An economist who delivered a prescient warning about the health of the U.S. banking system earlier this year is now saying a long-awaited U.S. recession could finally arrive in the months ahead.

Steve Blitz, chief U.S. economist at TS Lombard, said in a research note shared with MarketWatch on Wednesday that “…the recession view remains very much intact” as banks rein in lending while companies’ profits appear to have weakened once again during the second quarter ending in June.

Both are signs that the U.S. economy is slowing, and the stock market’s “daydream”, which has helped to propel the S&P 500 index

SPX,

nearly 14% higher so far this year according to FactSet data, might soon come to an abrupt end.

The pace of lending growth at small and large U.S. banks has slowed to almost nothing, according to TS Lombard’s analysis of Federal Reserve data on bank lending released weekly. It is the latest milestone in a trend that has persisted for most of this year, and even longer for large banks, the data show.

TS LOMBARD

Meanwhile, the U.S. Treasury’s plan to issue a flood of T-bills to replenish its coffers now that the federal debt ceiling has been raised could divert even more money away from markets and the economy.

See: The debt-ceiling deal may spark a new worry: Who will buy the deluge of Treasury bills?

Treasury has already started the process, and it is expected to issue $1 trillion in bills before the end of August, according to an estimate from BofA Global strategists. T-bills are Treasury bonds with maturities between four and 52 weeks.

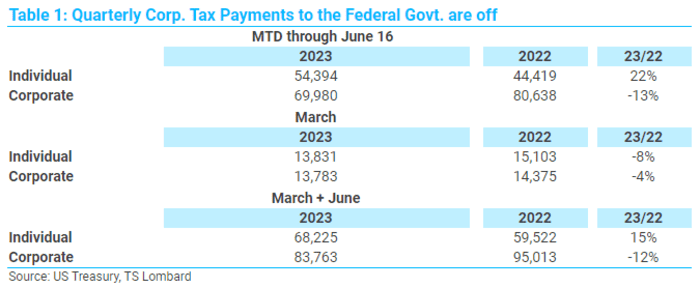

Finally, signs of slowing corporate earnings growth could push the economy over the edge. Even as Wall Street analysts have been raising their expectations for corporate profits, a slowdown in quarterly tax payments suggests that earnings have actually continued to sag in 2023. This comes after profits for S&P 500 firms previously shrank on a year-over-year basis during the first quarter of 2023 and fourth quarter of 2022, according to FactSet data.

U.S. Treasury Department data show corporate tax receipts are down 12% year-to-date through June 16, according to a TS Lombard analysis.

Lower tax payments means lower profits, Blitz said. And weaker profits will likely lead to more layoffs and a slowdown in wage growth, which could compound the impact from slowing credit creation and the flurry of T-bill issuance.

“Lower corporate earnings are a key indicator pointing to lower personal income and employment sooner rather than later. Aiding and abetting this process is the pace of lending slowing to a crawl – and then Treasury pulling 9% of GDP, annualized, out of the economy in the current quarter,” Blitz said.

TS LOMBARD

Hopes that the U.S. economy might avoid a recession have helped to lift stocks this year and investors are clinging to signs signs that the U.S. economy, particularly the labor market and the housing market, remains robust.

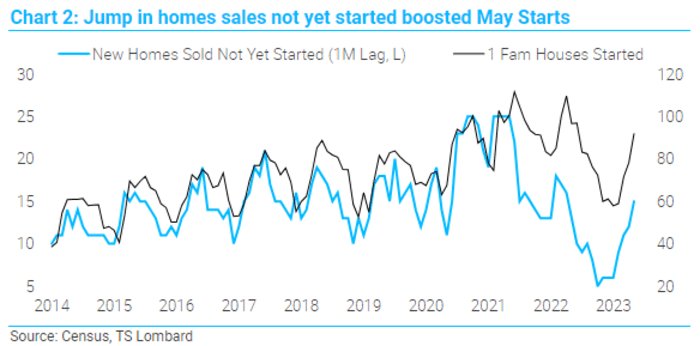

Blitz addressed some of these concerns, saying that corporate profits will lead to lower employment, while dismissing a surge in housing starts last month as a one-time “outlier.”

According to Commerce Department data released Tuesday, the closely watched measure of U.S. home-building rose 21.7% in May to a seasonally adjusted annual rate of 1.631 million, blowing away economists’ expectations for a modest decline.

“Housing is critical in getting to a recession, only 2001 saw a recession without a major contraction in home construction. It is possible for this to occur again, given the expected mildness of the downturn. Still, recessions rarely develop when construction is roaring ahead,” Blitz said.

“To this point, May looks like an outlier rooted in a jump in April homes sold that weren’t yet started,” he added.

TS LOMBARD

Blitz also cited a drop in railcar loadings of lumber and metal products as a sign that a recent uptick in the health of the manufacturing economy is already fading.

And even if the U.S. does manage to delay a recession, the Federal Reserve and markets could face other problems, like a a resurgence of inflation.

“Absent a recession, inflation will reaccelerate later in the year. Not to 8% or so, 5% is more likely,” he said.

A longtime chronicler of the U.S. economy, Blitz noted back in February that small U.S. banks could be vulnerable due to a number of factors, including a paucity of reserves and a mismatch between the duration of their loans and the short-term nature of their deposit obligations.

The asset-liability mismatch in particular became a major problem when Silicon Valley Bank collapsed into federal receivership a few weeks later after a last-ditch attempt to raise funding triggered a devastating bank run.

Wall Street economists had expected a U.S. recession would begin as soon as the first quarter of 2023, but so far, the economy has proven unexpectedly resilient to the Fed’s interest rate hikes, even after the central bank raised borrowing costs by five percentage points since March 2022.