Depending on how many people there are in your family, how much money you make, and other variables, a good emergency fund could be as small as $1,000 to $20,000 or more.

While it would be convenient if everyone could follow the 50/20/30 rule, putting 20% of your paycheck into a savings account isn’t always possible. The information below will provide a few ways to think about your emergency fund and how much you should have to stay afloat in case of a crisis.

1. Start by saving $1,000

While $1,000 is still a big number, it’s achievable. For example, you can reach this goal in less than a year if you manage to stash away $100 per month. And, by then, one surprise bill may not be able to throw your whole budget off track.

There are multiple options to reach this $1,000. For example, you could move $25 from your checking account to your emergency fund each week. By doing so, you’ll “pay yourself first” – and remove one major psychological roadblock to saving.

If you have a Chime Checking Account and Chime Savings Account*, you can turn on Round Ups to work on your savings. Round Ups transfer money from your checking account to your savings account every time you make a purchase or pay a bill with your Chime Visa® Debit Card. The transaction is rounded up to the next dollar and the difference is moved to your Chime Savings Account automatically.² It might not sound like much, but these small deposits add up over time.

Lastly, you can set up an automatic transfer so that a percentage of your paycheck deposits into your savings account each time you get paid. Turn on Save When I Get Paid in your Chime settings to automatically transfer 10% of deposits totaling $500 or more into your Savings Account.

2. Set aside several months’ worth of living expenses

Having several months of your expenses covered by an emergency fund can cushion you and your family in case of a job loss or another big financial hit. Having more savings lets you feel secure and provides breathing room to find another job.

Having the time to look for a job that will pay enough and provide you with the benefits you need will be better long-term than simply taking the first opportunity that comes along.

Chime tip: Don’t keep your emergency fund in your checking or investment accounts. Because you may need to access it quickly, keep it in a high-yield savings account or a money market account.

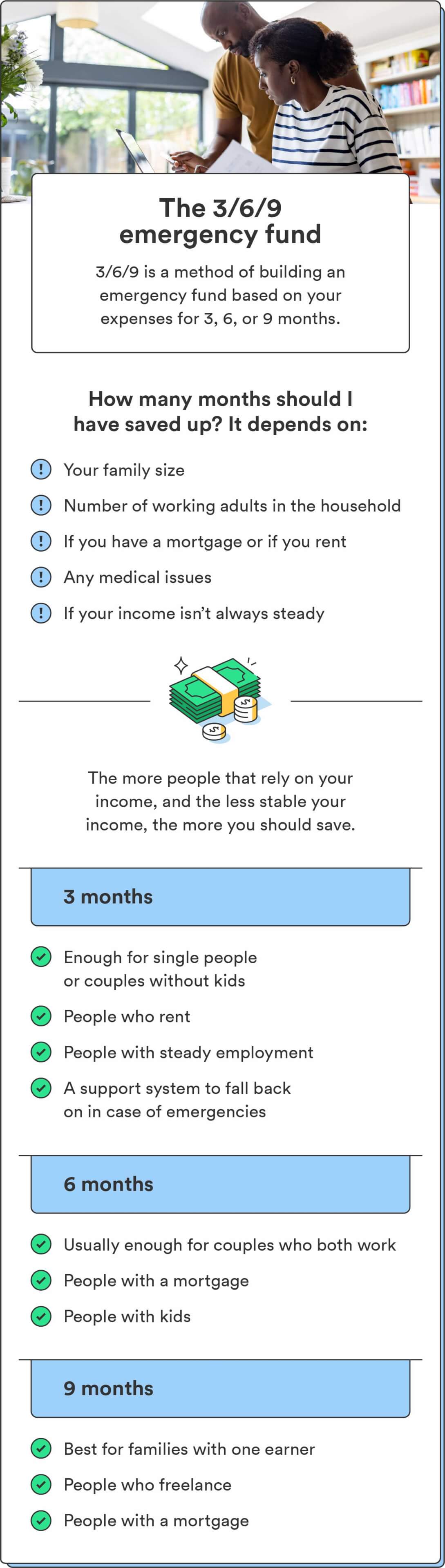

3. Use the 3/6/9 rule

The answer to the question of how much you should save each month can be tricky, but if you use the 3/6/9 rule, you’ll have a better idea of how much you should have stashed away for an emergency.

The 3/6/9 rule provides a basic breakdown of who should have three months of expenses saved up, who should have six, and who should have nine. It comes down to how much risk you and your family have of not having money to get by.

- Three months: For a single person or married couple with no kids and no dependents (and for those who would be able to move in with family members if needed), three months of savings is usually good enough to help them through a tough patch.

- Six months: For committed couples who are both working steadily with a mortgage and kids, six months of savings should provide enough for your family to get through a job loss, medical emergency, or another expensive, unplanned occurrence.

- Nine months: When you’re the sole earner in your family, or you have irregular income (like from freelancing), nine months of expenses will help sustain your household between jobs or in case of an emergency.

4. Use Chime’s emergency fund calculator

Chime’s emergency fund calculator was designed to make the process of figuring out what your emergency fund should look like as simple as possible.

Enter your monthly expenses, how much you’re already saving each month, and how much you have in savings to see how long it could take you to reach your goal.

ahampton

Source link