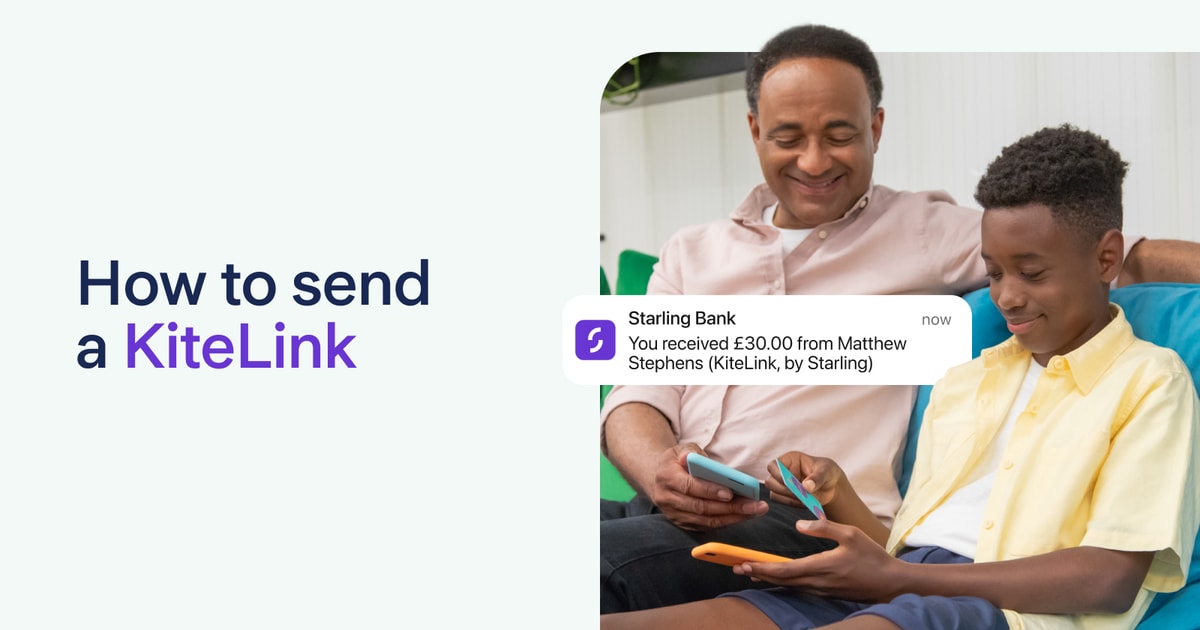

If you have a Kite debit card for your child, Christmas just came early. You can now create a unique link that trusted friends and family can use to transfer money straight to your child as a Christmas or birthday present or following a special occasion.

Kite is our award-winning debit card for children aged 6 to 16 which comes with its own version of the Starling app. The new feature, known as KiteLink, is a free addition to Kite that we’ve made following requests from our customers. You asked, we delivered.

How KiteLink can help

Starling customer John Hibbs, who set up a Kite card for his nine year old daughter Xanthe, is already a fan of KiteLink. “She gets money for her birthday and at Christmas from grandparents. Before, they’d transfer it into my Starling account and then I’d transfer it into her Kite Space,” he says. “The link makes things a lot simpler.”

KiteLink is free to set up, send and use. You can set up one link per Kite card. A Kite card is connected to a Starling personal or joint account.

Pocket money and Kite

Before Kite, John gave Xanthe her pocket money in cash. “I always found it a pain. We never had cash around – I’m very much digital banking wise. Kite is much easier for us and we both like it,” he says.

“I like how we can see the app on our phone and check how much money we’ve got,” says Xanthe. “It’s a really good and useful, helpful app.”

Financial education with Kite

Children can use the Kite version of the Starling app to see their balance and a list of transactions, which includes details of who has transferred money using KiteLink and how much they’ve transferred. These details can be especially helpful when writing thank you letters after Christmas or a birthday.

The Kite debit card, which is made from recycled plastic, can be used to make payments in person or online. “Having her own card helps her feel more grown up and gives her a better insight and understanding into money, rather than if she had a pile of money in a piggy bank or with a bank that didn’t have an app,” says John. “She can see her money in the app and she feels responsible for it.”

John, 44, runs and manages the charity Hibbs Lupus Trust. The charity supports people with lupus, a long-term condition that affects the immune system.

How to set up KiteLink

Parents can create a link by opening their Kite Space in the Starling app and tapping KiteLink.

The unique KiteLink can then be shared with trusted friends and family members via text, email or in a messaging app, such as WhatsApp. You can deactivate the link at any time from your Kite Space.

How to use KiteLink

When a family member or friend receives the KiteLink, they can use it to transfer money straight into the child’s Kite Space. If they’re a Starling customer, the link will take them to their own Starling app so they can make the payment. If they’re not a Starling customer, they’ll be directed to a secure webpage on their phone where they can type in their card details or make a payment using their digital wallet, for example through Apple Pay.

Once the money has arrived, the child can use their Kite card to buy something they love or keep the money in their Space until they have enough for whatever they’ve been saving up for. Say goodbye to cheques or cash and say hello to Kite, the debit card and app for kids designed to introduce them to independent money management.

Team Starling

Source link