The hurdles facing Germany’s economy in recent years have been plentiful, but the “sick man of Europe,” label is unfair, say Deutsche Bank strategists, who see promise for investors in the region’s biggest economy.

Contrary to the rest of the eurozone, Germany has only managed to get back to its pre-COVID growth level, yet a title of “sore athlete” is more accurate, say Maximilian Uleer, head of European equity and cross asset strategy and Carolin Raab, European equity and cross asset strategists, in a note to clients that published Friday.

“Germany has been facing multiple challenges, from rising energy costs, its high manufacturing exposure, to weak demand from its export destinations. Some of the challenges are ‘homemade’ and might persist, while others could start to unwind and soon turn into opportunities,” the pair said.

Germany’s economy is the worst-performing of the developed world this year, with both the International Monetary Fund and European Union forecasting contractions in growth.

Read: Germany’s economy struggles with an energy shock that’s exposing longtime flaws

But the strategists say economic growth is a poor proxy for German equity performance. The German DAX index

DX:DAX

is up 18% since the end of 2019. DAX constituents generate just 18% of their revenues domestically, compared to 22% from the U.S. and 15% from China.

Across the broader HDAX index of 100 members, manufacturing, information technology and financial services are the main contributors to equity performance. That’s as public services, trade, business services and real estate, all of which contributed significantly to GDP over the past four years, are underrepresented in the indexes.

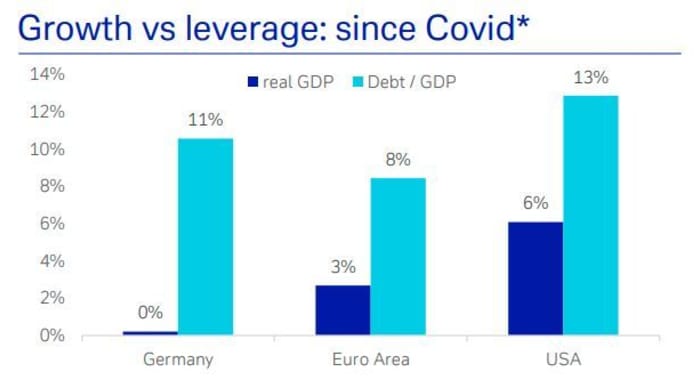

Germany has also managed to grow its real GDP by 26% over the past 20 years , and keep its debt-to-GDP ratio stable, while the eurozone (including Germany) has seen that debt ratio climb 30% since 2003. The short term has seen lower growth since COVID-19, and rising leverage owing to fiscal support measures to mitigate the pandemic and the war in Ukraine.

Again, the strategists see a silver lining. “Going forward, in our view, Germany has bigger leeway with regards to its fiscal support capacity, as its absolute debt/GDP ratio remains one of the lowest among the eurozone members,” said Uleer and Raab.

*Since 2003: Q3 2003-Q2 2023 / since Covid: Q4 2019-Q2 2023. Source: Bloomberg Finance LP, Deutsche Bank Research 09/20/2023

Among the country’s big hurdles is rising energy costs, with the pair noting that the country’s net-zero goals are laudable, but pose a “substantial challenge” to its energy-intensive industries. Power prices remain substantially higher than three years ago and are double the cost of those in the U.S.

Also read: Inside Germany’s industrial-sized effort to wean itself off Putin and Russian natural gas

“This price differential, combined with stronger fiscal support for energy-intensive companies in the U.S. via the Inflation Reduction Act, weigh on the competitiveness of German corporates,” said the strategists.

As for opportunities, China’s reopening remains a positive for DAX companies, though that country also seems to be making slow progress. Chinese households are sitting on massive savings still waiting to be spent, said the strategists. They advise investors to wait for data that confirms a stabilization of the country’s bumpy property market before they would turn more positive.

Overall, Deutsche Bank expects inflation to normalize in the coming 12 months and low growth in 2024, but a rebound in 2025.

Plus: A 1-liter stein of beer at Munich’s famed Oktoberfest will cost nearly $15 this year

And what’s priced into the DAX already? Even after a gain of 12% this year so far — French

FR:PX1

and Greek stocks

GR:GD

— are beating Germany by a respective 20% and 30% — the index is still cheap and trading at a 20% discount to its 10-year average on a forward one-year price/earnings basis. Germany can count on stronger U.S. data, even if Europe continues on a weak path.

“We expect the DAX to hold up in 2024, and do not forecast the index to underperform, despite lower German GDP growth as compared with the rest of the eurozone,” they said.