Amalgamated Bank trimmed its position in Fabrinet (NYSE:FN – Free Report) by 3.8% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 15,702 shares of the technology company’s stock after selling 627 shares during the quarter. Amalgamated Bank’s holdings in Fabrinet were worth $2,989,000 at the end of the most recent quarter.

Other institutional investors have also made changes to their positions in the company. Park Place Capital Corp bought a new position in Fabrinet in the fourth quarter valued at about $26,000. Salem Investment Counselors Inc. bought a new position in Fabrinet in the fourth quarter valued at approximately $29,000. GAMMA Investing LLC acquired a new stake in Fabrinet during the 4th quarter worth $34,000. Orion Capital Management LLC bought a new stake in shares of Fabrinet during the 3rd quarter valued at $47,000. Finally, McGlone Suttner Wealth Management Inc. acquired a new position in shares of Fabrinet in the 4th quarter valued at $52,000. 97.38% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

FN has been the subject of a number of recent analyst reports. B. Riley dropped their price objective on Fabrinet from $173.00 to $171.00 and set a “neutral” rating for the company in a report on Tuesday. Rosenblatt Securities reissued a “buy” rating and set a $230.00 price objective on shares of Fabrinet in a research note on Tuesday, February 6th. Northland Securities raised shares of Fabrinet from a “market perform” rating to an “outperform” rating and upped their target price for the company from $200.00 to $220.00 in a research note on Thursday, March 21st. JPMorgan Chase & Co. lifted their price target on shares of Fabrinet from $210.00 to $212.00 and gave the stock a “neutral” rating in a research report on Thursday, April 11th. Finally, Needham & Company LLC reissued a “buy” rating and issued a $220.00 price target on shares of Fabrinet in a report on Tuesday. Four investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the company’s stock. According to MarketBeat, the stock has an average rating of “Moderate Buy” and a consensus target price of $161.00.

Check Out Our Latest Analysis on Fabrinet

Fabrinet Trading Up 2.2 %

FN stock opened at $222.71 on Friday. The stock has a 50-day moving average price of $190.05 and a two-hundred day moving average price of $186.58. Fabrinet has a 1 year low of $90.19 and a 1 year high of $229.02. The stock has a market cap of $8.09 billion, a PE ratio of 29.58 and a beta of 1.04.

Insider Transactions at Fabrinet

In other news, Director Rollance E. Olson sold 10,000 shares of Fabrinet stock in a transaction that occurred on Monday, February 12th. The shares were sold at an average price of $205.52, for a total value of $2,055,200.00. Following the sale, the director now directly owns 25,981 shares in the company, valued at $5,339,615.12. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. 0.51% of the stock is owned by insiders.

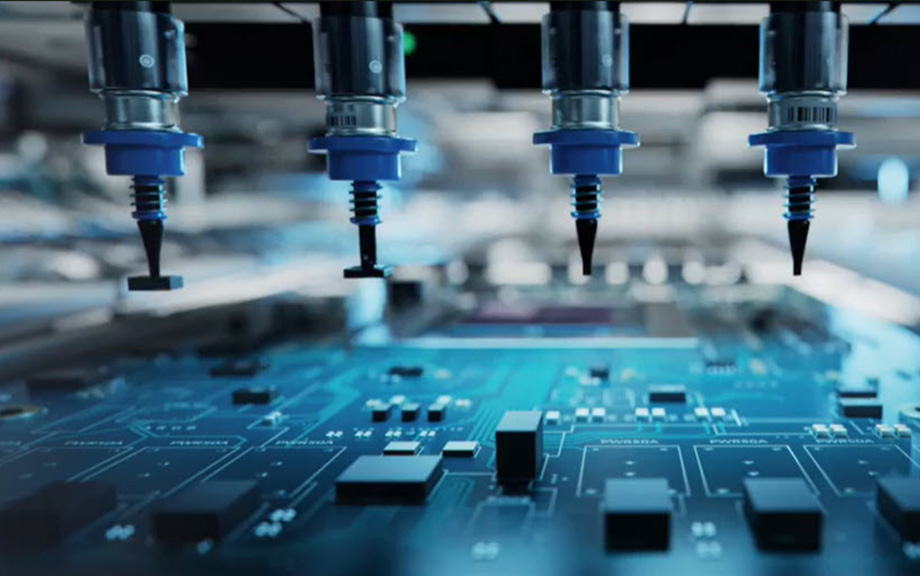

Fabrinet Profile

Fabrinet provides optical packaging and precision optical, electro-mechanical, and electronic manufacturing services in North America, the Asia-Pacific, and Europe. The company offers a range of advanced optical and electro-mechanical capabilities in the manufacturing process, including process design and engineering, supply chain management, manufacturing, printed circuit board assembly, advanced packaging, integration, final assembly, and testing.

Further Reading

Want to see what other hedge funds are holding FN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Fabrinet (NYSE:FN – Free Report).

Receive News & Ratings for Fabrinet Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Fabrinet and related companies with MarketBeat.com’s FREE daily email newsletter.

ABMN Staff

Source link