Are you receiving Inman’s Broker Edge? Make sure you’re subscribed here.

This post has been republished with permission from Mike DelPrete.

The real estate industry is in the midst of a massive financial reckoning: public company valuations are down by billions, widespread layoffs, and a rush for venture-funded disruptors to conserve cash and demonstrate sustainable business models.

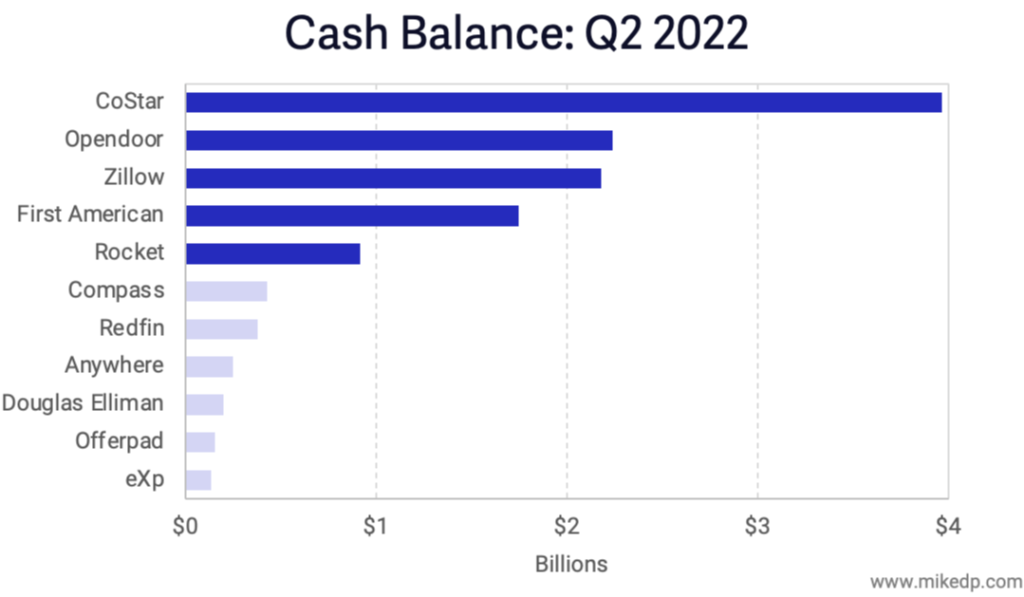

Why it matters: Amidst this turmoil, the industry is bifurcating into predators and prey — companies that have the resources to expand through acquisition and those burning cash that are vulnerable to takeover.

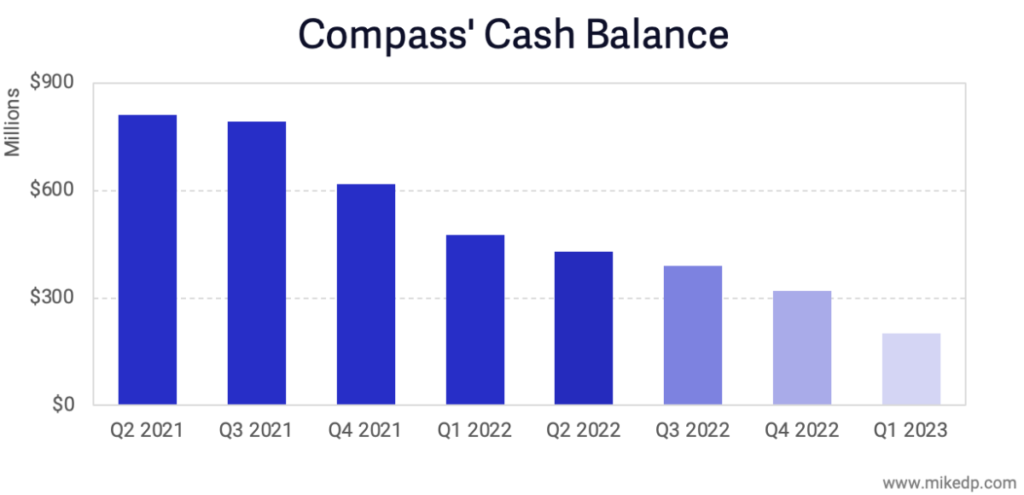

- Companies with dwindling cash balances and high cash burn will be forced to raise funds or face insolvency (for example, Reali closing operations).

The predators have the financial resources — namely, vast amounts of cash — to take advantage of the current market situation and acquire vulnerable businesses.

Companies like Zillow, CoStar and Rocket are certainly predators — flush with cash and opportunistically acquisitive in their outlook.

- Opendoor is the outlier. Although it has plenty of cash on hand, it’s about to enter (at least) two-quarters of massive financial losses.

- Private equity firms with plenty of cash to deploy are the other opportunistic predators.

The prey is vulnerable businesses — diminishing cash balances with high cash burn. In other words, a typical real estate tech disruptor.

The majority of prey are the hundreds of private companies whose financials are not publicly available.

- The severity of their situation depends on when they last raised money, how quickly they’re spending it, and how much they have in the bank.

- If a company doesn’t have at least 12 months of runway, they’re prey.

What to watch: The name of the game for the next 6-18 months is VUCA — volatile, uncertain, complex and ambiguous.

- Expect to see a larger amount of mergers, acquisitions, consolidations and liquidations.

The bottom line: Cash is king. In today’s market, a company’s cash flow determines if it is in control of its own destiny.

- If a company is burning cash and needs to raise additional funds, it will be forced to do so on someone else’s terms.

- But, if a company is cash flow positive with a solid balance sheet, a VUCA environment presents an incredible opportunity.

“Only when the tide goes out do you discover who’s been swimming naked.” – Warren Buffet

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.

Mike DelPrete

Source link