The notion of working in retirement may seem paradoxical, but it is not. Although you may have moved beyond your primary career, you should still devote a part of your week to some type of money-making activity. It is possible to round out your schedule and add satisfaction to your retirement through part-time, freelance, or consulting work. Furthermore, there are financial benefits as well.

To that end, here are nine reasons to consider reentering the workforce.

1. Additional financial stability.

In most cases, retirees have sufficient savings and income from their retirement plans to meet their basic needs. Nonetheless, inflation, long-term care, and rising medical expenses need to be taken into account as well.

A survey conducted by the Insured Retirement Institute found only 18% of baby boomers are confident they will have enough money in retirement to live comfortably. Those who own an annuity, however, report 45% more confidence.

In short, if you did not save enough money for retirement, you may need to continue working as you age. Even if it’s not, a paycheck goes a long way to supplementing and extending those savings over time.

More specially, in retirement, you can benefit financially from working:

- Taking care of essential expenses. It is possible to pay for housing, food, utilities, and health care without using retirement savings by continuing to work. As a result, you may be able to invest some of your savings more aggressively and spend more on “lifestyle” items.

- Savings growth. For 2023, you can contribute up to $22,500 plus $7,500 in catch-up contributions if your employer offers a 401(k) plan. After reaching the annual contribution limit on your 401(k) or IRA, you may be able to continue saving with a deferred annuity.

- The amount of savings you can use every year can be adjusted according to your needs. A number of factors affect the amount of savings you can spend sustainably during retirement (i.e., your withdrawal rate), including market volatility, interest rates, inflation, health care, and risk tolerance. By earning income, you can offset these factors and prolong the life of your savings.

