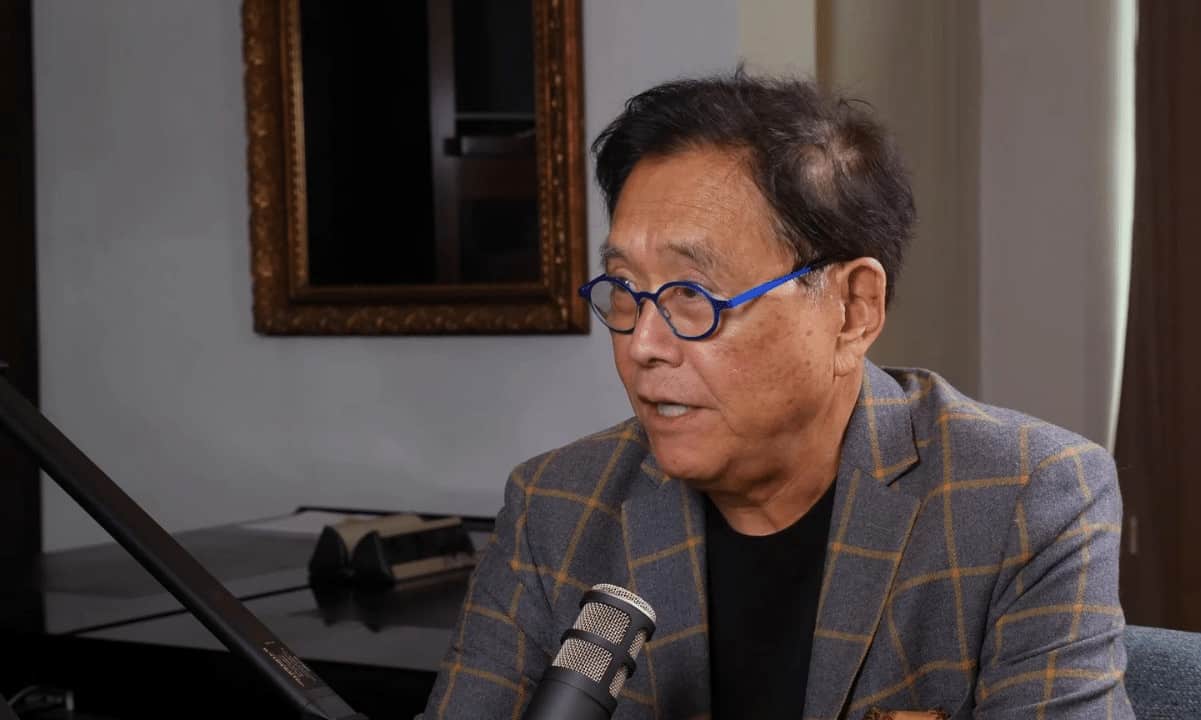

Robert Kiyosaki – the author of the bestseller “Rich Dad, Poor Dad” – thinks bitcoin will surge to $500,000 by 2025 due to an incoming market crash and a consecutive distrust in the US dollar.

He has previously warned people to avoid traditional fiat currencies during uncertain times and focus on BTC or gold.

Kiyosaki’s Latest Advice

The American businessman, investor, motivational speaker, and author predicted that markets are up for serious correction, which will trigger another massive printing of fiat currencies by the Federal Reserve.

Kiyosaki believes people should embrace bitcoin, gold, and silver amid that potential turbulence, predicting the leading digital asset to reach $500,000 in three years. He added that the yellow metal could climb to $5,000 while silver could trade at $500.

The main reason for the price expansion of those assets could be the undermined faith in the US dollar, which he described as “fake money.” On the other hand, he classified gold and silver as “God’s money,” while bitcoin is “people’s $.”

Giant crash coming. Depression possible. Fed forced to print billions in fake money. By 2025 gold at $5,000 silver at $500 and Bitcoin at $500,000. Why? Because faith in US dollar, fake money, will be destroyed. Gold & Silver Gods money. Bitcoin people’s $. Take care.

— Robert Kiyosaki (@theRealKiyosaki) February 13, 2023

Kiyosaki was among the few to forecast the severe 2008 economic crash. Over the past years, he has warned that a new financial collapse is on the horizon, urging people to avert from saving dollars due to the Fed’s controversial policies.

BTC is the Key to Future Happiness

The American opined in October last year that bitcoin, gold, and silver will continue their downtrend as long as the Federal Reserve keeps raising interest rates. However, he views that as a buying opportunity, saying investors picking those assets will “smile” once the US central bank pivots.

Prior to that, he listed several reasons why the greenback will lose its supremacy in the future, meaning people should embrace BTC, with the US government borrowing “too much money” being the main one. The world’s leading economy had an external debt of over $31 trillion as of January 2023.

According to Kiyosaki, other factors that could boost bitcoin’s valuation are the authorities’ intent to “keep interest rates low” and the galloping inflation.

He opined last month that all cryptocurrencies, apart from bitcoin, are securities, meaning that the US SEC will go after them. As such, BTC remains the only digital asset worth investing in.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

Dimitar Dzhondzhorov

Source link