P_Wei

Owens & Minor’s (NYSE:OMI) shares are trading largely flat on Thursday after yesterday’s rout where the stock slumped -34.97% after the company cut its FY earnings outlook.

Citi today downgraded OMI to Neutral/High Risk and reduced its price target to $18 from $52, to reflect increased risks and lack of management clarity.

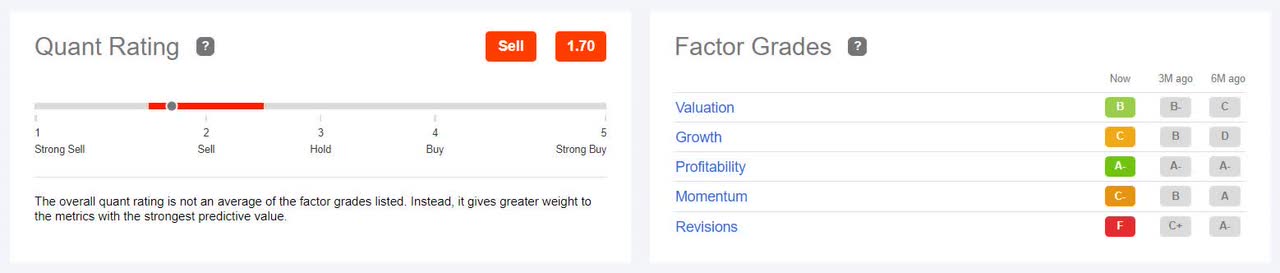

The SA Quant Rating on OMI shares is Sell, which takes into account factors such as Momentum, Profitability, and Valuation among others. OMI has an A- factor grade for Profitability but C for Growth. The average Wall Street Analysts’ Rating differs with a Buy rating, wherein 3 out of 6 analysts see the stock as Strong Buy. YTD, OMI shares have fallen ~66%. See chart here.

Citi analyst Daniel Grosslight noted that while the firm saw the ~35% sell-off as punitive, as OMI only reduced FY22 EBITDA/adj EPS by 10%/15% at midpoint, it believes the reaction was not totally unwarranted.

The company cuts its FY22 non-GAAP EPS outlook and now expects it to be in the range of $2.50 to $2.60 (prior forecast of $2.85 to $3.15) versus consensus now of $2.53. FY adjusted EBITDA expected to be between $527M and $537M, from the prior range of $570M-$610M.

The analyst noted that there was a lack of clarity in the press release and in the firm’s follow-up with management on the main causes of the outlook reduction and measures to rectify.

Adding to the lack of clarity is a reporting structure which obscure core distribution versus manufacturing pressure and limited quantification of PPE headwinds (management had noted PPE pricing has come down as expected), the analyst added.

Grosslight also indicated that if Owens & Minor’s LTM adj. EBITDA falls below ~$550M, they may begin to trip their debt covenants.

Among the known items, the analyst said that health systems have cut back on supply spending due to lower utilization and higher inflation. The company’s management had expected utilization to come back in Q4, but it did not materialized, and thus they failed to react speedily to these headwinds.

Among the unknown items Grosslight noted that the firm has very less clarity as from where the pressure is coming, PPE verus non-PPE products. The company’s management indicated that the reduction was broad-based. But, given the company tends to be over-indexed to PPE, the firm thinks that much of the outlook cut is because of lack of PPE demand.