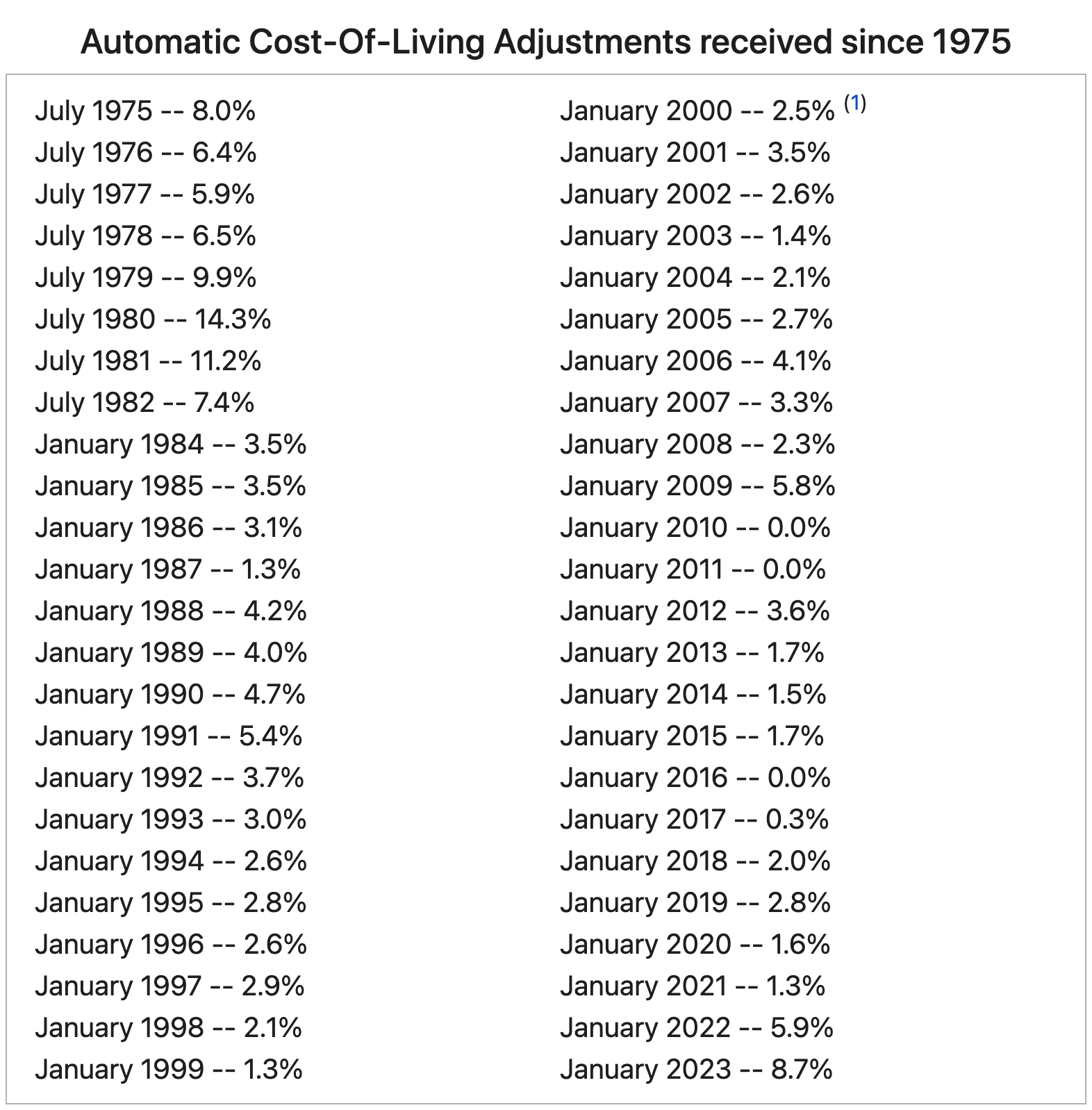

- Getting the most out of your Social Security benefits. In spite of the fact that you can begin collecting benefits at the age of 62, waiting to collect them can be a good decision. Every year you delay, your benefit increases until you reach the maximum age of 70 at which your benefit will be the highest. A person’s Social Security benefits are determined by his or her highest 35 years of earnings. Social Security benefits aren’t calculated based on your non-work years, so working longer could increase yours.

2. Keeps your brain healthy.

Most people are unaware that their work may affect their mental capabilities after they retire, according to the University of Michigan’s Health and Retirement Study (HRS).

“Your job can impact your cognitive functioning in later life,” says Amanda Sonnega, an associate research scientist at the Institute for Social Research (ISR).

It has been found that retirement is associated with some level of cognitive decline even after accounting for other health changes associated with age, she says.

“In general, working seems to provide a level of cognitive stimulation that is protective against cognitive decline at older ages,” Sonnega says. “Researchers are looking at what it is about work that serves this role.”

Part-time employment gives you the chance to switch jobs or roles. As a result, there are a number of benefits you can enjoy. For example, as you age, psychologists believe you should take on new challenges to slow your cognitive decline.

3. You’re too young to enroll in Medicare.

What happens if you’re retired but haven’t yet reached 65, the age at which you become eligible for Medicare? You may have to pay out-of-pocket for insurance or medical expenses.

When seniors retire and no longer have access to a company-sponsored medical plan, the high costs of medical care can be quite shocking.

The solution? Work for an employer that offers health insurance even to part-timers.

You can save hundreds or even thousands of dollars every month by working part-time for a company that offers health insurance.

Part-time employees are offered health insurance benefits by many large companies, including Starbucks, Ikea, UPS, Costco, Delta, Trader Joe’s, Lowe’s, REI, and the American Red Cross. You can find more companies that offer part-time employees health insurance benefits by searching online for “health insurance for part-time employees”.

Moreover, you may need to pay significant out-of-pocket expenses for prescription drugs once you qualify for Medicare. There are gaps in Medicare coverage that can be filled by additional health insurance through your employer or Medicare Supplement Insurance despite turning 65 and qualifying for Medicare.

Medicare may not cover all healthcare costs.

Furthermore, Medicare does not cover all healthcare costs. “Pre-pandemic, the average hospitalization cost was $285,000, meaning you could face staggering healthcare costs even with Medicare coverage,” writes Chris Porteous in a previous Due article.

