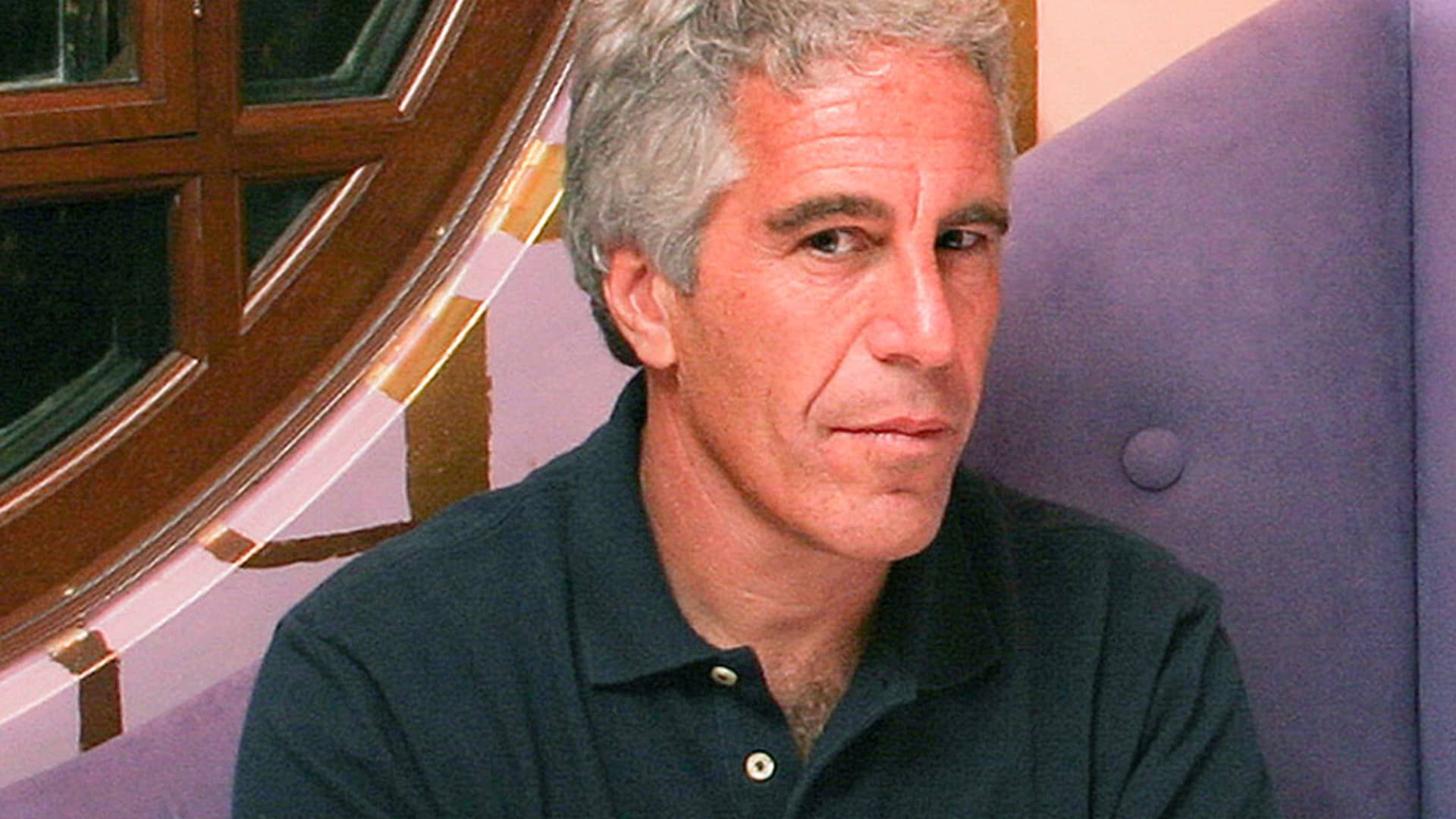

Jeffrey Epstein in Cambridge, MA in 1984.

