank account. Depending on the bank, this may take a few hours or a few days. Using these credentials, you can then access your Digital Savings Account. It’s that simple.

How to easily open a Digital Savings Account with RBL Bank?

The lengthy process of opening a savings account is no longer necessary. You can access the bank from the comfort of your home with a Digital Savings Account from RBL Bank.

You only need your Aadhaar and PAN numbers to start a Digital Savings Account. There are numerous ways an RBL Bank Digital Savings Account will simplify your life. With the RBL Bank Digital Savings Bank Account, you receive the following:

- No charges on non-maintenance of balances*

- Instant and paperless

- Higher interest rates

- Anytime banking

- Virtual Debit Card

*Just do an SIP or RD for a minimum amount of Rs. 2,000 (Applicable only on Digital Savings Account – Prime)

You can open Digital Savings Account in one of two ways: by visiting our website or by installing the RBL MoBank App. In both cases, you must provide your mobile phone number, your Aadhaar, and your PAN numbers. A virtual debit card that can be used for online payments and purchases, much like physical debit cards, is included with our Digital Savings Account. The usage of this debit card is possible for online shopping, recharges, scan-and-pay at retail locations, and bill payment.

To view any transactions that have taken place in your account, simply log onto RBL MoBank 2.0, whenever you wish. We have strong security measures in place to guarantee the security of your account. Two-factor authentication and other security measures ensure that only you can access your account.

You can bank while you’re on the go, which is yet another significant benefit of having an RBL Bank Digital Savings Account. Pay your utility bills easily while waiting at the airport, in the train, in the car, all while using your RBL MoBank 2.0 mobile banking app.

Go ahead and open an RBL Bank Digital Savings Account right away.

RBL Bank

Source link