(Bloomberg) — China’s Contemporary Amperex Technology Co. Ltd. reported annual earnings that beat estimates on stronger demand for cleaner cars, underscoring its dominance as the world’s biggest maker of batteries for electric vehicles.

Most Read from Bloomberg

The Tesla Inc. supplier on Thursday reported net income for the 12 months ended Dec. 31 of 30.72 billion yuan ($4.4 billion), an increase of 92.9% from the previous year. That beat the median analyst estimate of 28.8 billion yuan, according to data compiled by Bloomberg, and was in line with CATL’s preliminary guidance in January for profit between 29.1 billion yuan to 31.5 billion yuan.

Revenue came in at 328.6 billion yuan, up 152% and in line with analysts’ forecasts. CATL’s core power battery business, which in 2021 accounted for the majority of the company’s sales, generated margins of 17.2%, matching market estimates. Shares in CATL surged as much as 3.3% Friday despite a broader EV rout sparked by a round of steep price cuts that have stirred worries about overcapacity.

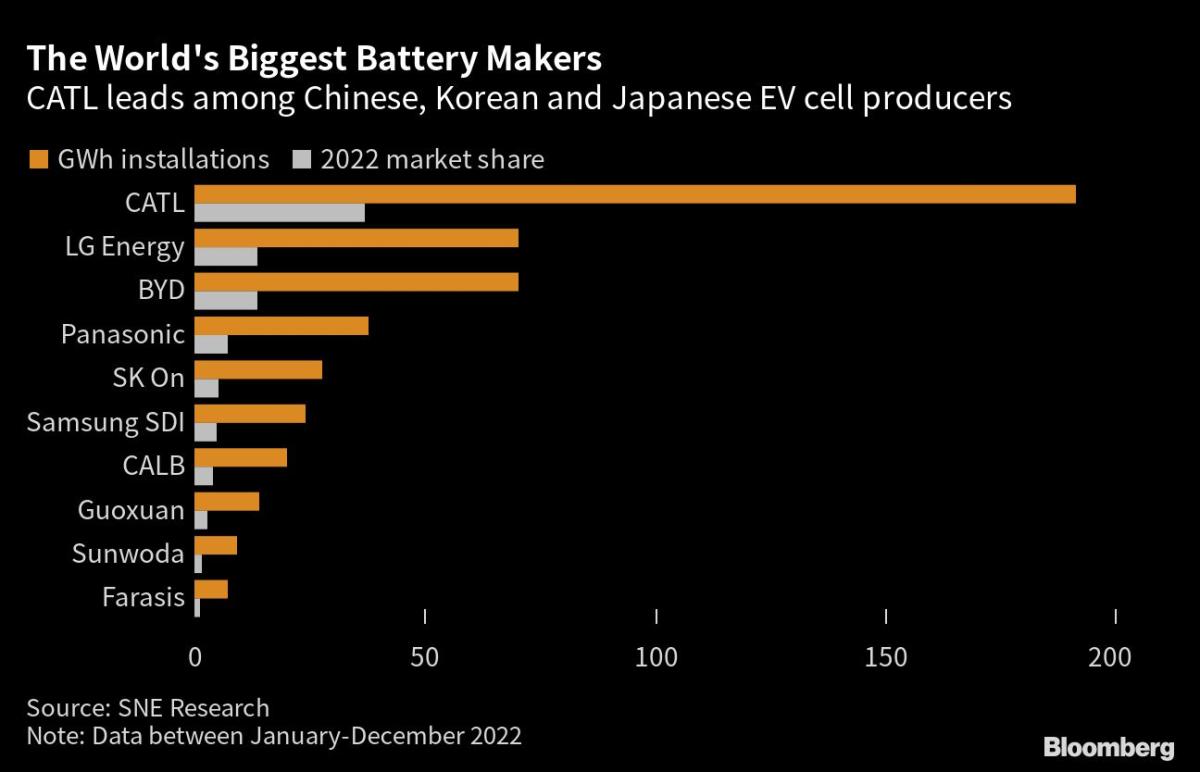

CATL commanded a 37% share of the global market for EV batteries in 2022, testimony to the popularity of its cheaper-to-produce lithium-iron-phosphate (LFP) batteries. In joint second place, with 13.6% each, are South Korea’s LG Energy Solution Ltd. and China’s BYD Co., the Warren Buffett-backed company that also makes cars, according to SNE Research data.

The size and dominance of CATL — which recently sealed a deal to build a plant with Ford Motor Co. in the US — has caught the attention of Chinese President Xi Jinping, who in rare remarks offered at annual parliamentary meetings in Beijing earlier this week said he viewed its leading position with “joy and worry.”

Read more: Ford’s Path to China Deal: A Surprise Biden Boost, Pelosi Furor

CATL also reported a strong performance in its fast-growing energy storage segment, which generated revenue of 45 billion yuan, ahead of expectations. That’s an area of the business that billionaire Chairman Zeng Yuqun is taking a keener interest in, recently calling for stricter standards — a move that could benefit his firm at the expense of smaller rivals.

Read more: CATL Chairman Urges Beijing to Review Energy Storage Standards

Based in Ningde, Fujian province, CATL is facing intensifying competition in the battery space. Those dynamics are in part being spurred by CATL itself, which reportedly has been offering discounts to some Chinese carmakers against the backdrop of tumbling prices for raw materials like lithium, where it has direct investments.

In comments to investors Friday, the battery maker clarified that recent rebates to some carmakers were aimed at sharing lithium mineral resources with long-term strategic clients.

What Bloomberg Intelligence says:

CATL’s battery profitability can recover further in 2023 on falling materials costs and greater economies of scale. We expect CATL’s battery sales volume to surge another 40-50% after more than doubling last year, fueled by robust demand from EVs as China extends a zero-purchase tax after ending Covid-Zero.

– Steve Man and Joanna Chen, BI auto analysts

Click here for the research

Citibank analysts led by Jack Shang, which maintains a buy rating on the stock, said CATL believed its competitive advantage versus peers were widening in comments during a post-earnings investor call. “We prefer battery leader CATL with strong pricing power and access to overseas customers,” said Shang in a note Friday.

Read more: China to Scrutinize Ford-CATL Deal to Ensure Top Tech Not Shared

Jefferies Financial Group Inc.’s Johnson Wan, which downgraded CATL, remained unimpressed with its battery business margins, and foresaw pressure ahead, he said in a note Friday.

Being the industry behemoth means CATL is particularly exposed to geopolitical risk, especially with the US seeking to limit reliance on Chinese companies in the EV supply chain and encouraging automakers to manufacture in North America.

Read more: Why Biden’s Green Subsidies Have US Allies Fuming: QuickTake

CATL’s recent agreement with Ford to license its LFP battery technology for use in a new $3.5 billion EV battery plant that Ford will run and control in southwest Michigan has drawn scrutiny from Beijing, people familiar with the matter have told Bloomberg News, with officials concerned that competitive aspects of CATL’s technology could be given to or accessed by the American automaker.

Meanwhile, CATL is on a global expansion push, with 13 production bases around the world including in Germany and Hungary, according to its website, and five R&D centers. It’s mulling a Swiss GDR fundraise of up to $6 billion to fuel its many capital investments.

(Updates with comments to investors in 8th paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.