There are more signs that investors are cooling a bit on the hot artificial intelligence play, though no one appears ready to let go of their Nvidia stock just yet.

That’s according to Vanda Research analysts, who shared a chart of their latest weekly data showing how retail investor’s net purchases of AI-themed stocks is “steadily waning”:

Marco Iachini, senior vice president, Giacomo Pierantoni, head of data and Lucas Mantle, data scientist at Vanda, said they’ve also noticed fewer news stories covering the sector as well, in their Vandatrack weekly comment that published Thursday.

The fervor for AI-related stocks and technology took off earlier this year, with a pinnacle moment in May when Nvidia

NVDA,

made big predictions on a boom for demand for its AI-related chips. Shares of the company are still up 211% so far this year, but enthusiasm for many tech stocks faded in August as China and interest rate-hike worries cropped up and some companies stressed AI benefits might not happen right away.

That said, Vanda analysts don’t expect Nvidia will feel the hurt of any such waning interest. They point out that short interest in the chip maker has seen a “considerable decline,” in line with its soaring stock price.

“This phenomenon suggests that bearish institutional investors, including long/short hedge funds, may have been compelled to cover their short positions,” said Iachini and his team. “As a result they are unlikely to want to sell the stock in the near term barring strong conviction to do so.”

“It is crucial to recognize that a slowdown in retail demand, by itself, is improbable to trigger substantial price movements, without active bearish participation from institutional investors,” they added.

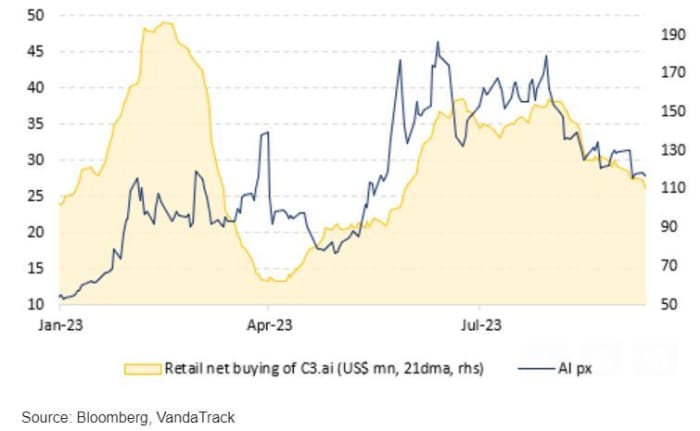

However, the story is different for smaller AI-related companies such as smaller-cap C3.ai

AI,

as seen in their chart:

For C3.ai, they see a selling trend persisting in coming weeks. The AI software group’s shares are up 154% so far this year, but down 9% this month, taking a hit recently from solid quarterly results that came with forecasts for a bigger-than-expected full year loss. Analysts aren’t quite giving up — among 10 covering the company tracked by FactSet most have hold or a similar rating.

“We believe C3.ai is taking the proper steps to capitalize on Generative AI, but it will take time to prove out,” said a team of analysts at Oppenheimer led by Timothy Horan, after those results were released on Sept. 7. They rate the company perform.

Vanda analysts said another exception to an AI buying slowdown has been IonQ

IONQ,

“a relatively small quantum computing company that has been outperforming its AI-related counterparts.” They noted “remarkably resilient” demand for the stock, as short interest also increases rapidly.

“This juxtaposition raises a cautionary flag, as a potential weakening of retail interest, coupled with speculative institutional investors accumulating short positions, could create a demand-supply imbalance, potentially triggering a selloff,” they said. Shares of IONQ have soared 422% year-to-date. The company lifted its lifted full-year bookings guidance last month as it reported blowout second-quarter sales.

Young Money blogger Jack Raines highlighted the slowing interest in AI in a post on Thursday , citing data from analytics firm Similarweb that showed ChatGPT traffic down 3.2% in August, after 10% declines in June and July.

“While ChatGPT will probably experience a resurgence this fall as students return to the classroom and expedite their homework via chatbot, it seems like talks of AI disrupting/replacing anything and everything have cooled down,” he said, adding that the “initial euphoria was a bit much.”

Deutsche Bank strategists hopped on the topic in a note to clients entitled “Even hype needs a summer break,” on Thursday, noting how AI interest waned as investors went to the beach and the media turned its attention to extreme weather and “silly season” stories.

“Under the surface, though, there have been important developments indicating a slow maturing of the cycle, of the underlying technologies and of attitudes to a revolution in waiting,” said a team led by analyst Adrian Cox.

Those include Ai being the “elephant in the earnings room,” this summer that also brought a steady stream of AI-related tech announcements. Another theme “Your job is safe..for now,” came via fresh evidence that AI might boost rather than replace white-collar jobs, while yet another saw U.S. politicians also got involved.

This week saw Tesla CEO Elon Musk telling Capital Hill politicians that a new federal agency to oversee AI development is a must.

Another big theme that erupted this summer was the chatter by contrarian commentators questioning the hype around generative AI. Cox alluded to the Similarweb report that got everyone excited as it showed Chat GPT traffic falling to 1.4 billion visitors in August from 1.8 billion in May.

“The bigger picture is that open.ai had zero visitors before the launch of ChatGPT less than a year ago and is now No. 28 in the world, according to Similarweb,” said the Deutsche Bank team.