Rick Friedman | Corbis News | Getty Images

JPMorgan Chase has racked up nearly $14 million in legal fees defending itself against two lawsuits alleging it abetted the sex trafficking by its longtime customer Jeffrey Epstein, according to lawyers for a former top executive who says he is being scapegoated by the huge bank.

Attorneys for former JPMorgan executive Jes Staley revealed the fee total in a filing late Wednesday in U.S. District Court in Manhattan.

Staley’s filing was later removed from public view on the court docket.

On Thursday, his lawyers filed a new version of the document that redacted the reference to the bank’s legal fees.

The filing challenges JPMorgan’s use of three financial experts to support its legal claims that Staley, a former friend of Epstein, should be responsible for paying the bank hundreds of millions of dollars to cover costs related to the lawsuits.

Staley’s lawyers did not immediately reply to a request for comment.

JP Morgan spokeswoman Patricia Wexler declined to comment on the bank’s purported legal costs from the suit.

But in a statement to CNBC, Wexler noted, “Both plaintiffs have accused Jes of unspeakable acts that had nothing to do with his job or responsibilities at our firm.”

“Indeed, Jane Doe herself has directly accused him of horrific sexual misconduct. If these allegations are true, he must be held accountable,” said Wexler, using the pseudonym for the plaintiff in one of the suits.

JPMorgan was sued last year by “Doe” in a would-be class action case on behalf of herself and other young women who were trafficked by the late money manager Epstein.

The bank separately was sued by the government of the U.S. Virgin Islands, where Epstein had maintained a residence on a private island, where he sexually abused women.

Both suits claim that the bank facilitated and profited Epstein’s trafficking of women when he was a customer from 1998 through 2013.

A lawyer for the Virgin Islands during a court hearing this month said that after Epstein killed himself in 2019, JPMorgan notified the Treasury Department of more than $1 billion in transactions related to “human trafficking” by Epstein dating back 16 years.

JPMorgan in July agreed to pay $290 million to victims of Epstein to settle the first lawsuit.

But the bank, which denies any wrongdoing is continuing to fight the suit by the Virgin Islands. That case is set to begin trial in late October.

Source: Court filings by attorneys for former JPMorgan executive Jes Staley

In March, JPMorgan sued Staley, its former chief of investment banking, alleging that he is legally responsible for “the entire amount” of any damages it incurs from both lawsuits. The bank also is seeking to claw back more than $80 million in compensation it paid Staley over the years.

Staley, 66, is opposing the bank’s claim. He also has denied an allegation Doe that he sexually assaulted her.

In their filing Wednesday, Staley’s lawyers wrote, “The one constant in these related cases has been JPMorgan’s attempt to pin the entirety of its problems with Jeffrey Epstein on its former executive Jes Staley.”

“Consistent with this theme, the three experts whom the bank has retained to support its third-party claims against Mr. Staley are focused on a single question: How much should Mr. Staley have to pay?” the filing said.

One expert, the accountant Edith Wong, has said JPMorgan’s $290 settlement was “reasonable,” the filing said.

And “Shelley Chapman, a retired bankruptcy judge, opines that JPMorgan’s $13.8 million in legal fees in the Jane Doe and USVI cases was ‘reasonable,’ ” according to Staley’s filing.

The third expert, an accountant named Carlyn Irwin, added up how much Staley earned at JPMorgan to assess how much might be clawed back by the bank if it wins its suit against Staley.

Staley’s lawyers wrote that “none of these experts’ opinions meets” a standard for the admissibility of expert opinions in federal court.

JPMorgan is being represented by attorneys from the law firm Wilmer Hale, including partner Felicia Ellsworth, who in 2020 co-edited an updated legal guide on human trafficking for attorneys “to represent victims and continue to make a difference.”

The firm’s website includes a statement on “modern slavery,” declaring, “We do not tolerate slavery, human trafficking or abusive or unfair treatment in any part of our business or in any part of our supply chain.”

Epstein, a former friend of Donald Trump and Bill Clinton, killed himself in a New York jail at age 66 in August 2019, a month after he was arrested on federal child sex trafficking charges.