(Bloomberg) — Federal Reserve Chair Jerome Powell said policymakers expect interest rates will need to move higher to reduce US growth and contain price pressures, even though they held rates steady at their meeting last week.

Most Read from Bloomberg

“Earlier in the process, speed was very important,” Powell said Wednesday in testimony before the House Financial Services Committee, referring to the pace at which officials lifted rates over the past year. “It is not very important now.”

It may make sense to continue moving rates higher in the coming months, but at a more moderate pace, Powell said in response to lawmakers’ questions about the Fed’s plans. The timing of additional hikes will be based on incoming data, he said in his opening statement.

US stocks fell as Powell warned that higher rates would be needed to combat inflation, thwarting bets that the US central bank was nearing the end of its tightening cycle.

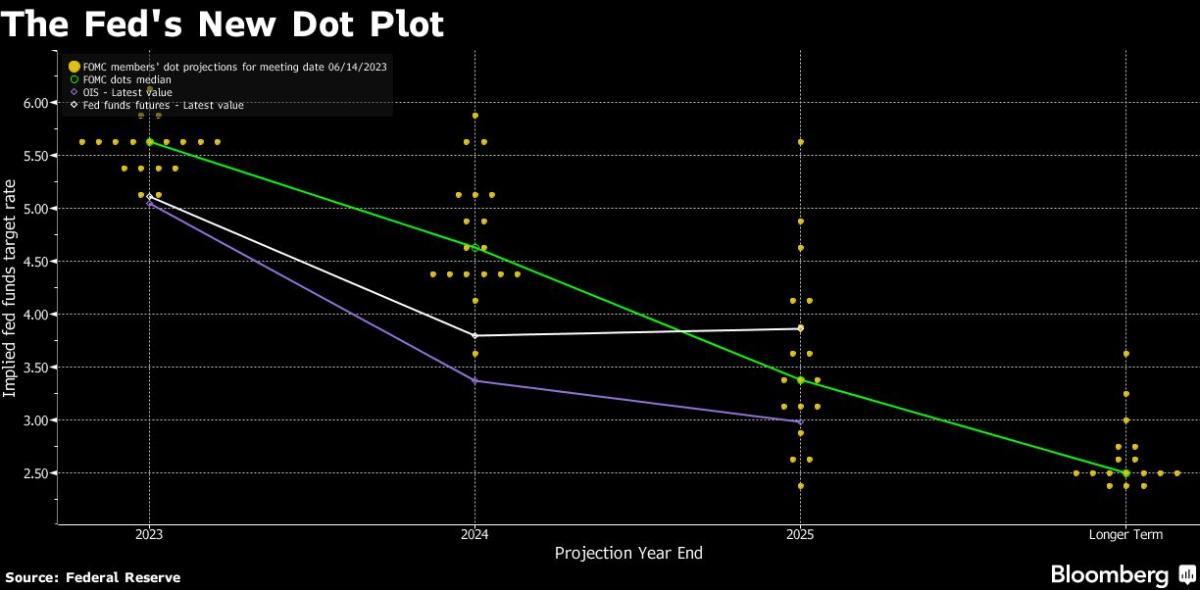

The Federal Open Market Committee paused its series of interest-rate hikes last week for the first time in 15 months, leaving rates in a range of 5% to 5.25%. But Fed officials estimated rates would rise to 5.6% by the end of the year, according to their median projection, implying two additional quarter-point hikes following surprisingly persistent inflation and labor-market strength.

“My colleagues and I understand the hardship that high inflation is causing, and we remain strongly committed to bringing inflation back down to our 2% goal,” Powell said in his prepared remarks.

“Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year,” he added. “Reducing inflation is likely to require a period of below-trend growth and some softening of labor market conditions.”

Read More: Powell Faces Tricky Task of Explaining Rate Pause in Congress

Powell is appearing on Capitol Hill this week for his semi-annual monetary policy testimony, the first time the Fed chief has answered questions from Congress in public since early March. He will also testify before the Senate Banking committee on Thursday.

His prepared comments largely echoed his remarks at his post-meeting press conference last week, where he said the committee felt it was appropriate to moderate the pace of rate increases following the most aggressive hiking in four decades as well as recent bank failures that might tighten credit conditions. At the same time, he said that the vast majority of the committee projected higher rates will be needed to tame inflation.

“In determining the extent of additional policy firming that may be appropriate to return inflation to 2% over time, we will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments,” Powell told lawmakers.

Fed officials have been disappointed in the pace of slowing inflation and are targeting a period of below-trend growth to reduce price pressures. The FOMC last week upgraded its view of economic growth and the labor market for 2023, but now is anticipating a rise in unemployment to 4.5% next year.

The Fed chair has faced criticism from some Democrats for his aggressive interest-rate hikes, with Senator Elizabeth Warren, for example, warning that his policies risk putting millions of people out of work.

Powell described the labor market as “very tight,” though the unemployment rate rose in May to 3.7%. “There are some signs that supply and demand in the labor market are coming into better balance,” he said.

Powell cited the Fed’s characterization in its semi-annual report to Congress released Friday of tighter US credit conditions following bank failures in March.

“The economy is facing headwinds from tighter credit conditions for households and businesses, which are likely to weigh on economic activity, hiring, and inflation,” he said. “The extent of these effects remains uncertain.”

(Updates with additional Powell comment in second paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

/Lodging/AnnaScozzafava%20232x232.jpeg?tr=w-1200,fo-auto)