Shares of Mullen Automotive Inc. rocketed on massive volume for a second-straight day, after the electric vehicle maker announced plans to buy back a chunk of its shares.

The company

MULN,

said it believes its stock is “significantly undervalued,” given its current cash position of about $235 million. Therefore, the board of directors have authorized the repurchase of up to $25 million worth of its outstanding shares through the end of this year.

The buyback amount represents 17.1% of Mullen’s current market capitalization of about $145.8 million.

“We are initiating this buyback program as an attractive opportunity to deploy capital and return value to our shareholders,” said Chief Executive Officer David Michery.

The stock soared as much as 88.2% intraday, before paring gains to be up 32.8% in afternoon trading. Trading volume swelled to an already record 1.78 billion shares, compared with the full-day average over the past 30 days of about 205.0 million shares.

On Wednesday, the stock blasted 69.4% higher, the biggest one-day gain since it ran up 145.6% on Feb. 28, 2022, on then-record volume of 1.39 billion shares. That followed the company’s announcement that it retained a law firm to combat illegal naked short selling.

FactSet, MarketWatch

A short sale is a way for investors to bet that prices will fall. The short seller must pay to borrow stock owned by another investor so they can sell it with the hope of buying the stock back at a lower price. If the investor who originally owned the stock sells their stock, the borrower must cover their short so they can return the stock.

“Naked” short selling refers to the illegal act of shorting a stock without borrowing it first. While that is often blamed for what companies believe are unwarranted declines in their stock, market structure experts have often refuted those claims.

Read: Short sellers are not evil, but they are misunderstood.

Before the stock’s two-day bounce, it had closed Monday at a record low of 10.1 cents, even after the company reported last week that it recorded revenue for the first time, and that it received additional financing that put it in the “best financial position” in its history.

Mullen had said on Wednesday that it “believes it may have been” targeted by naked short sellers, and therefore decided to investigate any “potential wrongdoing.”

FactSet, MarketWatch

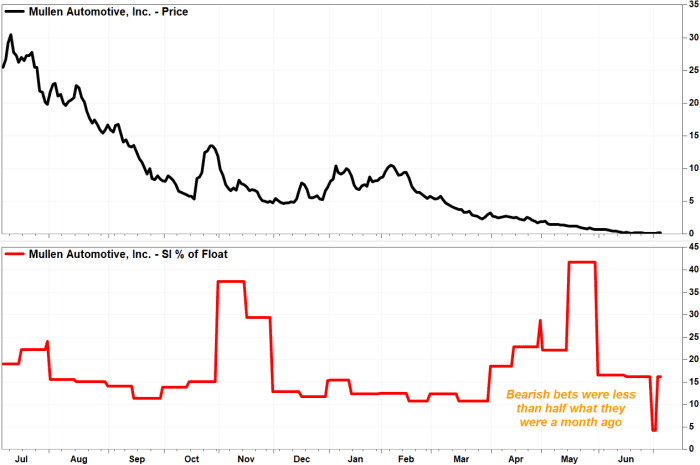

The latest exchange data showed that the percent of Mullen’s public float, or shares freely available to trade, that have been shorted was 16.2%, according to FactSet data. That’s less than half what the percentage was a month ago.

In comparison, fellow “meme” stock AMC Entertainment Holdings Inc.

AMC,

has 23.6% of its float shorted and 20.8% of GameStop Corp.’s

GME,

float is shorted.