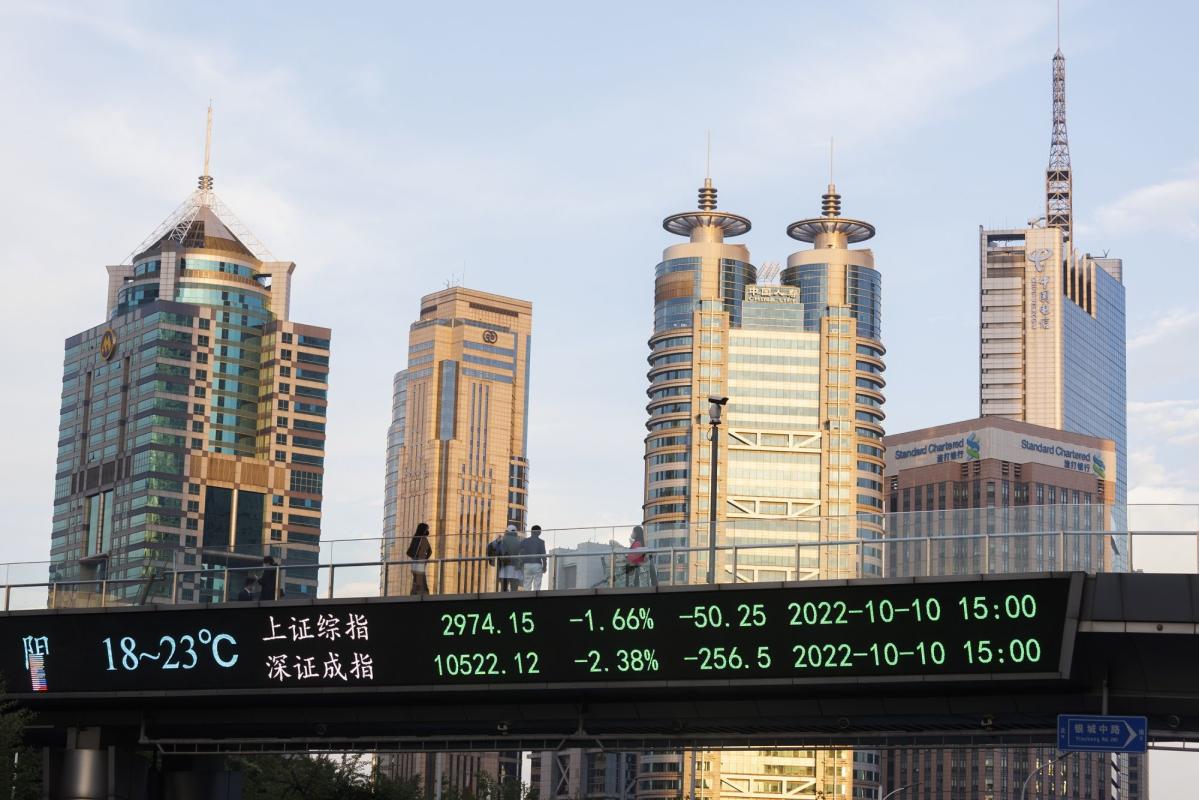

(Bloomberg) — Chinese traders hoping for signs of a shift away from Covid Zero and further support for the ailing property sector were disheartened by President Xi Jinping speech, spurring a decline in stocks.

Most Read from Bloomberg

The benchmark CSI 300 Index slid as much as 0.9% Monday, after anticipations ahead of the twice-a-decade Party Congress contributed to a jump on Friday. A gauge of Chinese equities listed in Hong Kong slumped as much as 2.2%.

Read: Xi Defends Covid Zero Without Showing China Path Out of Pandemic

China stock traders have been looking to the leadership gathering for fresh market impetus after suffering losses that have been among the worst in the world. Xi’s renewed pledge for tech self-reliance offered some reprieve to the sector, but overall, his reiteration of the signature Covid Zero policy and the absence of stimulus signals for the property sector came as a disappointment.

The onshore benchmark is down more than 22% this year as investors grappled with a slowing economy and rising hostility between the US and China. Economists surveyed by Bloomberg predict growth of just 3.3% this year, the second-weakest pace in more than four decades.

Read: Xi Gives Little Reassurance Big China Economic Risks to Ease

“Markets may be disappointed that it appears there is no change in Covid-Zero policy and no clarity on an exit strategy,” said Marvin Chen, analyst at Bloomberg Intelligence. “There was also no signal on the property sector. These two issues are the top concerns for investors and overall the speech was relatively status quo on both of them.”

Information tech and defense stocks were rare bright spots amid Monday’s slump as the sectors garnered strong rhetoric from Xi’s two-hour address. The CSI 300 Information Technology Index gained as much as 1.8%.

Xi vowed to “resolutely win the battle in key core technologies” in his opening speech, suggesting more state support to boost the sector. This follows the Biden administration’s restrictions on the sale of chip-related technology to Chinese customers, striking at the foundation of Xi’s efforts to develop the sector.

Defense stocks including AVIC Shenyang Aircraft Co. and AECC Aviation Power Co. rallied, while a Bloomberg index of Chinese developer shares fell more than 1%.

Meantime, Hong Kong’s benchmark Hang Seng Index slump as much as 1.7%.

With Xi’s speech providing broad directions on China’s long-term policy path, investors will be looking for more detailed signals to help fill in the detail over the coming weeks.

“The main takeaways of the speech were self-congratulatory anecdotes over current policies,” wrote Ales Koutny, emerging markets portfolio manager at Janus Henderson Investors. “As no imminent policy shift has been explicitly confirmed or denied, investors will be on the lookout this week for hints about the extent of Xi’s grip over the party.”

The moves in China and Hong Kong stocks were largely in line with the decline across Asia, with the MSCI Asia Pacific index down more than 1%. Sentiment was weak overall following a Friday slump in US stocks.

(Adds sectoral moves, analyst comment)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.