Bloomberg Market Specialists Keith Gerstein, William Collins and Max Flanagan contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

The price of Paramount Global (PARA) stock hangs in the balance, as analysts offer a wide range of possible outcomes for the media company and its bet on streaming service Paramount+. The streaming platform launched in 2021 as a rebranding of CBS All-Access.

Paramount+ has recently been the fastest-growing U.S. streaming service, although it recently announced it would raise prices while adding Showtime to the package. The price hike is in line with the industry, as streaming services look to capture additional revenue.

The issue

The current consensus on Paramount Global stock is a 20% drop in the next 12 months. However, analysts are divided on the stock’s expected performance, with thirteen sells, seven buys and eight holds. And while the consensus calls for a 20% drop, the difference between the minimum target price of $11 and the maximum of $40 is more than 1.25 times the median.

Paramount+ has rapidly increased its subscriber count, in part due to lucrative deals with companies including Walmart Inc. But the platform’s estimated 55 million subscribers are well behind industry leader Netflix, with 231 million. Paramount+ also trails Disney+, which suffered its first quarterly subscriber decline, but still boasts 161.8 million customers. With both Disney and Netflix now having experienced subscriber decline, they look towards providing ad revenue alternatives. A business model Paramount+ and Hulu have already implemented. To see these shifts, leverage Bloomberg’s new KPIC<GO> function for comparative abilities.

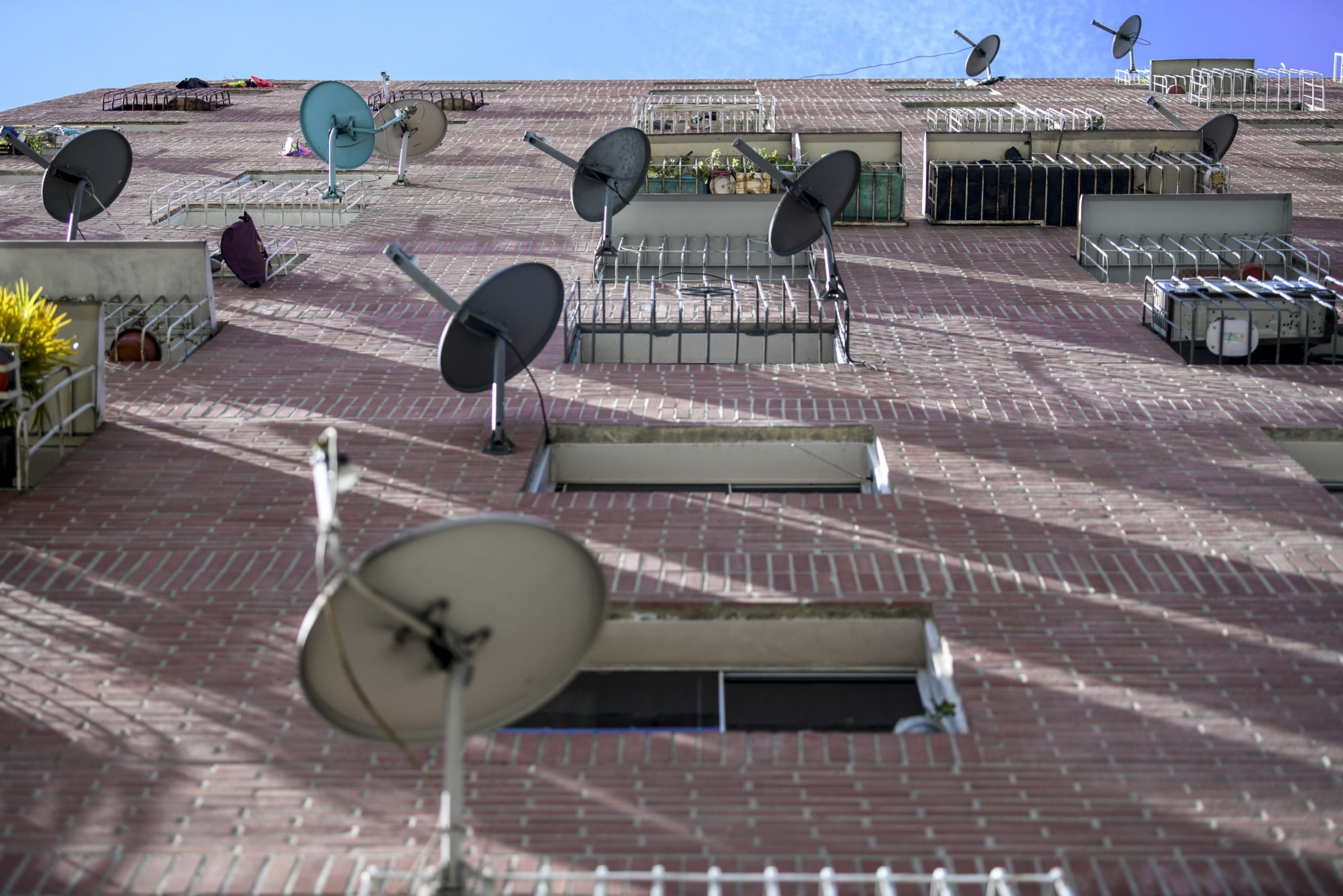

And while Paramount+ is off to a good start, its parent company is grappling with long-term advertising and subscriber declines for its cable networks, including BET and MTV.

Analysts expected Paramount+ to report per-user subscription revenue of $4.54 per user for 2022, and advertising revenue was projected to be less than $1 per user. Both values are expected to continue experiencing growth in 2023.

Tracking

Use Bloomberg’s ANR, MODL, and KPIC tools to compare performance and forecast metrics across peer groups. Run NSUB FFMSTORY to subscribe to functions-focused stories.

To see analysts’ price targets for Paramount:

- Type “paramount” in the command line and select PARA U.S. Equity from autocomplete.

- Click Research & Estimates to expand the menu options, and select ANR – Analyst Recommendations. The shortcut is PARA US <Equity> ANR <GO>.

- Click the Tgt Px heading in the table to rank target prices.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.

Bloomberg

Source link