Iconic German sandal maker Birkenstock Holdings Ltd.’s stock fell 10% out of the gate in its trading debut Wednesday, signaling that investors remain cautious about new deals and the casual-footwear market remains competitive.

The company’s initial public offering priced at $46 a share late Tuesday, a bit shy of the midpoint of its expected range. The company

BIRK,

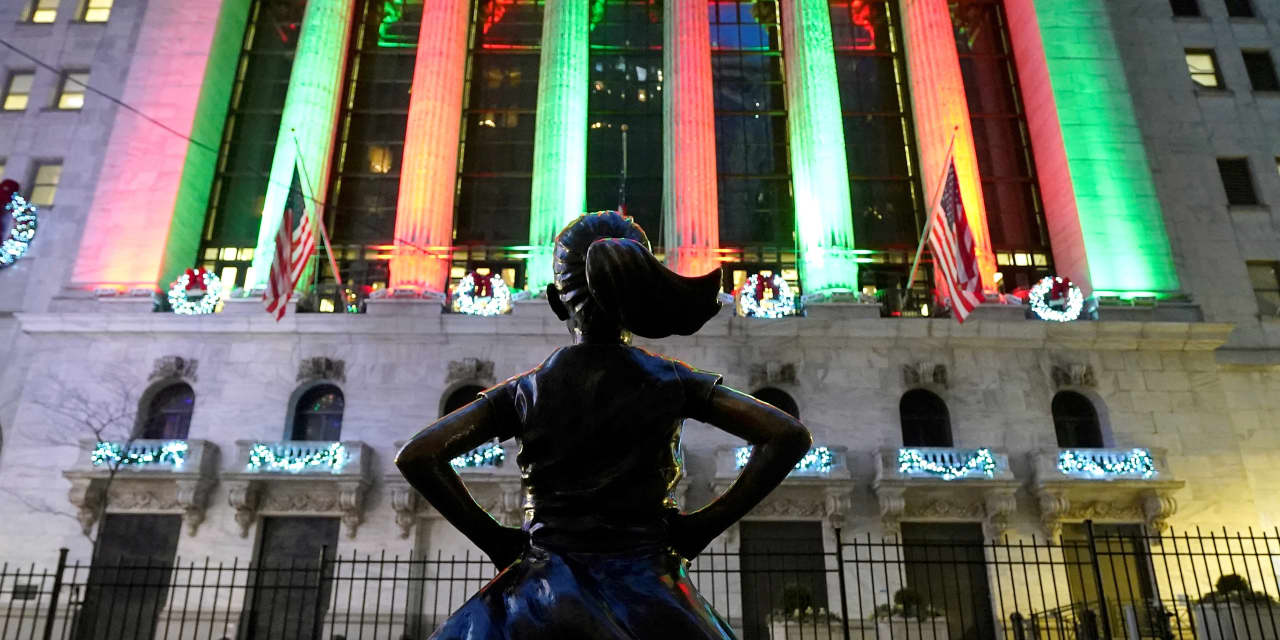

is trading on the New York Stock Exchange under the ticker “BIRK.” Goldman Sachs, JPMorgan and Morgan Stanley were the lead underwriters on the deal.

The deal was expected to prove the latest test for the IPO market, which recently saw three key deals perform strongly on their first day of trade, only to fall back in subsequent sessions.

Chip maker Arm Holdings Ltd.

ARM,

; Klaviyo

KVYO,

a digital marketing company; and Instacart, which trades as Maplebear Inc.

CART,

; all enjoyed strong gains on their first day of trade but pared those in the following sessions. Instacart was quoted at $25.50 on Wednesday, well below its issue price of $30.

Birkenstock clearly has its fans, as its customers are brand loyal, with 70% of existing U.S. consumers, for example, purchasing at least two pairs of its shoes, according to its filing documents.

A survey found 86% of recent purchasers said they wanted to buy again, while 40% said they did not even consider another brand while buying.

But as Kyle Rodda, Senior Market Analyst at Capital.com, said the Birkenstock deal was to be a good measure of broader market sentiment and sentiment toward consumer-sensitive stocks.

“It might tell us, too, whether cashed-up millennials like to buy the stocks of products they commonly find on the bottom shelf of their wardrobes,” he said in emailed comments.

The valuation of around $8.6 billion also looks rich, he said. Based on the company’s latest revenue release, the stock’s price-to-sales ratio is above 6, “which is at the higher end of comparable consumer discretionary companies on Wall Street.

“In a higher interest rate environment, these multiples may be hard to sustain in the short term, especially if consumer spending slows as expected next year as interest rate hikes bite households,” Rodda said.

David Trainer, Chief Executive of independent equity research company New Constructs, said ahead of the deal that the valuation was far too high, noting that it was higher than peers such as Skechers USA Inc.

SKX,

Crocs Inc.

CROX,

and Steve Madden Ltd.

SHOO,

“Even more shockingly, the only footwear companies with a larger market cap are Nike Inc.

NKE,

and Deckers Outdoor

DECK,

” he said, referring to the maker of Uggs.

“While Birkenstock is profitable, we think it is fair to say that the $8.7 billion valuation mark is too high, especially for a company that was valued at just $4.3 billion in early 2021. Not a whole lot has changed since then,” Trainer said in a report.

For more, see: Birkenstock is going public: 5 things to know about the iconic German sandal maker’s IPO designs

Trainer estimated that Birkenstock would need to generate more than $3.8 billion in annual revenue to justify its valuation, which is more than three times the $1.24 billion chalked up for all of 2022, according to its filing documents with the Securities and Exchange Commission.

“We don’t doubt that Birkenstock has strong brand equity and produces stylish sandals, but there is really no reason for this company to be public,” said Trainer. “We don’t think investors should expect to make any money by buying this IPO.”

The Renaissance IPO exchange-traded fund

IPO

has gained 29% in the year to date, while the S&P 500

SPX

has gained 13%.

:quality(70):focal(2095x736:2105x746)/cloudfront-us-east-1.images.arcpublishing.com/tronc/6E7DPKQB6JCAVPW7T4JJHKZDTE.jpg)