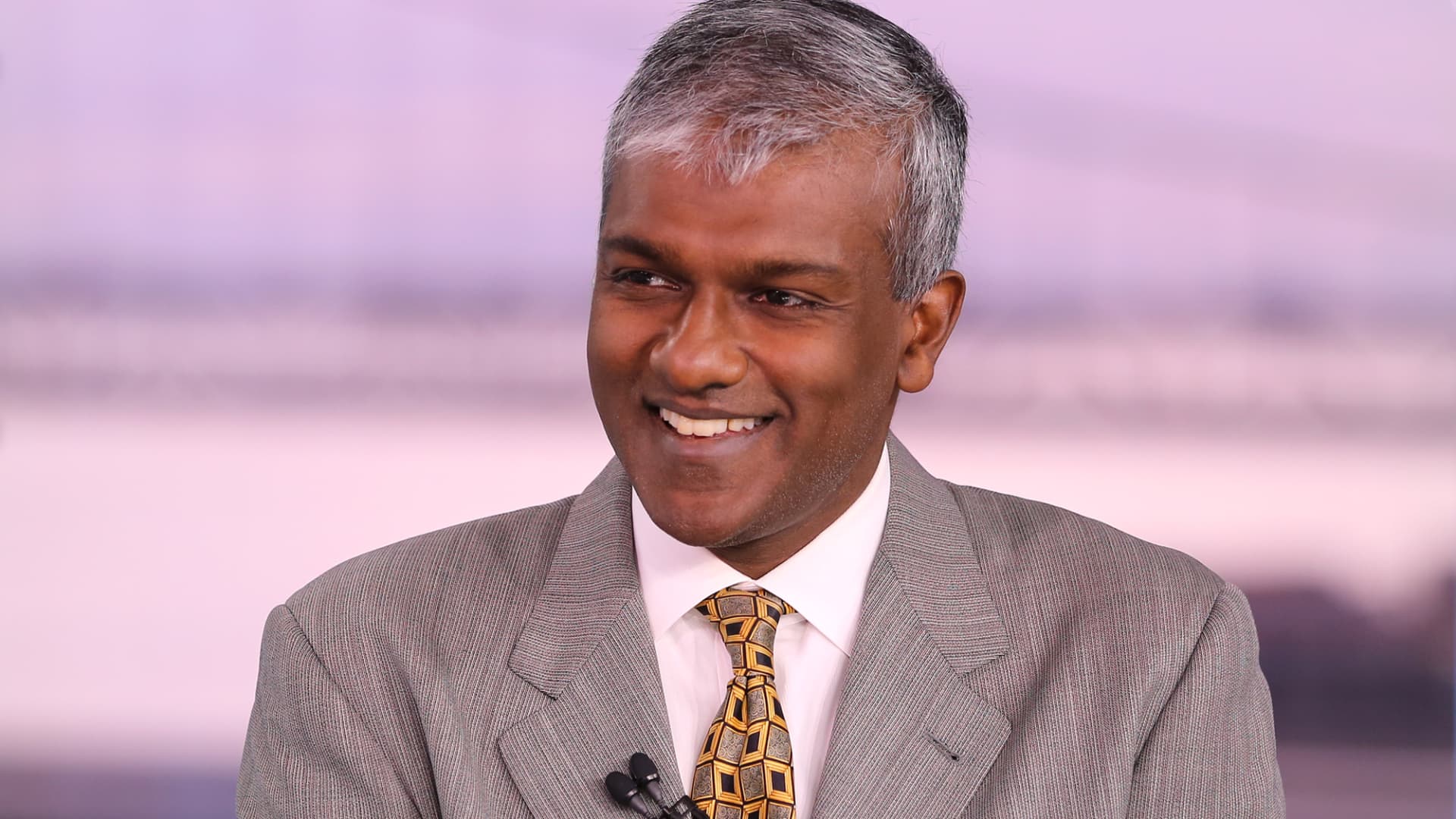

Stock trading firm Zerodha’s co-founder and CEO Nithin Kamath has shared some do’s and don’t for millennials and generation Z, who according to him need to take retirement a little seriously.

Kamath, who keeps sharing valuable tips for investors, on Saturday said what new generations don’t think about enough is that the retirement age is dropping fast due to technological progress and life expectancy going up due to medical progress.

As per American think-tank Pew research, anyone born between 1981 and 1996 (ages 23 to 38 in 2019) is considered a millennial, and anyone born from 1997 onward is part of a new generation (Gen G).

Kamath said that the retirement crisis will probably be the biggest problem for most countries in the next 25 years. Earlier generations, he said, got lucky with long-term real estate and equity bull markets that helped them create a retirement corpus but that may not be the case for new generations.

The stockbroker and investor said that in 20 years, retirement could be at 50 and life expectancy at 80. “How do you fund the 30 years?” he asked.

If climate change doesn’t kill us all, the retirement crisis will probably be the biggest problem for most countries 25 years from now, he said in a LinkedIn post.

“Earlier generations got lucky with long-term real estate & equity bull markets that helped create a retirement corpus. Unlikely in the future,” he added.

So, he suggested four things that new generations need to do to avoid a post-retirement crisis.

Kamath’s first advice to the new generations is to stop getting triggered by everyone trying to lend and stop borrowing to buy things you don’t need or depreciate in value. Second, start saving early and diversify across FDs, government securities, and SIPs (Systematic Investment Plans) of Index funds, ETFs (Exchange-Traded Funds). He said stocks are probably still the best bet to beat inflation long term.

Third, Kamath said one needs to have a comprehensive health insurance policy for oneself and everyone in the family. He said one health incident is enough to push most people into financial ruin or set them back many years financially. “Jobs don’t last forever, hence one policy outside of what is provided at work,” he added.

Fourth, if one has dependents, s/he should be covered. “Buy a term policy with adequate cover. In the worst case, this money in a bank FD should cover their financial needs,” Kamath wrote. In the last, he said the biggest fix for most people is they should stop taking loans.