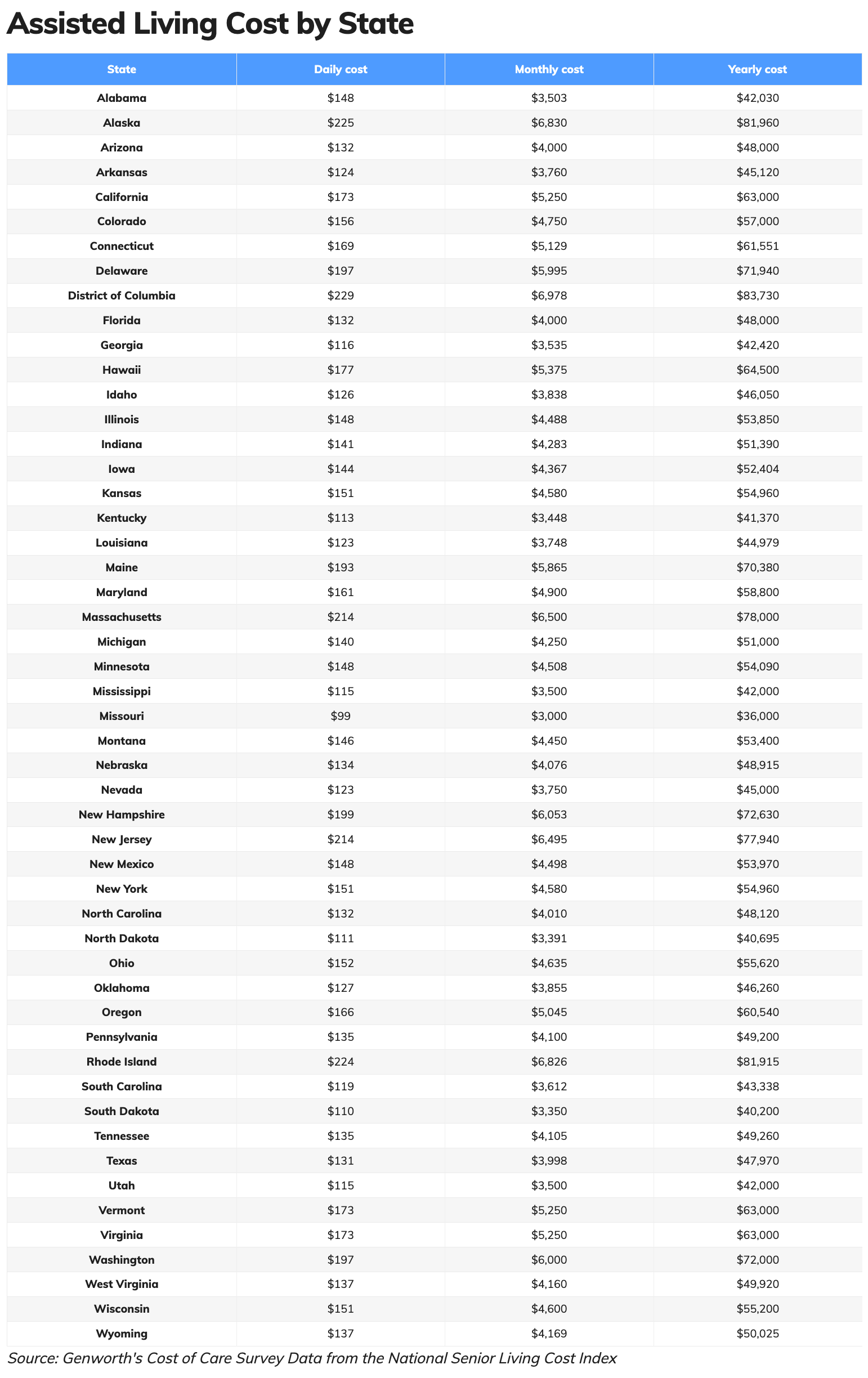

“Additionally, you should know that Medicare does not cover some critical health needs of retirees,” he adds. “These include long-term care, dentures, and hearing aids. Since 70% of seniors need assisted living care, that could be a significant financial problem.”

“The average cost of assisted living facilities is $4,500 per month,” states Chris. If you do not have Medicare Advantage, it is not covered by Medicare. For a limited time, it may only pay part of assisted living costs.

“While Medicare covers many healthcare costs, it stops short of paying enrollees for long-term or custodial care,” he continues.

4. Preserves your portfolio.

The more money you earn in retirement, the less money you’ll need to take from your investments to pay for it. The length of your savings can even be affected by low-paying jobs.

Suppose you earn $20,000 a year as a retiree working part-time. For 30 years in retirement, a $500,000 portfolio generates $20,000 per year using the 4% withdrawal rule, notes Carolyn McClanahan, a financial advisor as well as a medical doctor. In most cases, it’s easier to earn $20,000 a year working part-time than to accumulate another half million.

“By not having to pull from your portfolio, it allows it to grow,” says Karl Schwartz, a Miami financial advisor, and certified public accountant. “Your assets end up growing quite a bit longer in that scenario.”

