This year could mark the end of the affair — between Americans and their stockholdings.

That’s according to Goldman Sachs analysts who say due to the rise in bond yields since the start of 2022, and increased flows to bond and money-market funds, U.S. households could end up dumping up to $1.1 trillion of equity holdings this year.

“The current level of market yields clearly shows that the era of TINA (There is No Alternative) has ended and that now there are reasonable alternatives (TARA) to equities,” said a team of strategists led by Cormac Conners and David Kostin.

“Although equity demand remained resilient amid sharply rising rates in 2022, we believe the YTD [year-to-date] flows into money market and bond funds signal an escalating household shift away from equities and toward the alternatives.”

Their model of household equity demand is based on the 10-year U.S. Treasury yield and personal savings rate. The analysts say that higher yields and lower savings tend to be associated with a decrease in demand for equity among households.

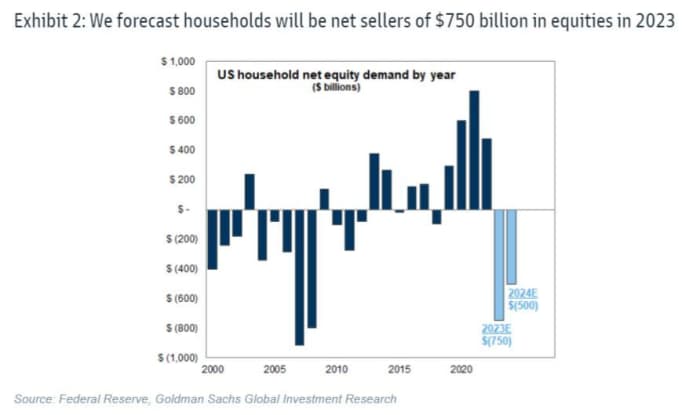

In their base case, they estimate net selling of $750 billion this year, alongside their forecast for the yield on the 10-year Treasury note

TMUBMUSD10Y,

to rise from around 3.6% currently to 4.2% by the end of this year, and the personal savings rate will rise to 5.3% from 4.5%. Conners and the team said such stock selling would reverse six previous quarters of household equity demand.

Uncredited

Should bond yields tilt lower, and the savings rate move higher, Goldman sees that estimate nearly halved to $400 billion in equity sales. In a worst-case scenario, where yields push even higher and the savings rate lower, household selling would reach $1.1 trillion, they cautioned.

As for the idea that there are now reasonable alternatives to equities (TARA), Goldman said households tend to buy fixed income products during years in which they sell stocks. They pointed to data showing $51 billion has flowed out of U.S. equity mutual funds and exchange-traded funds, year to date, while $282 billion has poured into U.S. money-market funds and $137 billion into U.S. bond funds.

Read: Money-market funds swell to record $5.4 trillion as savers pull money from bank deposits

Picking up some of the slack left by U.S. investors, the Goldman team predict foreign investors and corporations will be net stock buyers of $550 billion and $350 billion, respectively.

“We expect buyback and cash M&A activity will slow but remain relatively robust this year, driving corporations to be net buyers of U.S. stocks – though a potential [second-half] recovery in equity issuance presents one risk to this forecast. A weaker dollar should drive foreign investors to be net buyers of U.S. stocks in 2023. Pension funds will also be net buyers of $200 billion in equities in 2023,” said the strategists.

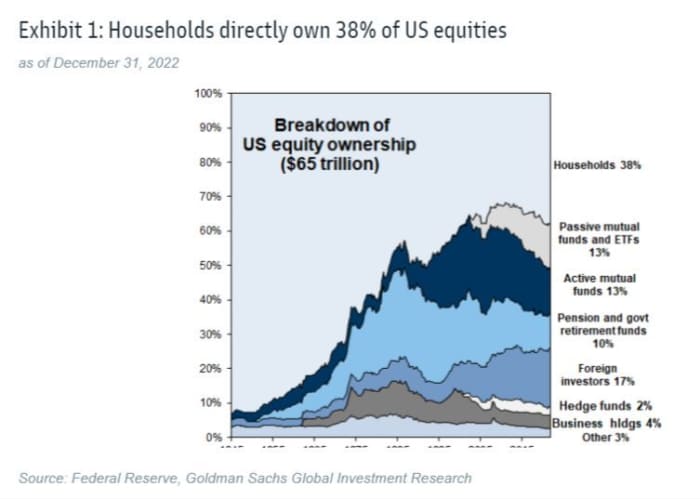

The pace of household buying has been slowing, they noted. Citing the Federal Reserve’s Financial Accounts data, Goldman said households are estimated to own 38% of the total equity market. From the start of 2020 through mid-2022, they bought $1.7 trillion in equities, but in 2022 demand for those assets fell 40% to $480 billion.

“Adjusting the Fed’s household demand series for our estimate of hedge fund net equity demand (which is included in the household category by default), implies households were net buyers of just $209 billion in equities in 2022, a 78% decline from 2021,” they said.

Up 2% so far this year, the S&P 500

SPX,

lost 19% in 2022, the worst year for the index since the global financial crisis of 2008, as a war in Europe added to inflationary pressures across the globe, driving central banks such as the Federal Reserve to raise interest rates sharply. Wednesday’s 25-basis point Fed rate hike marked the ninth rise since March 2022.

From under 1.5% at the start of 2022, the yield on the 10-year Treasury note

TY00,

has climbed to around 3.468%, levels not seen since the 2008 crisis.