U.S. stocks just touched their highest levels in two months. Yet, signs of a looming selloff are piling up, according to Jonathan Krinsky, chief technical strategist at BTIG.

The S&P 500

SPX,

and Russell 3000

RUA,

are both trading just shy of their highs from mid-February, but market breadth hasn’t recovered, as index gains over the past month have largely relied on megacap names like Microsoft Corp.

MSFT,

and Apple Inc.

AAPL,

helping to offset weakness in other areas of the market.

As of Friday, only 45% of Russell 3000 stocks were trading above their 200-day moving averages, according to data cited by Krinsky. By comparison, when the broad-market gauge was trading at its highest level of 2023 back in February, 70% of the individual stocks included in the index were trading above their 200-day moving average. Technical analysts use moving averages as a gauge of a stock or index’s momentum.

BTIG

Lackluster breath is looking like more of an issue analysts say, especially now that the Nasdaq’s outperformance appears to be fading after leading markets higher since the start of the year.

Over the last two weeks, the Dow Jones Industrial Average

DJIA,

has outperformed the Nasdaq Composite

COMP,

by the widest margin since the two-week period ending Dec 30, according to FactSet data.

Krinsky cited exchange-traded funds that feature megacap technology names, including the iShares Expanded Tech-Software ETF

IGV,

the Communications Services Select Sector SPDR Fund ETF

XLC,

and Consumer Discretionary Select Sector SPDR Fund ETF

XLY,

as examples of emerging weakness in this critical sector of the market. Meanwhile, regional bank stocks, small-cap stocks and shares of retailers, all of which have lagged behind the market this year, look weak.

See: Are tech stocks becoming a haven again? ‘It is a mistake,’ say market analysts.

Krinsky summed up this dynamic thus: “The weak parts of the market remain weak, while the strong parts now appear vulnerable,” the BTIG analyst said in a Sunday note to clients.

Furthermore, “[i]n absolute and relative terms, the tech sector looks like a poor risk/reward to us here,” Krinsky added.

Low implied volatility is another issue for markets, Krinsky said. That can mean investors have gotten too complacent and markets may be heading for a selloff, analysts say.

The Cboe Volatility Index

VIX,

otherwise known as Wall Street’s “fear gauge,” finished Friday at its lowest end-of-day level since Jan. 4, according to Dow Jones Market Data. The Cboe S&P 500 9-Day Volatility Index, which tracks implied volatility over a shorter time horizon, has also fallen to January lows, FactSet data show.

Such low levels mean volatility could be poised to “mean revert,” Krinsky said, which may portend a selloff in the months ahead for the S&P 500, the most liquid and most closely watched gauge of U.S. stock-market performance.

Implied volatility gauges measure activity in option contracts linked to the S&P 500 to gauge how volatile traders expect markets to be over the coming days and weeks. Typically, implied volatility advances when U.S. stocks are falling.

The greenback has shown some signs of life in recent sessions, although the U.S. dollar remains well below the multi decade highs it reached back in September. That the buck bounced off its February lows late last week suggests that momentum could be skewed toward the upside for the dollar, Krinsky said, which could create more problems for stocks given the dollar’s tendency to weigh on markets during 2022.

The ICE U.S. Dollar Index

DXY,

a gauge of the dollar’s strength measured against a basket of rivals, was up 0.7% in recent trade at 102.22.

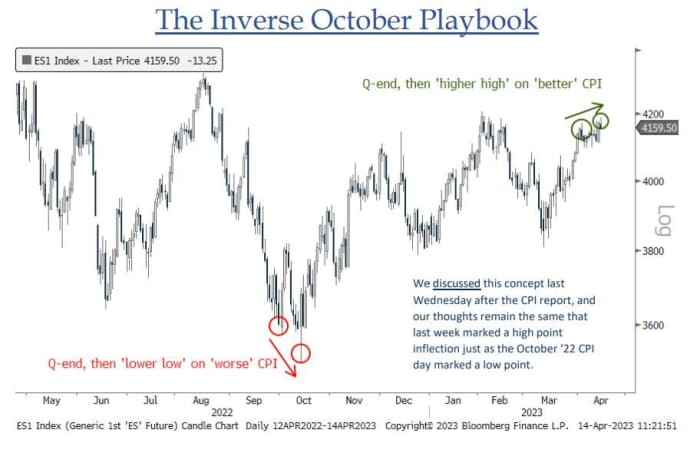

All of these factors support the notion that stocks could be headed for what Krinsky called the “reverse October playbook.”

BTIG

Just as the S&P 500 bottomed following the hotter-than-expected September report on consumer-price inflation, the market’s monthslong rebound rally may have peaked following last week’s CPI report for March, which showed consumer prices rose a scant 0.1% last month, less than the 0.2% increase that had been forecast by economists polled by MarketWatch.

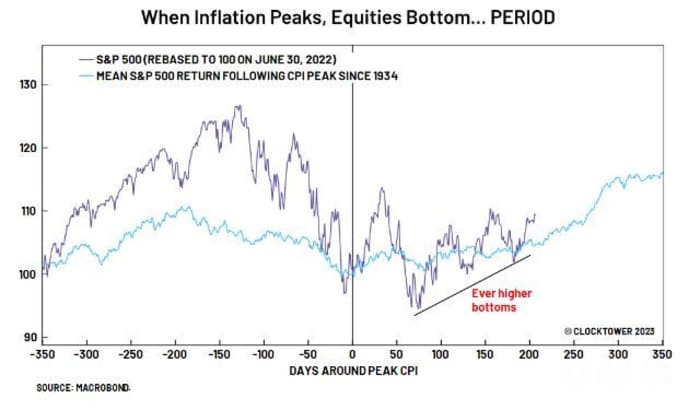

Not everybody agrees with this assessment. Marko Papic, chief strategist at Clocktower Group, cited market data going back to 1934 to show that U.S. stocks tend to rally after inflation peaks. Consumer-price inflation reached its highest level in more than four decades when the CPI headline number showed prices up 9.1% year-over-year in June.

CLOCKTOWER GROUP

U.S. stocks look set to decline for a second day in a row on Monday, with the S&P 500 off 0.3% at 4,126, while the Nasdaq Composite was down by 0.4% at 12,070, and the Dow Jones Industrial Average traded marginally lower at 33,881.