5. Having a sense of community.

Since 1938, the Harvard Study of Adult Development has been tracking generations of families, and one of its major findings has been that retirement well-being depends on good-quality relationships, according to Robert J. Waldinger, Harvard Medical School professor of psychiatry and study director.

In retirement, the happiest participants replaced their old work relationships with new ones. Working regularly—whether full-time, part-time, or as a volunteer—creates an environment in which new interactions can be formed.

Furthermore, studies show that a variety of social relationships – such as those you might find at a part-time job – can contribute to stress reduction, lowering heart-related risks, alleviating depression, and even extending your life.

6. It is possible to draw Social Security while working.

Did you know that you can work while drawing Social Security benefits without losing your benefits if you stay under the IRS earnings limit?

As of 2023, the earnings limit will increase to $21,240 for workers younger than full retirement age. For each $2 earned over $21,240, the Social Security Administration (SSA) deducts $1 from your benefits.

Earnings limits for people reaching full retirement age in 2023 are $56,520. For every $3 earned over $56,520, the SSA deducts $1 until you reach full retirement age. The earnings limit for those over full retirement age is not applicable for the entire year, however.

7. Eases boredom.

Here’s something that no one tells you about retirement. You’re probably going to be bored — especially if you retire early. However, it is possible to combat boredom after retiring by taking on new work.

A retirement job may provide mental stimulation to retirees. Retirement can cause boredom when retirees are suddenly faced with long days with nothing to do. With a part-time job, retirees can still travel or spend time with their families while enjoying the excitement of working.

8. Gives you an identity.

When you meet someone new, the first question they ask is, “What do you do?” Most people answer this question by listing their job titles. But, the answer to this question is often elusive to retired people.

A person’s job typically indicates how they contribute to their community. The ability to bring value to someone else is one of the benefits of having a part-time job.

“You can build on your past experiences, your past skills and your past colleagues to look for that part-time job, or you can create your own new part-time job based on your interests,” says Sally Balch Hurme, author of Get the Most Out of Retirement. “Your enthusiasm for the topic or the area will put you ahead in becoming a successful employee.”

9. You can (finally) get creative.

As already mentioned, you can improve your health and reduce your risk of serious illness by staying socially active and exercising your brain. Engaging in creative part-time work that challenges your mind and body is the perfect outlet to remain healthy.

Moreover, you can earn an income from your creative talents with a little effort.

For example, now that you have the time, you can finally pursue your passions, like painting, photography, woodworking, or baking. A local shop selling your products can be very satisfying and a great way to make some extra money. Or perhaps Etsy would be a better place for you to sell your items online.

Regardless, monetizing a lifelong hobby can become an exciting and lucrative part-time job.

FAQs

Can you work after retirement?

Short answer? Yes.

Approximately 20% of Americans 65 years and older are either actively working or looking for a job, according to a report from the Administration for Community Living. Most of them are still employed full-time, although many have taken on alternative work or scaled back their hours after leaving their long-term careers.

Is it possible to collect retirement benefits and work at the same time?

Definitely.

It wasn’t uncommon for employers to have mandatory retirement policies as late as the 1970s. Typically, these employers did not hire workers older than 65 years old. Generally, these policies are illegal today.

As far as Medicare rules are concerned, they are relatively clear-cut. It’s a different story with cash benefits, though. A retiree’s wage income does not affect Social Security benefits once he or she reaches FRA (Full Retirement Age). On the other hand, the earnings limitation rules for younger retirees are quite complex and vary by age.

What are the risks of working after retirement?

Stress is one of the first things that comes to mind. It is possible to feel physically and emotionally drained if you choose the wrong job.

As such, you don’t have to feel bad about quitting your part-time job if it leaves you exhausted and stressed. Instead, find another job that’s more suitable.

Additionally, there are unintended financial consequences. You should speak to a financial advisor before taking on a part-time job during retirement to ensure you won’t suffer financially. You’ll want to consider your retirement accounts, Social Security, insurance, and even tax consequences.

Finally, you will have less free time. Not all companies offer more flexibility to retirees. As such, pre-approval may be required for time off. You may also struggle to set your own schedule in retirement if you take on a part-time job.

What motivates you to work in retirement beyond earning an income?

Many retirees who stopped working are surprised at how much they miss the sense of community, routine, and purpose they had when they worked. It is important to grasp the “why” behind your desire to keep working so you can decide which post-retirement opportunities to pursue.

The post The Benefits of Working Part-Time in Retirement appeared first on Due.

Deanna Ritchie

Source link